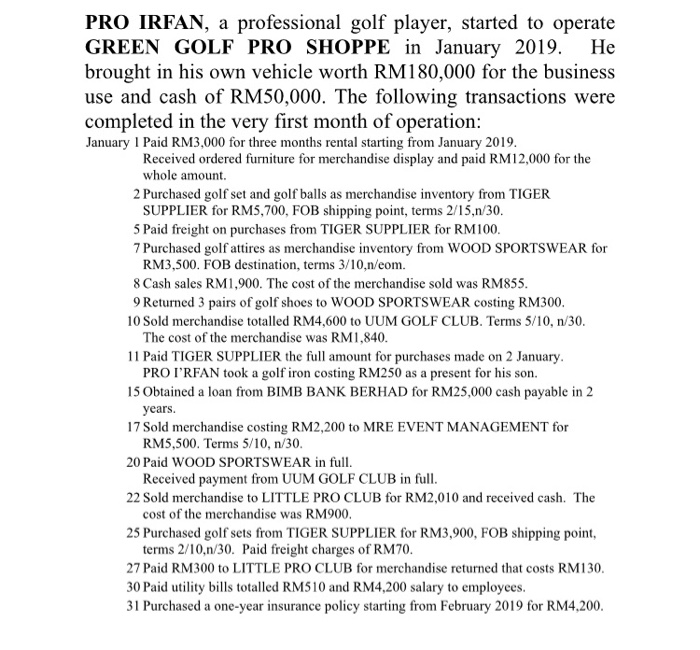

PRO IRFAN, a professional golf player, started to operate GREEN GOLF PRO SHOPPE in January 2019. He brought in his own vehicle worth RM180,000 for the business use and cash of RM50,000. The following transactions were completed in the very first month of operation: January 1 Paid RM3,000 for three months rental starting from January 2019. Received ordered furniture for merchandise display and paid RM12,000 for the whole amount 2 Purchased golf set and golf balls as merchandise inventory from TIGER SUPPLIER for RM5,700, FOB shipping point, terms 2/15,n/30. 5 Paid freight on purchases from TIGER SUPPLIER for RM100. 7 Purchased golf attires as merchandise inventory from WOOD SPORTSWEAR for RM3,500. FOB destination, terms 3/10,n/eom. 8 Cash sales RM1,900. The cost of the merchandise sold was RM855. 9 Returned 3 pairs of golf shoes to WOOD SPORTSWEAR costing RM300. 10 Sold merchandise totalled RM4,600 to UUM GOLF CLUB. Terms 5/10, n/30. The cost of the merchandise was RM1.840. 11 Paid TIGER SUPPLIER the full amount for purchases made on 2 January. PRO I'RFAN took a golf iron costing RM250 as a present for his son. 15 Obtained a loan from BIMB BANK BERHAD for RM25,000 cash payable in 2 years. 17 Sold merchandise costing RM2,200 to MRE EVENT MANAGEMENT for RM5,500. Terms 5/10, n/30. 20 Paid WOOD SPORTSWEAR in full. Received payment from UUM GOLF CLUB in full. 22 Sold merchandise to LITTLE PRO CLUB for RM2,010 and received cash. The cost of the merchandise was RM900. 25 Purchased golf sets from TIGER SUPPLIER for RM3,900, FOB shipping point, terms 2/10,n/30. Paid freight charges of RM70. 27 Paid RM300 to LITTLE PRO CLUB for merchandise returned that costs RM130. 30 Paid utility bills totalled RM510 and RM4,200 salary to employees, 31 Purchased a one-year insurance policy starting from February 2019 for RM4.200. 5. Return on Assets 6. Return on Equity PRO IRFAN, a professional golf player, started to operate GREEN GOLF PRO SHOPPE in January 2019. He brought in his own vehicle worth RM180,000 for the business use and cash of RM50,000. The following transactions were completed in the very first month of operation: January 1 Paid RM3,000 for three months rental starting from January 2019. Received ordered furniture for merchandise display and paid RM12,000 for the whole amount 2 Purchased golf set and golf balls as merchandise inventory from TIGER SUPPLIER for RM5,700, FOB shipping point, terms 2/15,n/30. 5 Paid freight on purchases from TIGER SUPPLIER for RM100. 7 Purchased golf attires as merchandise inventory from WOOD SPORTSWEAR for RM3,500. FOB destination, terms 3/10,n/eom. 8 Cash sales RM1,900. The cost of the merchandise sold was RM855. 9 Returned 3 pairs of golf shoes to WOOD SPORTSWEAR costing RM300. 10 Sold merchandise totalled RM4,600 to UUM GOLF CLUB. Terms 5/10, n/30. The cost of the merchandise was RM1.840. 11 Paid TIGER SUPPLIER the full amount for purchases made on 2 January. PRO I'RFAN took a golf iron costing RM250 as a present for his son. 15 Obtained a loan from BIMB BANK BERHAD for RM25,000 cash payable in 2 years. 17 Sold merchandise costing RM2,200 to MRE EVENT MANAGEMENT for RM5,500. Terms 5/10, n/30. 20 Paid WOOD SPORTSWEAR in full. Received payment from UUM GOLF CLUB in full. 22 Sold merchandise to LITTLE PRO CLUB for RM2,010 and received cash. The cost of the merchandise was RM900. 25 Purchased golf sets from TIGER SUPPLIER for RM3,900, FOB shipping point, terms 2/10,n/30. Paid freight charges of RM70. 27 Paid RM300 to LITTLE PRO CLUB for merchandise returned that costs RM130. 30 Paid utility bills totalled RM510 and RM4,200 salary to employees, 31 Purchased a one-year insurance policy starting from February 2019 for RM4.200. 5. Return on Assets 6. Return on Equity