Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In anticipation of the new oPhone and Astronote, you decide to invest some of your $17,000 savings in the Mandarin (M) and Tri-Star (TS)

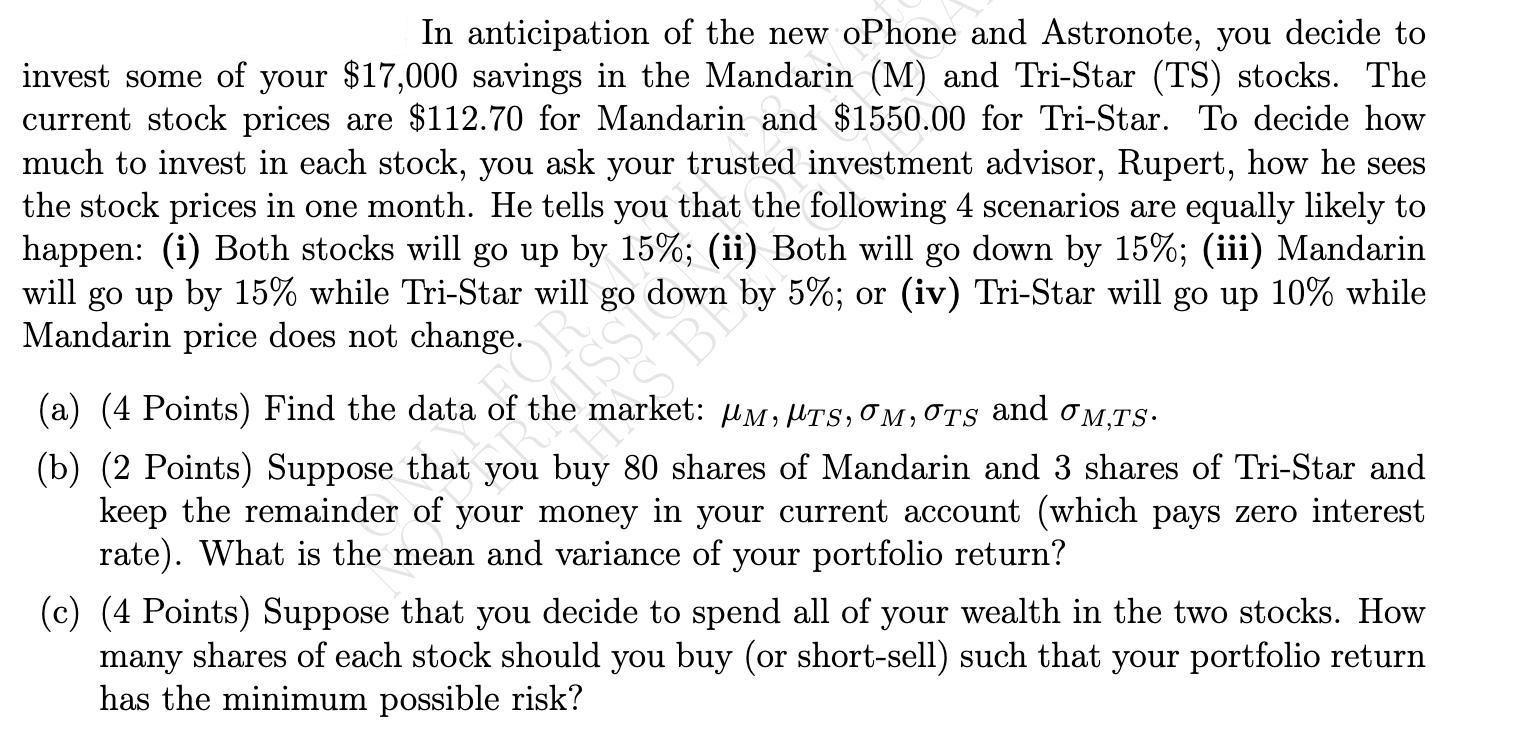

In anticipation of the new oPhone and Astronote, you decide to invest some of your $17,000 savings in the Mandarin (M) and Tri-Star (TS) stocks. The current stock prices are $112.70 for Mandarin and $1550.00 for Tri-Star. To decide how much to invest in each stock, you ask your trusted investment advisor, Rupert, how he sees the stock prices in one month. He tells you that the following 4 scenarios are equally likely to happen: (i) Both stocks will go up by 15%; (ii) Both will go down by 15%; (iii) Mandarin will go up by 15% while Tri-Star will go down by 5%; or (iv) Tri-Star will go up 10% while Mandarin price does not change. BR (a) (4 Points) Find the data of the market: M, TS, M, OTS and M,TS. (b) (2 Points) Suppose that you buy 80 shares of Mandarin and 3 shares of Tri-Star and keep the remainder of your money in your current account (which pays zero interest rate). What is the mean and variance of your portfolio return? (c) (4 Points) Suppose that you decide to spend all of your wealth in the two stocks. How many shares of each stock should you buy (or short-sell) such that your portfolio return has the minimum possible risk?

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a To find the data of the market we need to calculate the means expected returns and standard deviations of the two stocks Lets denote Mandarin as M and TriStar as TS M 15 025 15 025 15 025 0 025 375 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started