Answered step by step

Verified Expert Solution

Question

1 Approved Answer

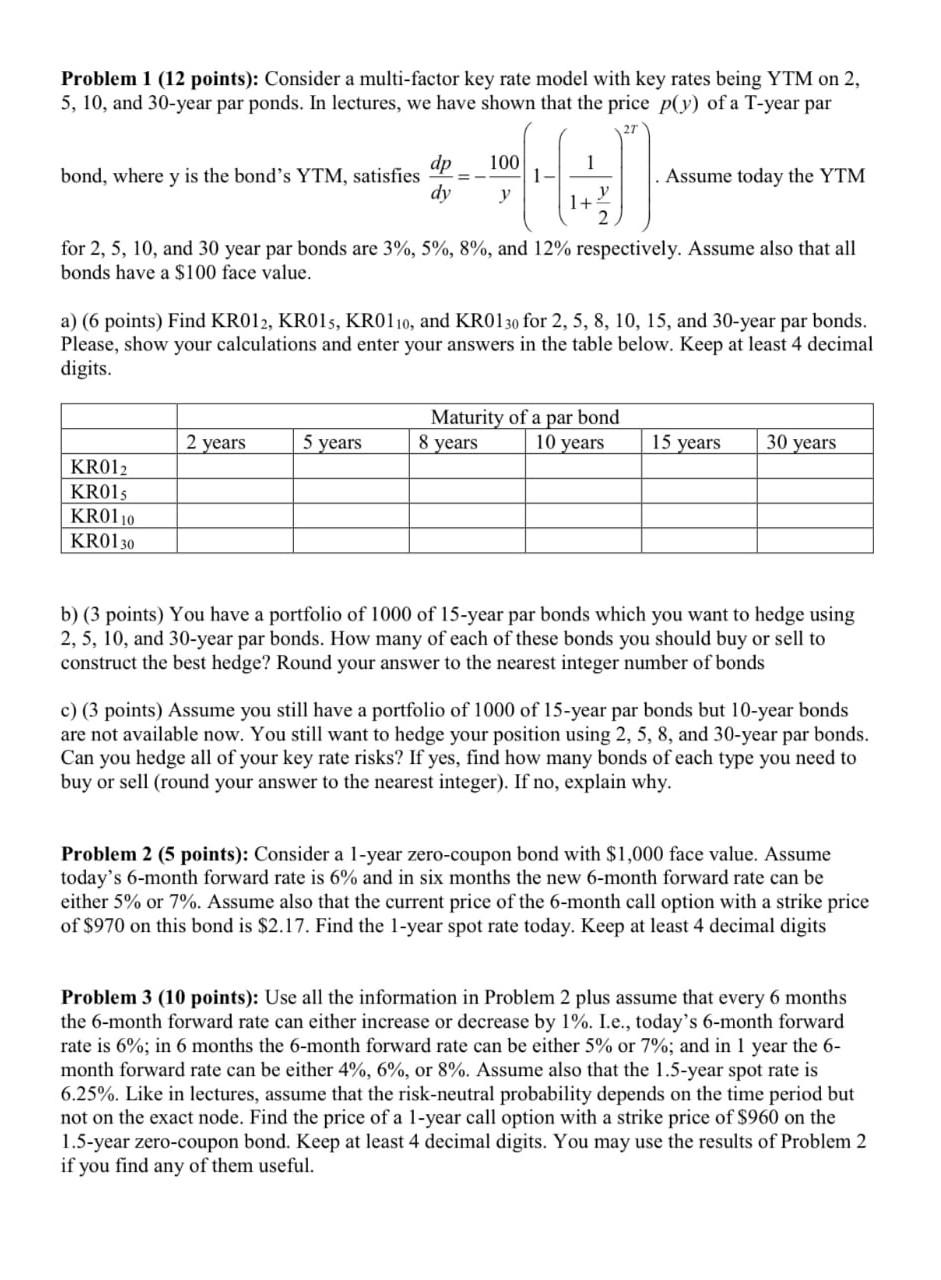

Problem 1 (12 points): Consider a multi-factor key rate model with key rates being YTM on 2, 5, 10, and 30-year par ponds. In lectures,

