Answered step by step

Verified Expert Solution

Question

1 Approved Answer

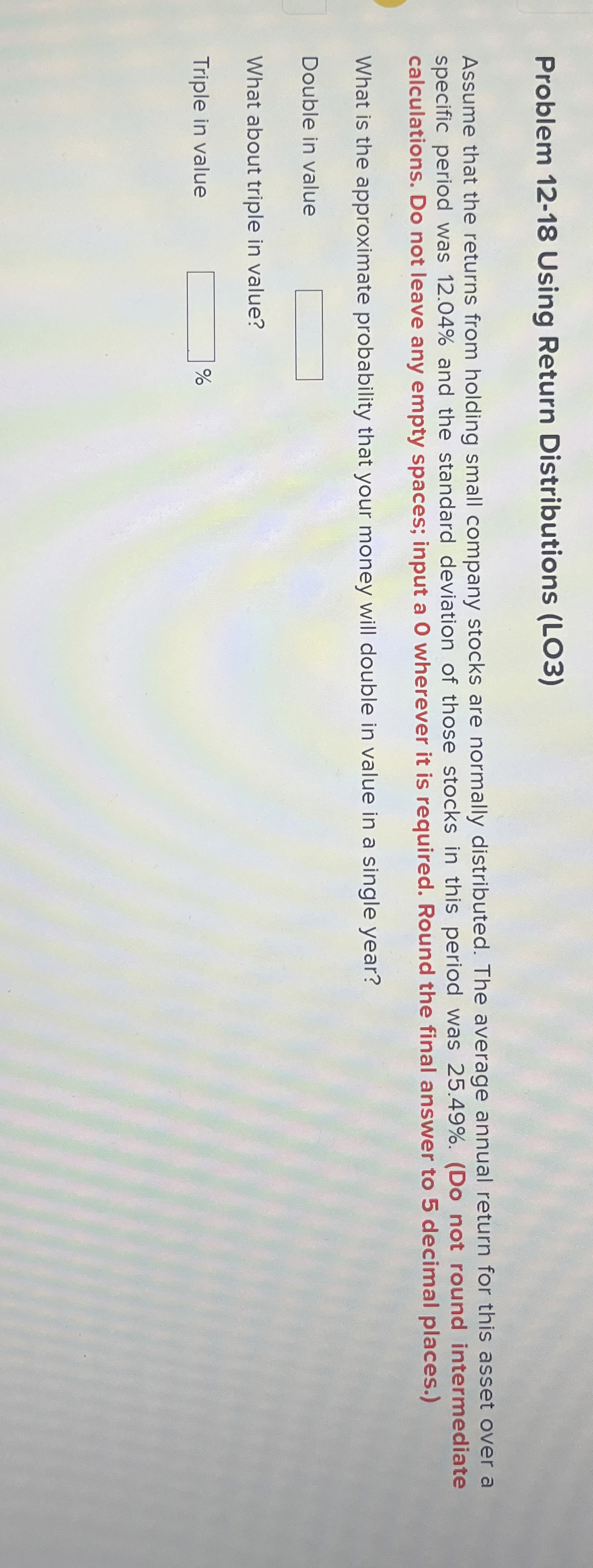

Problem 1 2 - 1 8 Using Return Distributions ( LO 3 ) Assume that the returns from holding small company stocks are normally distributed.

Problem Using Return Distributions LO

Assume that the returns from holding small company stocks are normally distributed. The average annual return for this asset over a specific period was and the standard deviation of those stocks in this period was Do not round intermediate calculations. Do not leave any empty spaces; input a wherever it is required. Round the final answer to decimal places.

What is the approximate probability that your money will double in value in a single year?

Double in value

What about triple in value?

Triple in value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started