Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prob. 1(a). Consider a stock currently trading at $40.25. For a strike price of $38, you want to price both a call and put

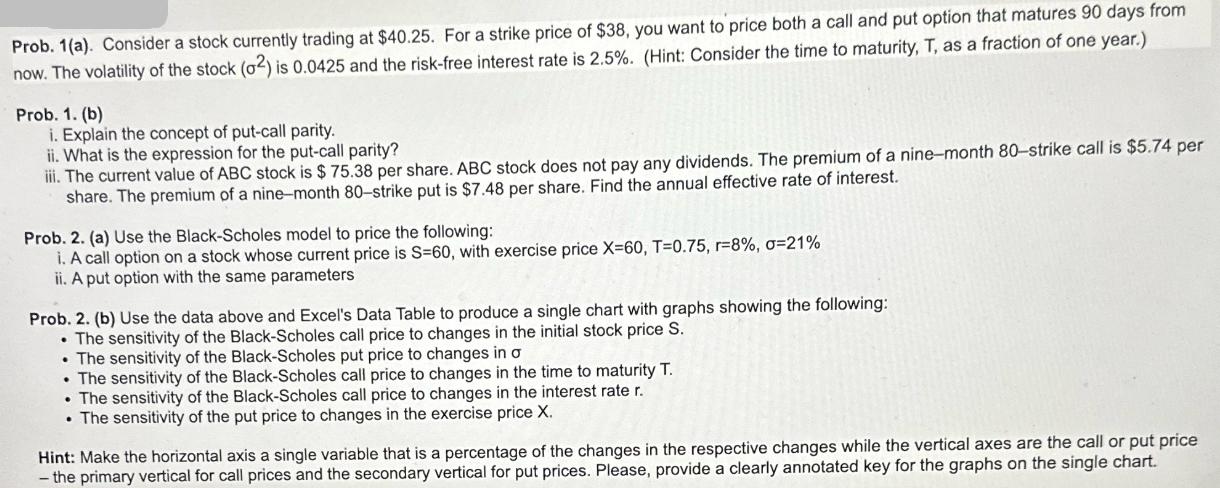

Prob. 1(a). Consider a stock currently trading at $40.25. For a strike price of $38, you want to price both a call and put option that matures 90 days from now. The volatility of the stock (2) is 0.0425 and the risk-free interest rate is 2.5%. (Hint: Consider the time to maturity, T, as a fraction of one year.) Prob. 1. (b) i. Explain the concept of put-call parity. ii. What is the expression for the put-call parity? iii. The current value of ABC stock is $ 75.38 per share. ABC stock does not pay any dividends. The premium of a nine-month 80-strike call is $5.74 per share. The premium of a nine-month 80-strike put is $7.48 per share. Find the annual effective rate of interest. Prob. 2. (a) Use the Black-Scholes model to price the following: i. A call option on a stock whose current price is S-60, with exercise price X=60, T=0.75, r=8%, 0=21% ii. A put option with the same parameters Prob. 2. (b) Use the data above and Excel's Data Table to produce a single chart with graphs showing the following: The sensitivity of the Black-Scholes call price to changes in the initial stock price S. The sensitivity of the Black-Scholes put price to changes in The sensitivity of the Black-Scholes call price to changes in the time to maturity T. .The sensitivity of the Black-Scholes call price to changes in the interest rate r. The sensitivity of the put price to changes in the exercise price X. Hint: Make the horizontal axis a single variable that is a percentage of the changes in the respective changes while the vertical axes are the call or put price -the primary vertical for call prices and the secondary vertical for put prices. Please, provide a clearly annotated key for the graphs on the single chart.

Step by Step Solution

★★★★★

3.32 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Certainly Lets tackle the problems one by one 1a Pricing a Call and Put Option Given Current stock p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started