Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1: 12 Cabins, 12 Vacancies (4 points) Bates Motel, Inc. is incorporated and headquartered in State Z. It owns and operates several hotels

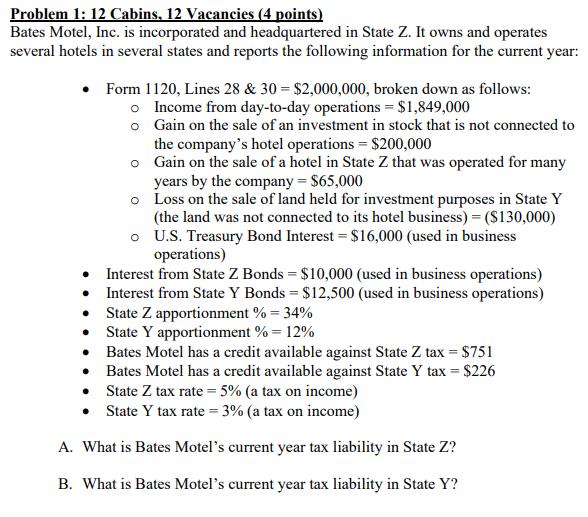

Problem 1: 12 Cabins, 12 Vacancies (4 points) Bates Motel, Inc. is incorporated and headquartered in State Z. It owns and operates several hotels in several states and reports the following information for the current year: Form 1120, Lines 28 & 30 = $2,000,000, broken down as follows: o Income from day-to-day operations = $1,849,000 Gain on the sale of an investment in stock that is not connected to the company's hotel operations = $200,000 Gain on the sale of a hotel in State Z that was operated for many years by the company = $65,000 Loss on the sale of land held for investment purposes in State Y (the land was not connected to its hotel business) = ($130,000) U.S. Treasury Bond Interest = $16,000 (used in business operations) Interest from State Z Bonds $10,000 (used in business operations) Interest from State Y Bonds = $12,500 (used in business operations) State Z apportionment % = 34% State Y apportionment % = 12% Bates Motel has a credit available against State Z tax = $751 . Bates Motel has a credit available against State Y tax = $226 State Z tax rate 5% (a tax on income) State Y tax rate=3% (a tax on income) A. What is Bates Motel's current year tax liability in State Z? B. What is Bates Motel's current year tax liability in State Y?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A State Z Tax Liability 1 State Z apportionable income Total income State Z apportionment 2000000 34 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started