Question

Probability tools, idiosyncratic and systematic factors. The purpose of this toy question is to use some probability tools, investigate the effect of a systematic factor,

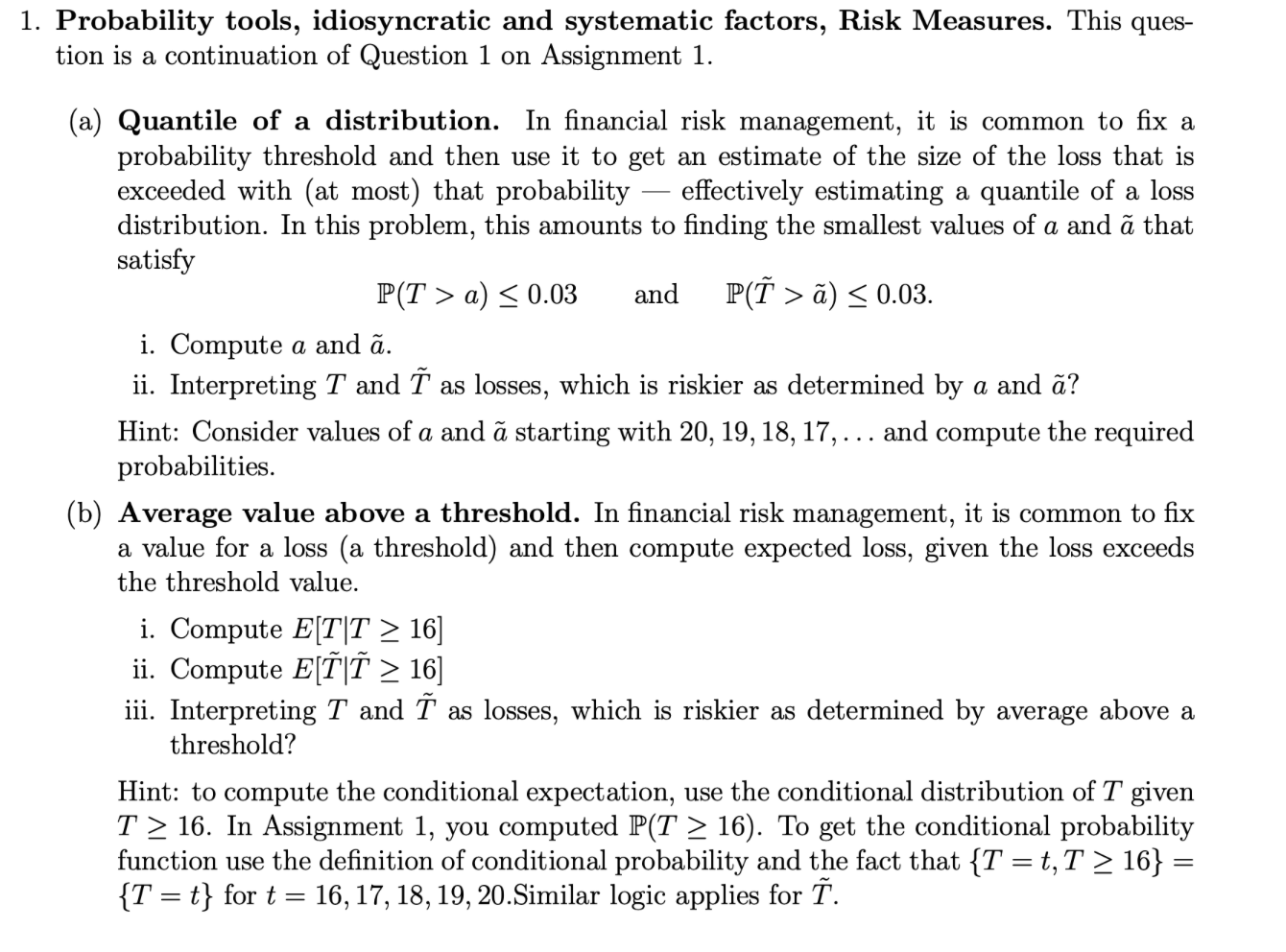

Probability tools, idiosyncratic and systematic factors. The purpose of this toy question is to use some probability tools, investigate the effect of a systematic factor, and to compute expected values, variances and probabilities, including some quantities conditional on the value of a systematic factor. Consider a single roll of a pair of 6-sided dice and a flip of two fair coins. Let Xi be the outcome for die i, i = 1, 2, and let Ci be the number of heads obtained by filling coin i, i = 1, 2. Define the following S1 = X1 + 4C1, S2 = X2 + 4C2 and T = S1 + S2 = X1 + X2 + 4C1 + 4C2; and S1 = X1 + 4C1, S2 = X2 + 4C1 and T = S1 + S2 = X1 + X2 + 8C1. Thus, S1 and S2 are independent random variables (since no coin in common between S1 and S2). Thus, there is no systematic factor influencing the values of S1 and S2 and T is determined only by idiosyncratic effects. S1 and S2 are not independent random variables as they both depend on C1, the systematic factor in this example. Hence T is the sum of two dependent random variables. Note that T can be written as a linear combination of 3 independent random variables (see above). In this example, consider high values of T and T as bad outcomes the higher the value the worse the outcome. In an analogy to finance, think of T or T as loss random variables, which means as they get larger, the loss gets larger and hence the outcome worse.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started