Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Four years ago, PAR Company purchased 40% of the 60,000 outstanding shares of SUB Limited for $95,000. As of December 31, 2018, its fiscal

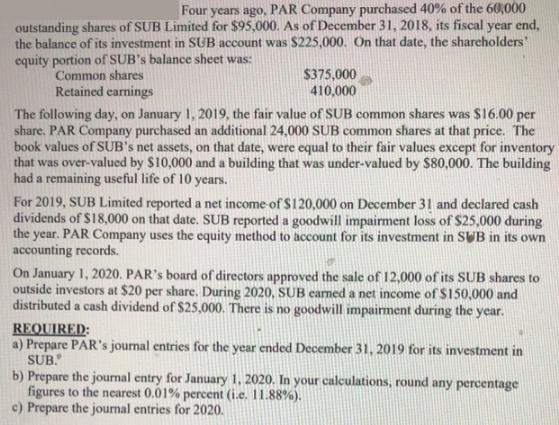

Four years ago, PAR Company purchased 40% of the 60,000 outstanding shares of SUB Limited for $95,000. As of December 31, 2018, its fiscal year end, the balance of its investment in SUB account was $225,000. On that date, the shareholders' equity portion of SUB's balance sheet was: Common shares Retained earnings $375,000 410,000 The following day, on January 1, 2019, the fair value of SUB common shares was $16.00 per share. PAR Company purchased an additional 24,000 SUB common shares at that price. The book values of SUB's net assets, on that date, were equal to their fair values except for inventory that was over-valued by $10,000 and a building that was under-valued by $80,000. The building had a remaining useful life of 10 years. For 2019, SUB Limited reported a net income of $120,000 on December 31 and declared cash dividends of $18,000 on that date. SUB reported a goodwill impairment loss of $25,000 during the year. PAR Company uses the equity method to account for its investment in SUB in its own accounting records. On January 1, 2020. PAR's board of directors approved the sale of 12,000 of its SUB shares to outside investors at $20 per share. During 2020, SUB earned a net income of $150,000 and distributed a cash dividend of $25,000. There is no goodwill impairment during the year. REQUIRED: a) Prepare PAR's journal entries for the year ended December 31, 2019 for its investment in SUB. b) Prepare the journal entry for January 1, 2020. In your calculations, round any percentage figures to the nearest 0.01% percent (i.e. 11.88%). c) Prepare the journal entries for 2020.

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Journal entries for the year ended December 31 2019 1 To record the share of SUBs net income Inves...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started