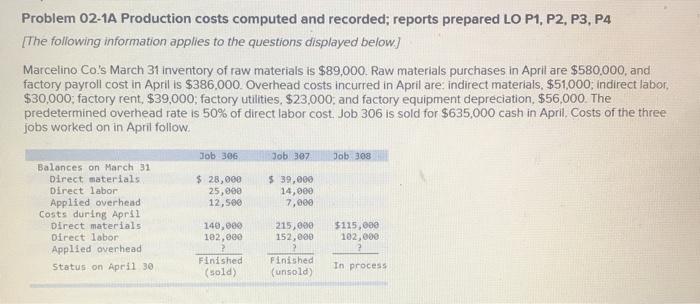

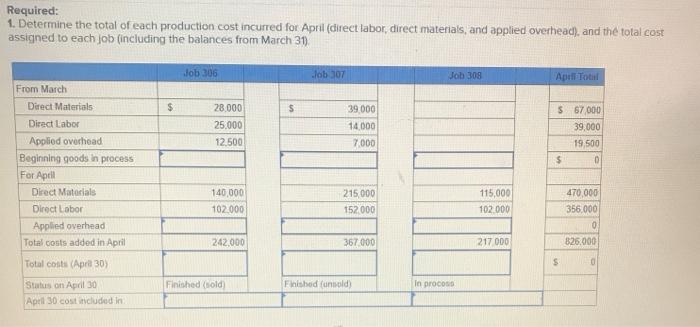

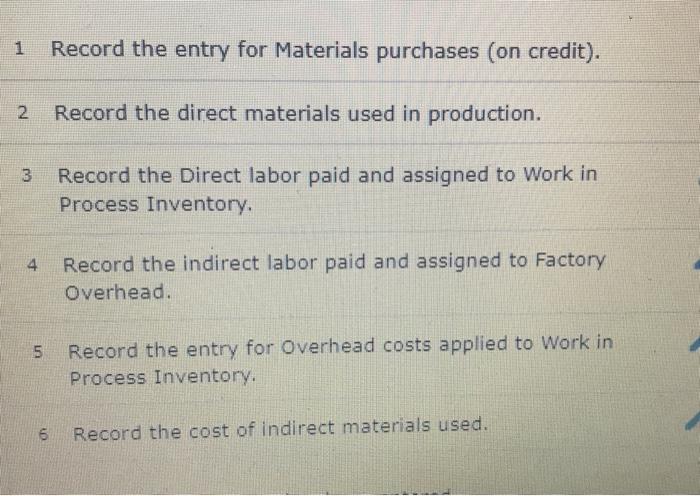

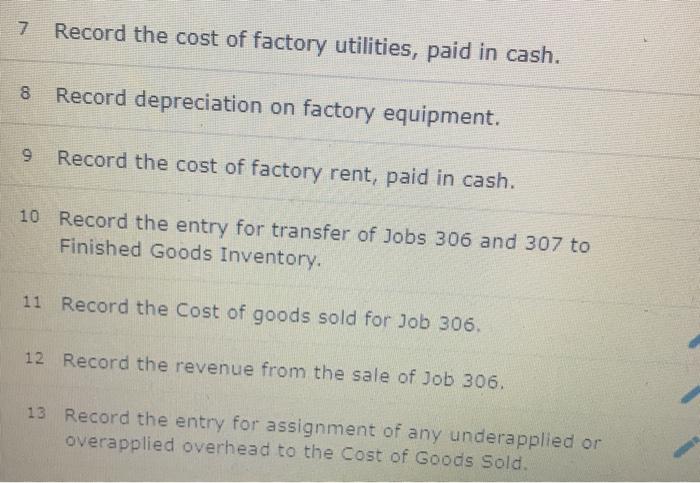

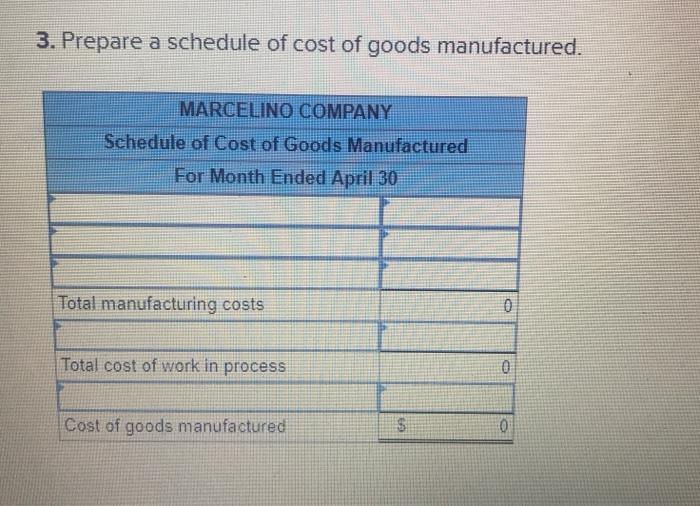

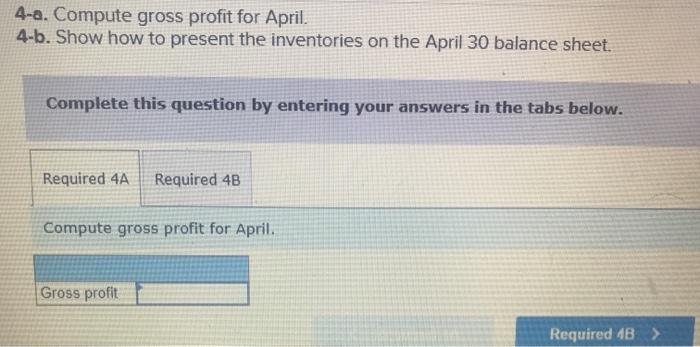

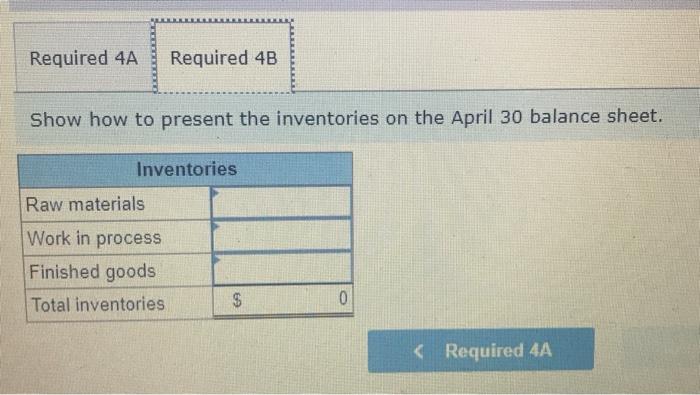

Problem 02-1A Production costs computed and recorded; reports prepared LO P1, P2, P3, P4 The following information applies to the questions displayed below) Marcelino Co.'s March 31 inventory of raw materials is $89,000. Raw materials purchases in April are $580,000, and factory payroll cost in April is $386,000. Overhead costs incurred in April are: indirect materials. $51,000; indirect labor, $30,000; factory rent, $39,000; factory utilities, $23,000, and factory equipment depreciation, $56,000. The predetermined overhead rate is 50% of direct labor cost. Job 306 is sold for $635,000 cash in April. Costs of the three jobs worked on in April follow. Job 306 Job 3e7 Job 308 Balances on March 31 Direct materials $ 28,000 $ 39,000 Direct labor 25,000 14,000 Applied overhead 12,500 7,000 Costs during April Direct materials 140,000 215,000 $115,000 Direct labor 102,000 152,000 102,000 Applied overhead 2 2 2 Finished Finished Status on April 30 (sold) (unsold) In process Required: 1. Determine the total of each production cost incurred for April (direct labor, direct materials, and applied overhead), and the total cost assigned to each job (including the balances from March 31) Job 306 Job 307 Job 308 Apill Total $ $ 39.000 28.000 25,000 12.500 S67 000 39,000 14.000 7000 19.500 0 $ From March Direct Materials Direct Labor Applied overhead Beginning goods in process For Apell Direct Materials Direct