Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1 1 . 4 : Assume you work for Stellar Solar, a manufacturer of roof - top solar panels. Stellar is considering three capital

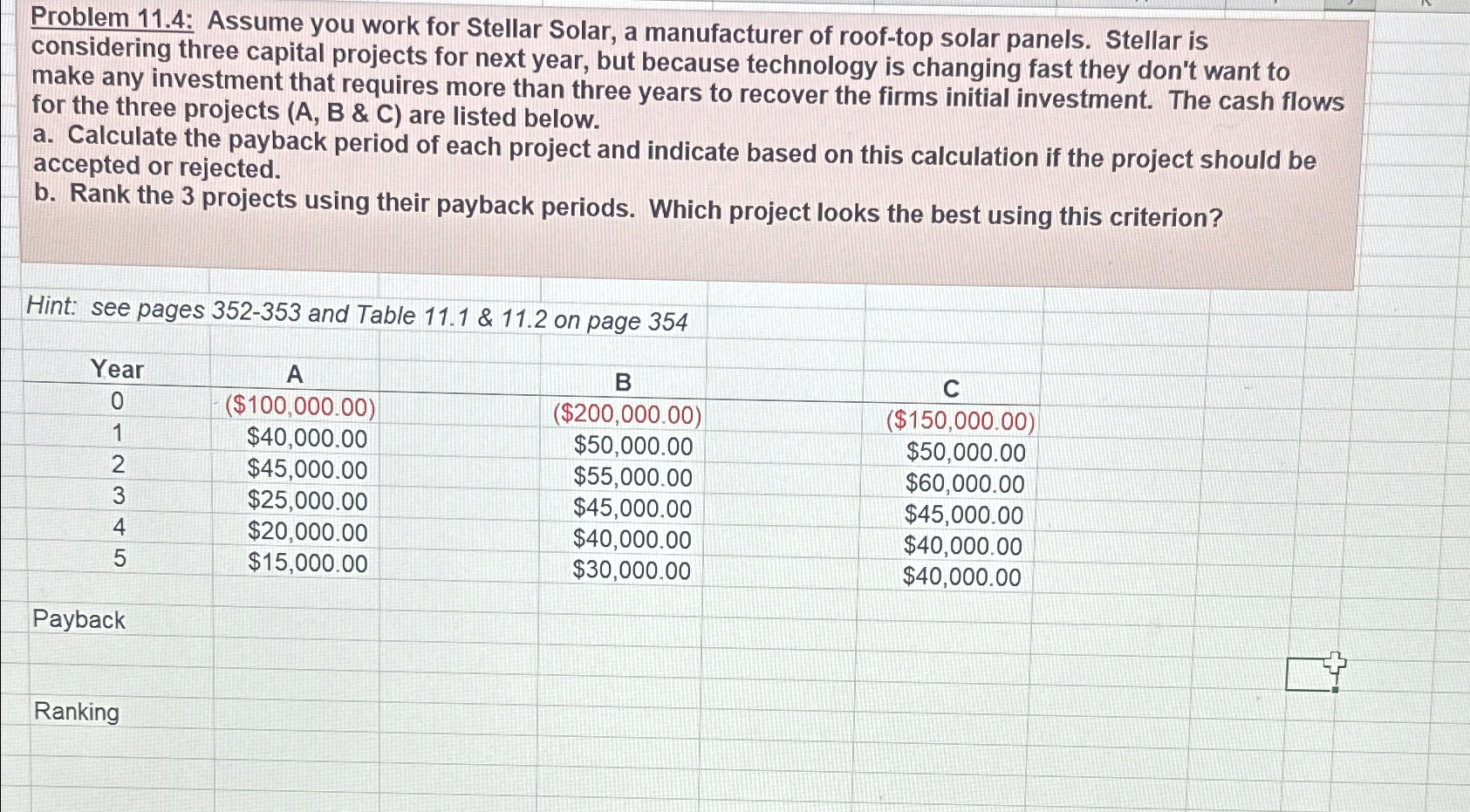

Problem : Assume you work for Stellar Solar, a manufacturer of rooftop solar panels. Stellar is considering three capital projects for next year, but because technology is changing fast they don't want to make any investment that requires more than three years to recover the firms initial investment. The cash flows for the three projects A B & C are listed below.

a Calculate the payback period of each project and indicate based on this calculation if the project should be accepted or rejected. Use excel functions and formulas

b Rank the projects using their payback periods. Which project looks the best using this criterion?

Hint: see pages and Table & on page

tableYearABC$$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started