Answered step by step

Verified Expert Solution

Question

1 Approved Answer

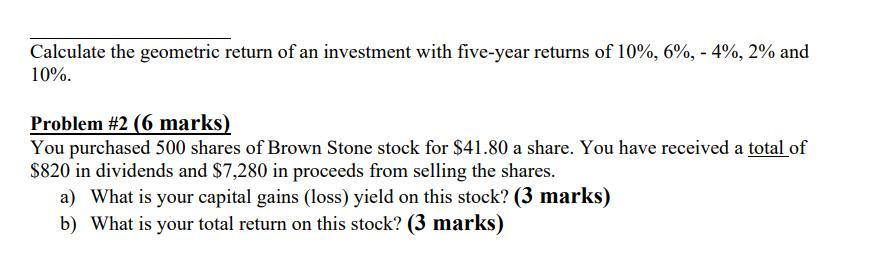

Calculate the geometric return of an investment with five-year returns of 10%, 6%, - 4%, 2% and 10%. Problem #2 (6 marks) You purchased

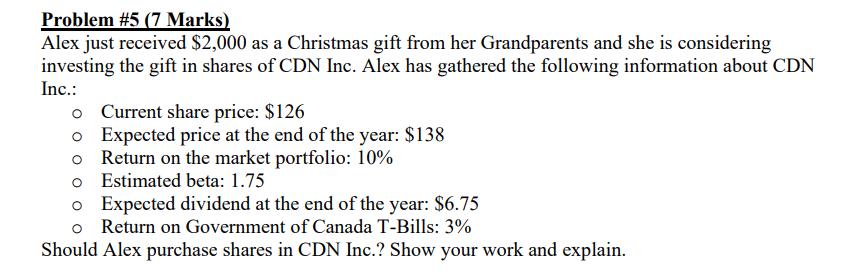

Calculate the geometric return of an investment with five-year returns of 10%, 6%, - 4%, 2% and 10%. Problem #2 (6 marks) You purchased 500 shares of Brown Stone stock for $41.80 a share. You have received a total of $820 in dividends and $7,280 in proceeds from selling the shares. a) What is your capital gains (loss) yield on this stock? (3 marks) b) What is your total return on this stock? (3 marks) Problem #5 (7 Marks) Alex just received $2,000 as a Christmas gift from her Grandparents and she is considering investing the gift in shares of CDN Inc. Alex has gathered the following information about CDN Inc.: Current share price: $126 Expected price at the end of the year: $138 Return on the market portfolio: 10% Estimated beta: 1.75 o o o Expected dividend at the end of the year: $6.75 o Return on Government of Canada T-Bills: 3% Should Alex purchase shares in CDN Inc.? Show your work and explain.

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Problem 1 The geometric return of the investment is 820 This can be calculated using the following f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started