Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1 (22 Marks) Sun Ltd purchased 80% of the issued shares in Saturn Ltd on 1 January 2018 for consideration of $2,400,000 and

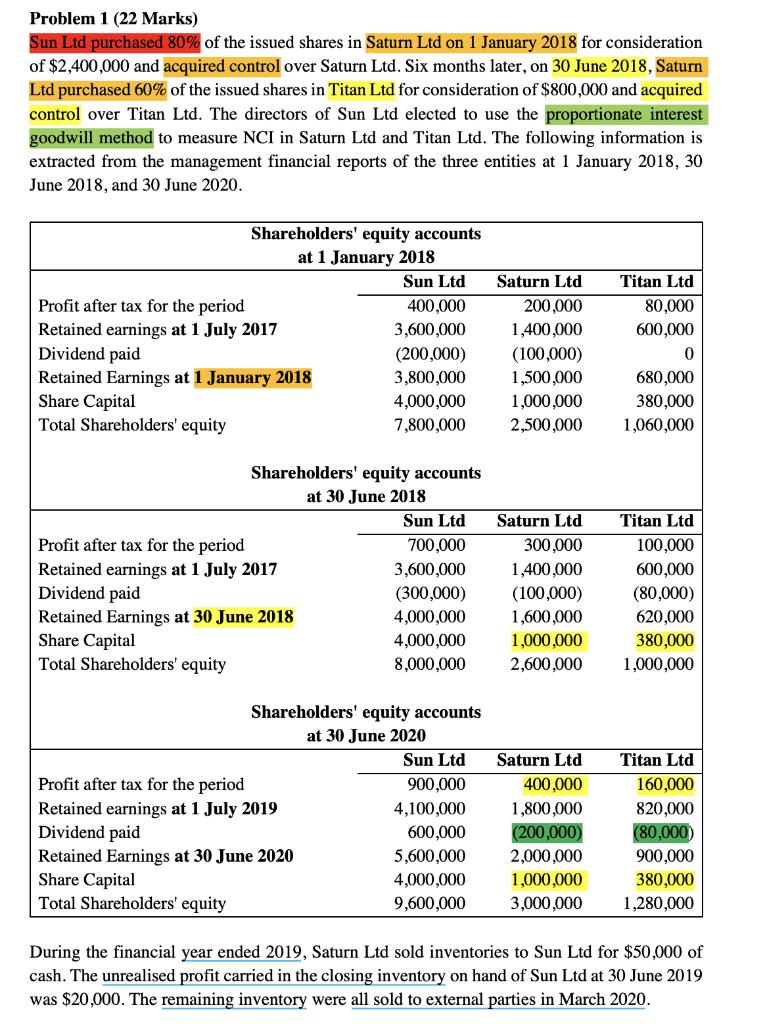

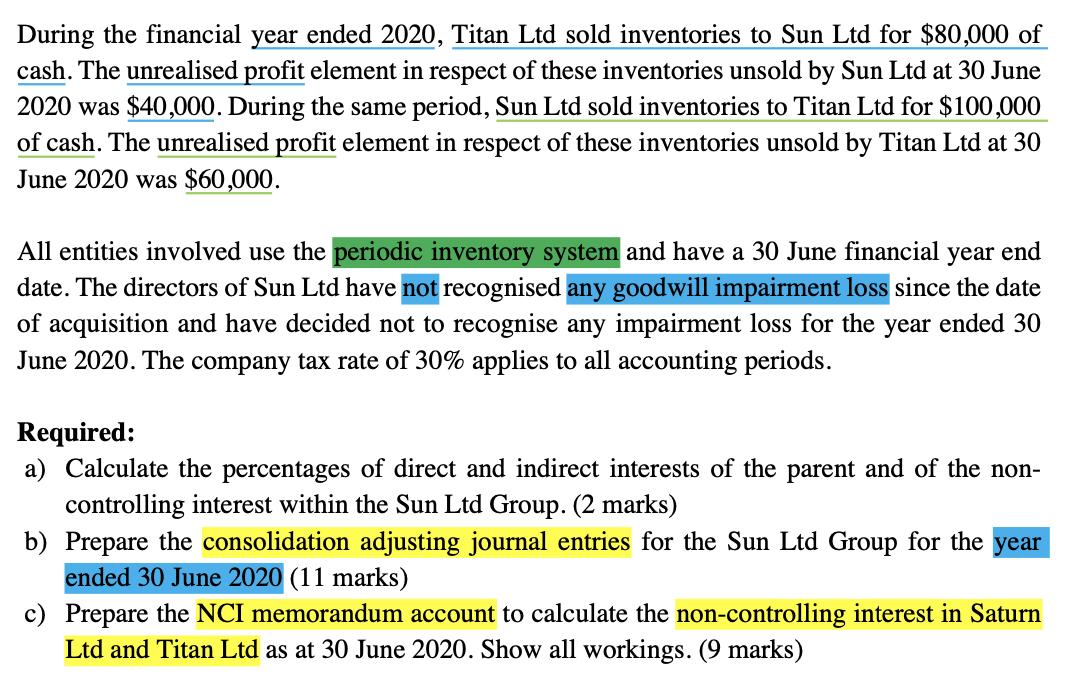

Problem 1 (22 Marks) Sun Ltd purchased 80% of the issued shares in Saturn Ltd on 1 January 2018 for consideration of $2,400,000 and acquired control over Saturn Ltd. Six months later, on 30 June 2018, Saturn Ltd purchased 60% of the issued shares in Titan Ltd for consideration of $800,000 and acquired control over Titan Ltd. The directors of Sun Ltd elected to use the proportionate interest goodwill method to measure NCI in Saturn Ltd and Titan Ltd. The following information is extracted from the management financial reports of the three entities at 1 January 2018, 30 June 2018, and 30 June 2020. Shareholders' equity accounts at 1 January 2018 Profit after tax for the period Retained earnings at 1 July 2017 Dividend paid Retained Earnings at 1 January 2018 Share Capital Total Shareholders' equity Shareholders' equity accounts at 30 June 2018 Profit after tax for the period Retained earnings at 1 July 2017 Dividend paid Retained Earnings at 30 June 2018 Share Capital Total Shareholders' equity Sun Ltd 400,000 3,600,000 (200,000) 3,800,000 4,000,000 7,800,000 Profit after tax for the period Retained earnings at 1 July 2019 Dividend paid Retained Earnings at 30 June 2020 Share Capital Total Shareholders' equity Sun Ltd Shareholders' equity accounts at 30 June 2020 Saturn Ltd 700,000 300,000 3,600,000 1,400,000 (300,000) (100,000) 4,000,000 1,600,000 4,000,000 1,000,000 8,000,000 2,600,000 Sun Ltd Saturn Ltd 200,000 1,400,000 (100,000) 1,500,000 1,000,000 2,500,000 900,000 4,100,000 600,000 5,600,000 4,000,000 9,600,000 Saturn Ltd 400,000 1,800,000 (200,000) 2,000,000 1,000,000 3,000,000 Titan Ltd 80,000 600,000 