Labor Applied overhead Total costs added in April 140 000 102.000 215,000 152000 115,000 102.000 470.000 356.000 0 826.000 242.000 367 000 217 000 Total costs (April 30) $ Finished Gold Finished (untold) In pocos Status on April 30 April 30 cost included in 1 Record the entry for Materials purchases (on credit). 2 Record the direct materials used in production. 3 Record the Direct labor paid and assigned to Work in Process Inventory. 4 Record the indirect labor paid and assigned to Factory Overhead. 5 Record the entry for Overhead costs applied to Work in Process Inventory. 6 Record the cost of indirect materials used. 7 Record the cost of factory utilities, paid in cash. CO Record depreciation on factory equipment. 9 Record the cost of factory rent, paid in cash. Record the entry for transfer of Jobs 306 and 307 to Finished Goods Inventory. 11 Record the Cost of goods sold for Job 306. 12 Record the revenue from the sale of Job 306. 13 Record the entry for assignment of any underapplied or overapplied overhead to the Cost of Goods Sold. 3. Prepare a schedule of cost of goods manufactured. MARCELINO COMPANY Schedule of Cost of Goods Manufactured For Month Ended April 30 Total manufacturing costs 0 Total cost of work in process 0 Cost of goods manufactured $ 0 4-a. Compute gross profit for April. 4.b. Show how to present the inventories on the April 30 balance sheet. Complete this question by entering your answers in the tabs below. Required 4A Required 4B Compute gross profit for April. Gross profit Required 4B > Required 4A Required 4B Show how to present the inventories on the April 30 balance sheet. Inventories Raw materials Work in process Finished goods Total inventories $ 0