Answered step by step

Verified Expert Solution

Question

1 Approved Answer

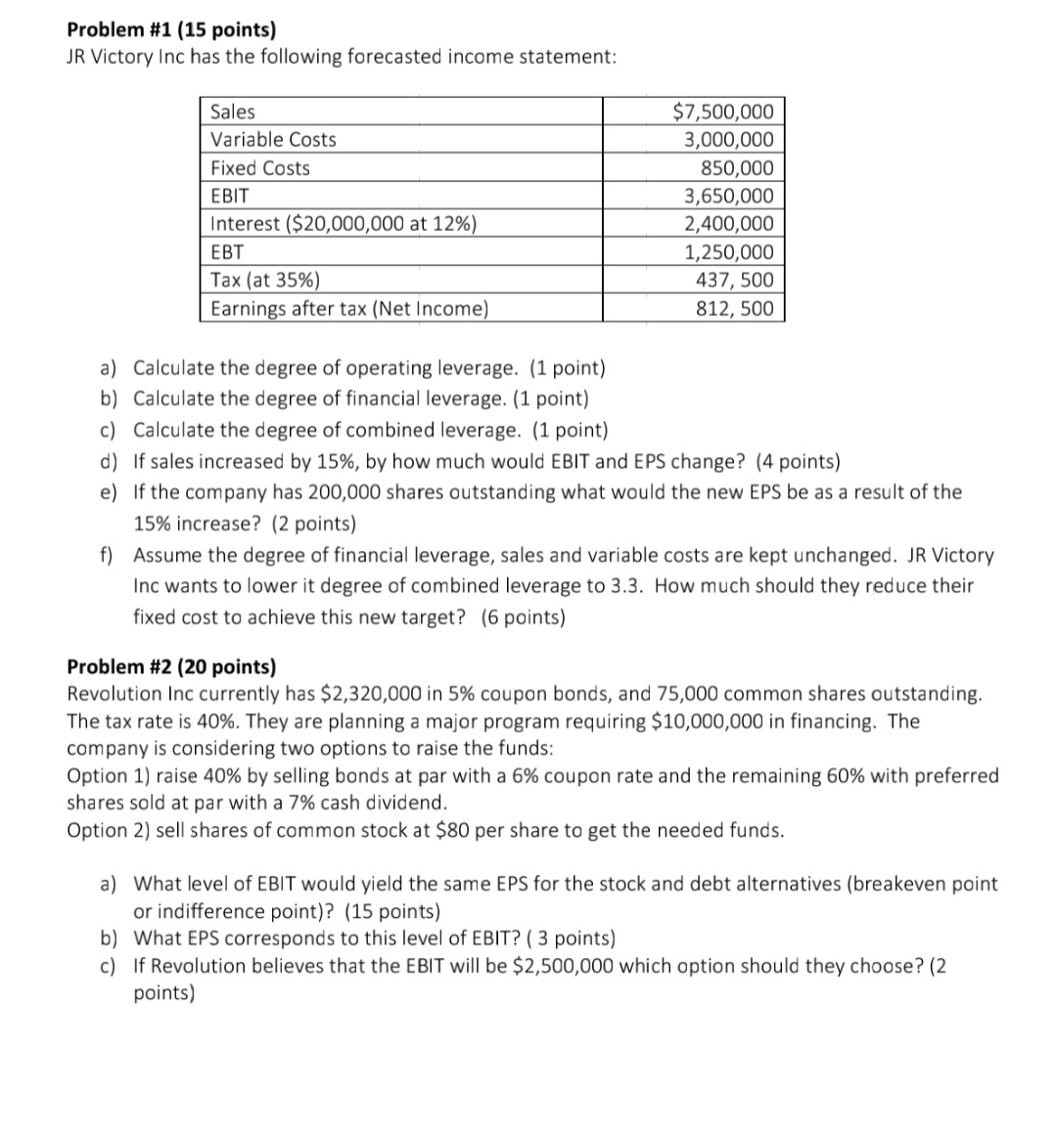

Problem #1 (15 points) JR Victory Inc has the following forecasted income statement: Sales Variable Costs Fixed Costs EBIT Interest ($20,000,000 at 12%) EBT

Problem #1 (15 points) JR Victory Inc has the following forecasted income statement: Sales Variable Costs Fixed Costs EBIT Interest ($20,000,000 at 12%) EBT Tax (at 35%) Earnings after tax (Net Income) $7,500,000 3,000,000 850,000 3,650,000 2,400,000 1,250,000 437, 500 812, 500 a) Calculate the degree of operating leverage. (1 point) b) Calculate the degree of financial leverage. (1 point) c) Calculate the degree of combined leverage. (1 point) d) If sales increased by 15%, by how much would EBIT and EPS change? (4 points) e) If the company has 200,000 shares outstanding what would the new EPS be as a result of the 15% increase? (2 points) f) Assume the degree of financial leverage, sales and variable costs are kept unchanged. JR Victory Inc wants to lower it degree of combined leverage to 3.3. How much should they reduce their fixed cost to achieve this new target? (6 points) Problem #2 (20 points) Revolution Inc currently has $2,320,000 in 5% coupon bonds, and 75,000 common shares outstanding. The tax rate is 40%. They are planning a major program requiring $10,000,000 in financing. The company is considering two options to raise the funds: Option 1) raise 40% by selling bonds at par with a 6% coupon rate and the remaining 60% with preferred shares sold at par with a 7% cash dividend. Option 2) sell shares of common stock at $80 per share to get the needed funds. a) What level of EBIT would yield the same EPS for the stock and debt alternatives (breakeven point or indifference point)? (15 points) b) What EPS corresponds to this level of EBIT? (3 points) c) If Revolution believes that the EBIT will be $2,500,000 which option should they choose? (2 points)

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Answer problem 1 Problem 2 a To find the level of EBIT that would yield the same EPS for the stock a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started