Answered step by step

Verified Expert Solution

Question

1 Approved Answer

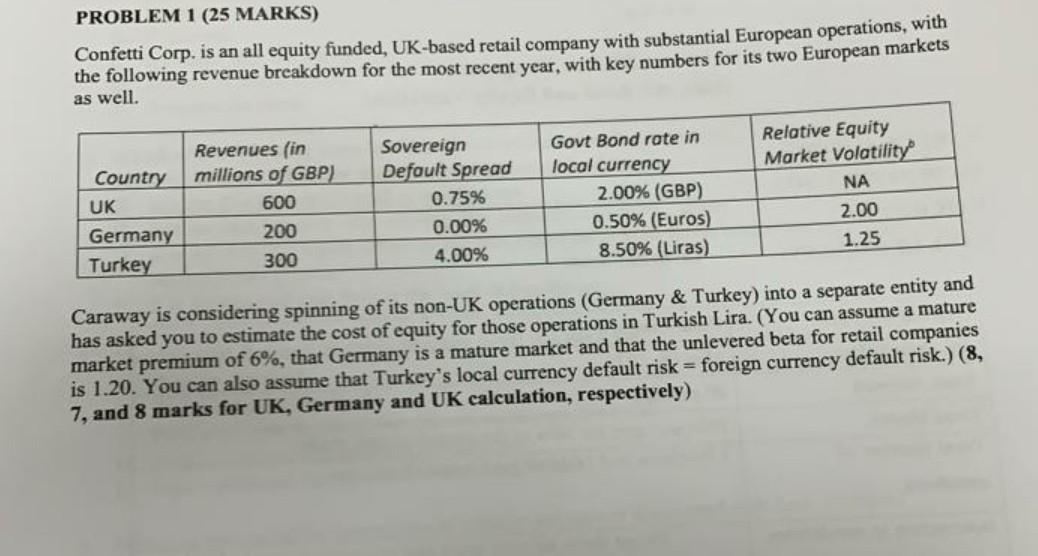

PROBLEM 1 (25 MARKS) Confetti Corp. is an all equity funded, UK-based retail company with substantial European operations, with the following revenue breakdown for the

PROBLEM 1 (25 MARKS) Confetti Corp. is an all equity funded, UK-based retail company with substantial European operations, with the following revenue breakdown for the most recent year, with key numbers for its two European markets as well. Country UK Germany Turkey Revenues (in millions of GBP) 600 200 300 Sovereign Default Spread 0.75% 0.00% 4.00% Govt Bond rote in local currency 2.00% (GBP) 0.50% (Euros) 8.50% (Liras) Relative Equity Market Volatility NA 2.00 1.25 Caraway is considering spinning of its non-UK operations (Germany & Turkey) into a separate entity and has asked you to estimate the cost of equity for those operations in Turkish Lira. (You can assume a mature market premium of 6%, that Germany is a mature market and that the unlevered beta for retail companies is 1.20. You can also assume that Turkey's local currency default risk = foreign currency default risk.) (8, 7, and 8 marks for UK, Germany and UK calculation, respectively) PROBLEM 1 (25 MARKS) Confetti Corp. is an all equity funded, UK-based retail company with substantial European operations, with the following revenue breakdown for the most recent year, with key numbers for its two European markets as well. Country UK Germany Turkey Revenues (in millions of GBP) 600 200 300 Sovereign Default Spread 0.75% 0.00% 4.00% Govt Bond rote in local currency 2.00% (GBP) 0.50% (Euros) 8.50% (Liras) Relative Equity Market Volatility NA 2.00 1.25 Caraway is considering spinning of its non-UK operations (Germany & Turkey) into a separate entity and has asked you to estimate the cost of equity for those operations in Turkish Lira. (You can assume a mature market premium of 6%, that Germany is a mature market and that the unlevered beta for retail companies is 1.20. You can also assume that Turkey's local currency default risk = foreign currency default risk.) (8, 7, and 8 marks for UK, Germany and UK calculation, respectively)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started