Question

PROBLEM 1: 1. How much is the taxable income of Mike assuming he is a resident citizen? 2. How much is the taxable income

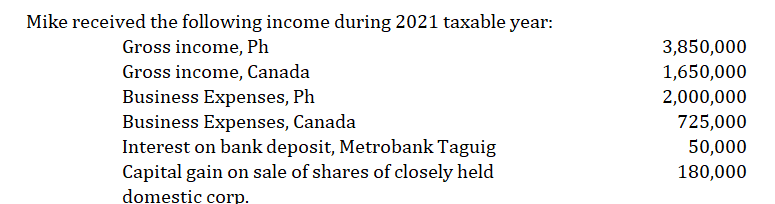

PROBLEM 1:

1. How much is the taxable income of Mike assuming he is a resident citizen?

2. How much is the taxable income of Mike assuming he is a non-resident citizen?

3. How much is the taxable income of Mike assuming he is a non-resident alien not engaged in trade or business?

4. How much is the tax due of Mike assuming he is a resident citizen?

5. How much is the tax due of Mike assuming he is a non-resident alien engaged in trade or business?

6. How much is the tax due of Mike assuming he is a non-resident alien non engaged in trade or business?

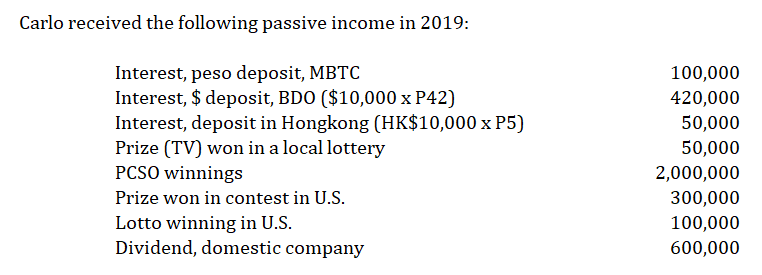

PROBLEM 2:

1. How much is the total final tax in 2019 if Carlo is a resident citizen?

2. How much is the total final tax in 2019 if Carlo is a non-resident citizen?

3. How much is the total final tax in 2019 if Carlo is a non-resident alien engaged in trade or business?

4. How much is the total final tax in 2019 if Carlo is a non-resident alien not engaged in trade or business?

5. If the taxable year is 2021 and Carlo is a non-resident alien engaged in trade or business, how much is the total final tax for 2021?

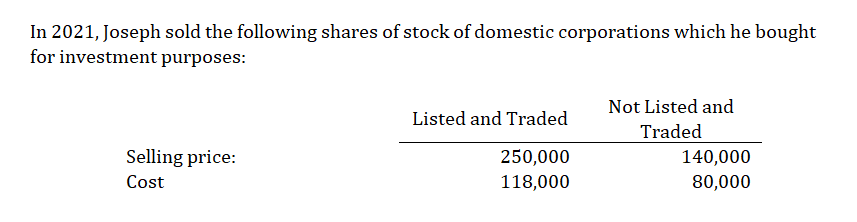

PROBLEM 3:

1. How much is the capital gains tax?

2. Assuming that Joseph is a dealer in securities, how much is the capital gains tax?

3. Assume the shares sold were issued by foreign corporations, the capital gains tax should be;

4. Assume the shares not listed and traded in the local stock exchange were only sold for P60,000, the capital gains tax should be:

PART 2:

1. Duterte sold 10,000 shares in X Corporation on June 30, 2021. The corporation's accounting period is a calendar basis. How is the fair value of the stock in X Corporation determined?

2. Joshua, a resident citizen taxpayer owns a property converted into apartment units with a monthly rental of P10,000 per unit. He subsequently sold the property to Jessy, a resident alien taxpayer. The sale shall be subject to:

3. Virgilio sold a residential house and lot held for P10,000,000 to his friend. Its FMV when he inherited it from his father was P12,000,000 although its present FMV is P15,000,000. The tax on the transaction is:

4. Assuming the house and lot was Virgilio's principal residence and he used 1/2 of the proceeds to buy a new principal residence within 18 months after the above sale. Assume further that Virgilio properly informed the BIR about the sale. It shall be:

5. A professional also refer to a person who engages in some art or sport for enjoyment of the art or sport

6. The provision of the Tax Code, as amended, which allows an 8% income tax rate on gross sales/receipts and other non-operating income in excess of P250,000 is only available to purely self-employed and or professionals.

7. Minimum Wage Earners receiving "other benefits" exceeding P90,000 limit shall be

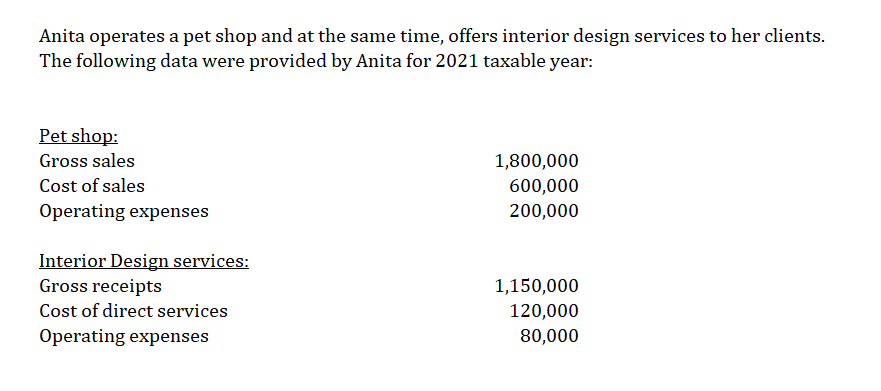

PROBLEM 4:

1. How much is her income tax liability for the year?

2. Assume Anita signified her intention to be taxed at the 8% income tax rate on her initial quarterly income tax return, how much is her income tax liability for the year?

3. Assume Anita is a vat-registered taxpayer, how much is her income tax liability for the year under the 8% income tax regime?

Mike received the following income during 2021 taxable year: Gross income, Ph Gross income, Canada Business Expenses, Ph Business Expenses, Canada Interest on bank deposit, Metrobank Taguig Capital gain on sale of shares of closely held domestic corp. 3,850,000 1,650,000 2,000,000 725,000 50,000 180,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started