Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1 (22 points): The dataset LOANAPP from Wooldridge is indeed utilized for the 1996 paper The Cultural Affinity Hypothesis and Mortgage Lending Decisions,

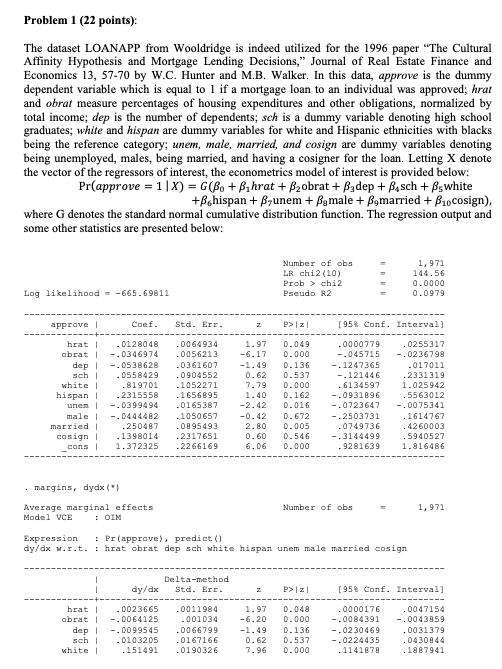

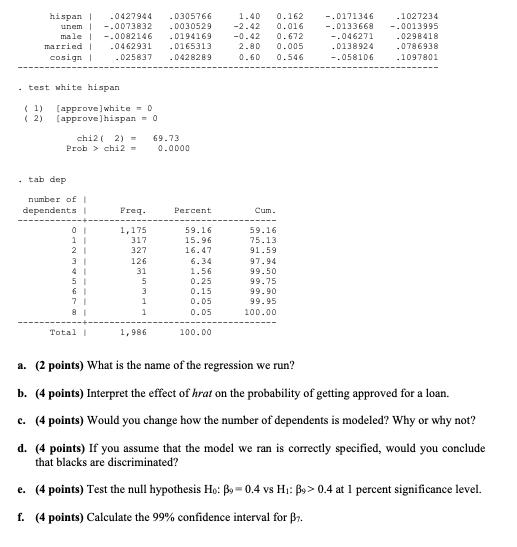

Problem 1 (22 points): The dataset LOANAPP from Wooldridge is indeed utilized for the 1996 paper "The Cultural Affinity Hypothesis and Mortgage Lending Decisions," Journal of Real Estate Finance and Economics 13, 57-70 by W.C. Hunter and M.B. Walker. In this data, approve is the dummy dependent variable which is equal to 1 if a mortgage loan to an individual was approved; hrat and obrat measure percentages of housing expenditures and other obligations, normalized by total income; dep is the number of dependents; sch is a dummy variable denoting high school. graduates; white and hispan are dummy variables for white and Hispanic ethnicities with blacks being the reference category; unem, male, married, and cosign are dummy variables denoting being unemployed, males, being married, and having a cosigner for the loan. Letting X denote the vector of the regressors of interest, the econometrics model of interest is provided below: Pr(approve = 1|X) = G(Bo + Bhrat + B2obrat + Badep + Bosch + Bswhite +Behispan + B,unem + Bamale + B,married + B0 cosign), where G denotes the standard normal cumulative distribution function. The regression output and some other statistics are presented below: Log likelihood -665.69811 approve I hrat | obrat | dep | sch | white | hispan | Coef. 0128048 -.0346974 -.0538628 0558429 .819701 2315558 unen | -.0399494 married | male | --0444482 .250487 cosign | .1398014 cons | 1.372325 .margins, dydx (*) Average marginal effects Model VCE : OIM Std. Err. dy/dx hrat | .0023665 obrat | -.0064125 dep | -.0099545 sch | white | 0103205 151491 .0064934 .0056213 .0361607 .0904552 1052271 .1656895 .0165387 1050657 .0895493 .2317651 .2266169 Delta-method Std. Err. .0011984 001034 z .0066799 .0167166 .0190326 Number of obs LR chi2 (10) Prob> chi2 Pseudo R2 1.97 -6.17 -1.49 0.136 0.62 0.537 7.79 1.40 P> |z| 0.049 0.000 0.000 0.162 -2.42 0.016 -0.42 0.672 2.80 0.005 0.60 0.546 6.06 0.000 z 1.97 -6.20 Expression : Pr (approve), predict() dy/dx w.r.t.: hrat obrat dep sch white hispan unem male married cosign P> |z| Number of obs 0.048 0.000 [95% Conf. Interval) .0000779 -.045715 -.1247365 -121446 .6134597 -.0931896 -1.49 0.136 0.62 0.537 7.96 0.000 0749736 -.3144499 .9281639 017011 .2331319 1.025942 .5563012 -.0723647 -.0075341 -.2503731 1,971 144.56 0.0000 0.0979 .0255317 -.0236798 .0000176 -.0084391 -.0230469 -.0224435 1141878 1614767 4260003 .5940527 1.816486 1,971 [95% Conf. Interval] .0047154 -.0043859 .0031379 0430844 .1887941 hispan | 0427944 unem | -.0073832 male | -.0082146 0462931 . 025837 married | cosign | . test white hispan (1) [approve]white = 0 (2) (approve]hispan= 0 . tab dep chi2 (2) - 69.73 Prob> chi2= 0.0000 number of I dependents | 01 11 21 31 41 5 61 7 8 0305766 .0030529 0194169 0165313 .0428289 Freq. Percent 1,175 59,16 317 15.96 327 16.47 T 126 6.34 31 1.56 5 0.25 3 0.15 1 0.05 1 0.05 Total I 1,986 1.40 0.162 -2.42 0.016 -0.42 0.672 2.80 0.005 0.60 0.546 100.00 Cum. 59.16. 75.13 91.59 97.94 99.50 99.75 99.90 99.95 100.00 -.0171346 .1027234 -.0133668 -.0013995 -.046271 .0298418 .01389241 0786938 -.058106 .1097801 a. (2 points) What is the name of the regression we run? b. (4 points) Interpret the effect of hrat on the probability of getting approved for a loan. c. (4 points) Would you change how the number of dependents is modeled? Why or why not? d. (4 points) If you assume that the model we ran is correctly specified, would you conclude that blacks are discriminated? e. (4 points) Test the null hypothesis Ho: B=0.4 vs H: B9> 0.4 at 1 percent significance level. f. (4 points) Calculate the 99% confidence interval for B7.

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a The name of the regression is the cultural affinity hypothesis and mortgage lending decisions b Th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started