0 680,000 380,000 1,060,000 Titan Ltd 100,000 600,000 (80,000) 620,000 380,000 1,000,000 Titan Ltd 160,000 820,000 (80,000) 900,000 380,000 1,280,000 During the financial year ended 2019, Saturn Ltd sold inventories to Sun Ltd for $50,000 of cash. The unrealised profit carried in the closing inventory on hand of Sun Ltd at 30 June 2019 was $20,000. The remaining inventory were all sold to external parties in March 2020. During the financial year ended 2020, Titan Ltd sold inventories to Sun Ltd for $80,000 of cash. The unrealised profit element in respect of these inventories unsold by Sun Ltd at 30 June 2020 was $40,000. During the same period, Sun Ltd sold inventories to Titan Ltd for $100,000 of cash. The unrealised profit element in respect of these inventories unsold by Titan Ltd at 30 June 2020 was $60,000. All entities involved use the periodic inventory system and have a 30 June financial year end date. The directors of Sun Ltd have not recognised any goodwill impairment loss since the date of acquisition and have decided not to recognise any impairment loss for the year ended 30 June 2020. The company tax rate of 30% applies to all accounting periods. Required: a) Calculate the percentages of direct and indirect interests of the parent and of the non- controlling interest within the Sun Ltd Group. (2 marks) b) Prepare the consolidation adjusting journal entries for the Sun Ltd Group for the year ended 30 June 2020 (11 marks) c) Prepare the NCI memorandum account to calculate the non-controlling interest in Saturn Ltd and Titan Ltd as at 30 June 2020. Show all workings. (9 marks)

Step by Step Solution

★★★★★

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the percentage of indirect interest of the parent and of the noncontrolling interest within the Sun Lid Group we need to calculate the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started