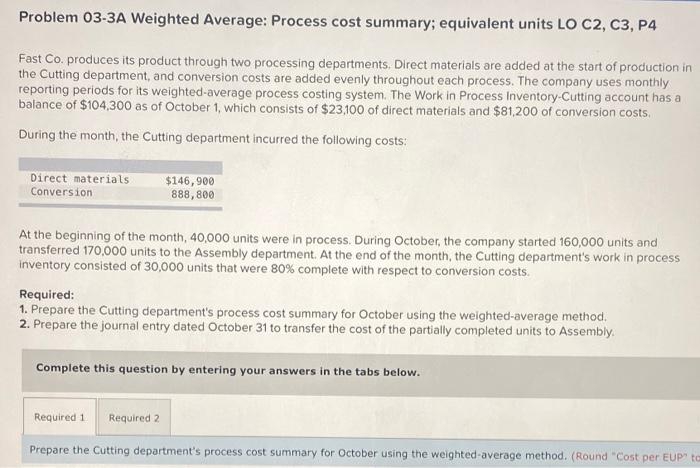

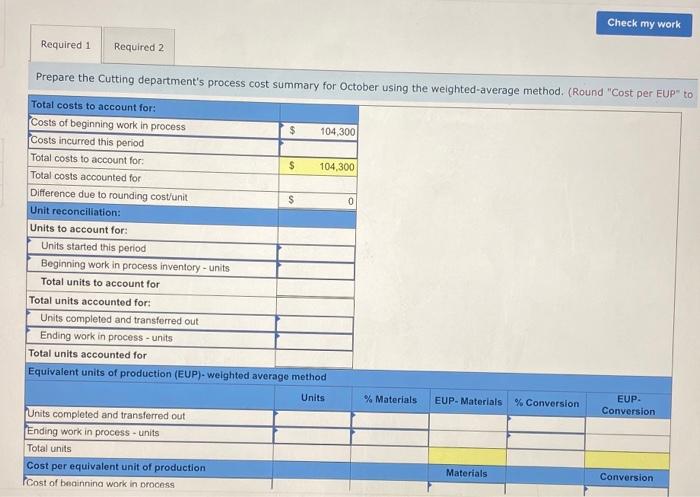

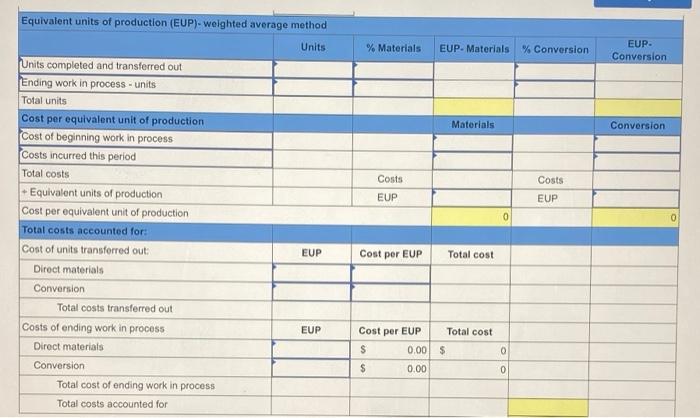

Problem 03-3A Weighted Average: Process cost summary; equivalent units LO C2, C3, P4 Fast Co. produces its product through two processing departments. Direct materials are added at the start of production in the Cutting department, and conversion costs are added evenly throughout each process. The company uses monthly reporting periods for its weighted-average process costing system. The Work in Process Inventory-Cutting account has a balance of $104,300 as of October 1, which consists of $23,100 of direct materials and $81,200 of conversion costs. During the month, the Cutting department incurred the following costs: Direct materials Conversion $146,900 888,800 At the beginning of the month, 40,000 units were in process. During October, the company started 160,000 units and transferred 170,000 units to the Assembly department. At the end of the month, the Cutting department's work in process inventory consisted of 30,000 units that were 80% complete with respect to conversion costs. Required: 1. Prepare the Cutting department's process cost summary for October using the weighted average method. 2. Prepare the journal entry dated October 31 to transfer the cost of the partially completed units to Assembly Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the Cutting department's process cost summary for October using the weighted average method. (Round "Cost per EUP' to Check my work Required 1 Required 2 Prepare the Cutting department's process cost summary for October using the weighted average method. (Round "Cost per EUP" to Total costs to account for: Costs of beginning work in process $ 104,300 Costs incurred this period Total costs to account for: $ 104,300 Total costs accounted for Difference due to rounding cost/unit $ 0 Unit reconciliation: Units to account for: Units started this period Beginning work in process inventory - units Total units to account for Total units accounted for: Units completed and transferred out Ending work in process - units Total units accounted for Equivalent units of production (EUP)-weighted average method Units Units completed and transferred out Ending work in process units Total units Cost per equivalent unit of production I'Cost of beginning work in process % Materials EUP-Materials % Conversion EUP Conversion Materials Conversion Equivalent units of production (EUP)-weighted average method Units % Materials EUP- Materials % Conversion EUP Conversion Materials Conversion Costs EUP Costs EUP 0 0 Units completed and transferred out Ending work in process - units Total units Cost per equivalent unit of production Cost of beginning work in process Costs incurred this period Total costs + Equivalent units of production Cost per equivalent unit of production Total costs accounted for Cost of units transferred out: Direct materials Conversion Total costs transferred out Costs of ending work in process Direct materials Conversion Total cost of ending work in process Total costs accounted for EUP Cost per EUP Total cost EUP Cost per EUP Total cost S 0.00 $ $ 0.00 0 0