Problem 1 (12 points): Consider a multi-factor key rate model with key rates being YTM on 2, 5, 10, and 30-year par ponds. In lectures, we have shown that the price p(y) of a T-year par 100 1 = 1 bond, where y is the bond's YTM, satisfies dp dy Assume today the YTM y 1+ 2 for 2, 5, 10, and 30 year par bonds are 3%, 5%, 8%, and 12% respectively. Assume also that all bonds have a $100 face value. a) (6 points) Find KR012, KR015, KR0110, and KR0130 for 2, 5, 8, 10, 15, and 30-year par bonds. Please, show your calculations and enter your answers in the table below. Keep at least 4 decimal digits. Maturity of a par bond 2 years 5 years 8 years 10 years 15 years 30 years KR012 KR015 KR0110 KR0130 b) (3 points) You have a portfolio of 1000 of 15-year par bonds which you want to hedge using 2, 5, 10, and 30-year par bonds. How many of each of these bonds you should buy or sell to construct the best hedge? Round your answer to the nearest integer number of bonds c)(3 points) Assume you still have a portfolio of 1000 of 15-year par bonds but 10-year bonds are not available now. You still want to hedge your position using 2, 5, 8, and 30-year par bonds. Can you hedge all of your key rate risks? If yes, find how many bonds of each type you need to buy or sell (round your answer to the nearest integer). If no, explain why. Problem 2 (5 points): Consider a 1-year zero-coupon bond with $1,000 face value. Assume today's 6-month forward rate is 6% and in six months the new 6-month forward rate can be either 5% or 7%. Assume also that the current price of the 6-month call option with a strike price of $970 on this bond is $2.17. Find the 1-year spot rate today. Keep at least 4 decimal digits Problem 3 (10 points): Use all the information in Problem 2 plus assume that every 6 months the 6-month forward rate can either increase or decrease by 1%. I.e., today's 6-month forward rate is 6%; in 6 months the 6-month forward rate can be either 5% or 7%; and in 1 year the 6- month forward rate can be either 4%, 6%, or 8%. Assume also that the 1.5-year spot rate is 6.25%. Like in lectures, assume that the risk-neutral probability depends on the time period but not on the exact node. Find the price of a 1-year call option with a strike price of $960 on the 1.5-year zero-coupon bond. Keep at least 4 decimal digits. You may use the results of Problem 2 if you find any of them useful. Problem 1 (12 points): Consider a multi-factor key rate model with key rates being YTM on 2, 5, 10, and 30-year par ponds. In lectures, we have shown that the price p(y) of a T-year par 100 1 = 1 bond, where y is the bond's YTM, satisfies dp dy Assume today the YTM y 1+ 2 for 2, 5, 10, and 30 year par bonds are 3%, 5%, 8%, and 12% respectively. Assume also that all bonds have a $100 face value. a) (6 points) Find KR012, KR015, KR0110, and KR0130 for 2, 5, 8, 10, 15, and 30-year par bonds. Please, show your calculations and enter your answers in the table below. Keep at least 4 decimal digits. Maturity of a par bond 2 years 5 years 8 years 10 years 15 years 30 years KR012 KR015 KR0110 KR0130 b) (3 points) You have a portfolio of 1000 of 15-year par bonds which you want to hedge using 2, 5, 10, and 30-year par bonds. How many of each of these bonds you should buy or sell to construct the best hedge? Round your answer to the nearest integer number of bonds c)(3 points) Assume you still have a portfolio of 1000 of 15-year par bonds but 10-year bonds are not available now. You still want to hedge your position using 2, 5, 8, and 30-year par bonds. Can you hedge all of your key rate risks? If yes, find how many bonds of each type you need to buy or sell (round your answer to the nearest integer). If no, explain why. Problem 2 (5 points): Consider a 1-year zero-coupon bond with $1,000 face value. Assume today's 6-month forward rate is 6% and in six months the new 6-month forward rate can be either 5% or 7%. Assume also that the current price of the 6-month call option with a strike price of $970 on this bond is $2.17. Find the 1-year spot rate today. Keep at least 4 decimal digits Problem 3 (10 points): Use all the information in Problem 2 plus assume that every 6 months the 6-month forward rate can either increase or decrease by 1%. I.e., today's 6-month forward rate is 6%; in 6 months the 6-month forward rate can be either 5% or 7%; and in 1 year the 6- month forward rate can be either 4%, 6%, or 8%. Assume also that the 1.5-year spot rate is 6.25%. Like in lectures, assume that the risk-neutral probability depends on the time period but not on the exact node. Find the price of a 1-year call option with a strike price of $960 on the 1.5-year zero-coupon bond. Keep at least 4 decimal digits. You may use the results of Problem 2 if you find any of them useful

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started