Answered step by step

Verified Expert Solution

Question

1 Approved Answer

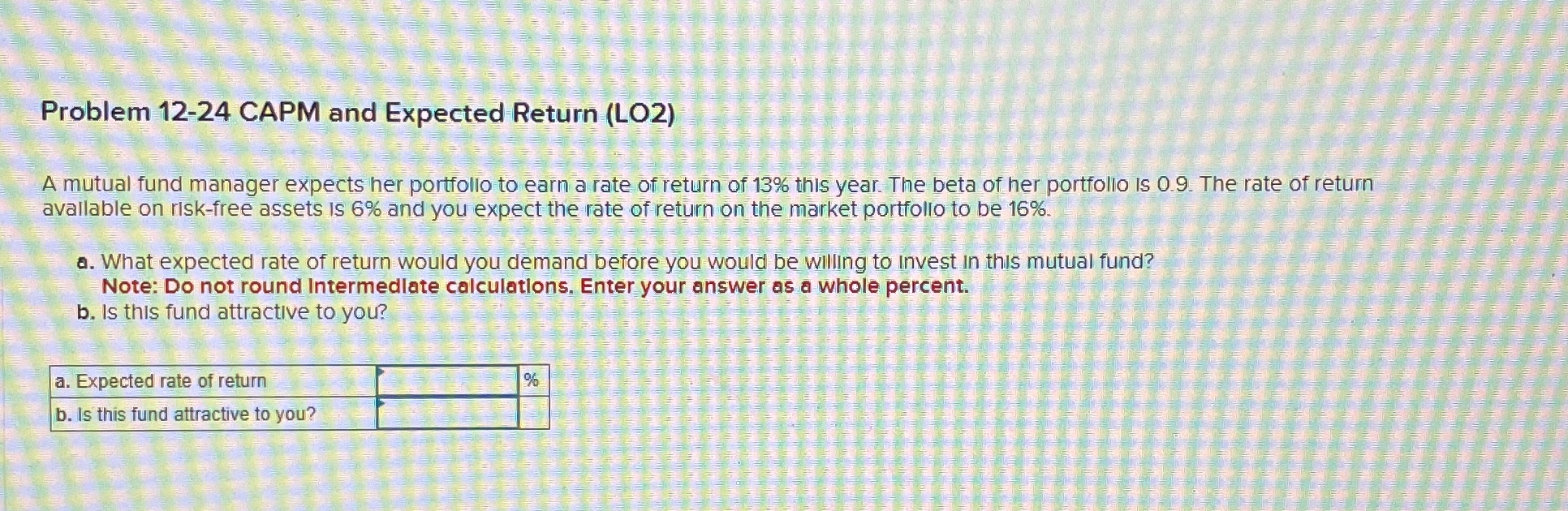

Problem 1 2 - 2 4 CAPM and Expected Return ( LO 2 ) A mutual fund manager expects her portfolio to earn a rate

Problem CAPM and Expected Return LO

A mutual fund manager expects her portfolio to earn a rate of return of this year. The beta of her portfollo is The rate of return avallable on riskfree assets is and you expect the rate of return on the market portfolio to be

a What expected rate of return would you demand before you would be willing to invest in this mutual fund?

Note: Do not round Intermedlate calculations, Enter your answer as a whole percent.

b Is this fund attractive to you?

tablea Expected rate of return,,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started