Answered step by step

Verified Expert Solution

Question

1 Approved Answer

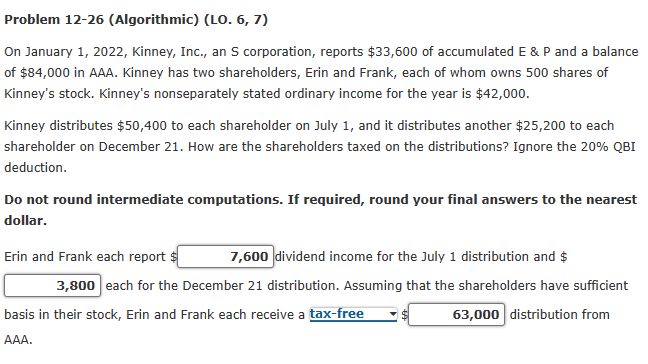

Problem 1 2 - 2 6 ( Algorithmic ) ( Lo . 6 , 7 ) On January 1 , 2 0 2 2 ,

Problem AlgorithmicLo

On January Kinney, Inc., an S corporation, reports $ of accumulated E & P and a balance

of $ in AAA. Kinney has two shareholders, Erin and Frank, each of whom owns shares of

Kinney's stock. Kinney's nonseparately stated ordinary income for the year is $

Kinney distributes $ to each shareholder on July and it distributes another $ to each

shareholder on December How are the shareholders taxed on the distributions? Ignore the QBI

deduction.

Do not round intermediate computations. If required, round your final answers to the nearest

dollar.

Erin and Frank each report $ dividend income for the July distribution and $

each for the December distribution. Assuming that the shareholders have sufficient

basis in their stock, Erin and Frank each receive a

distribution from

AAA.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started