Answered step by step

Verified Expert Solution

Question

1 Approved Answer

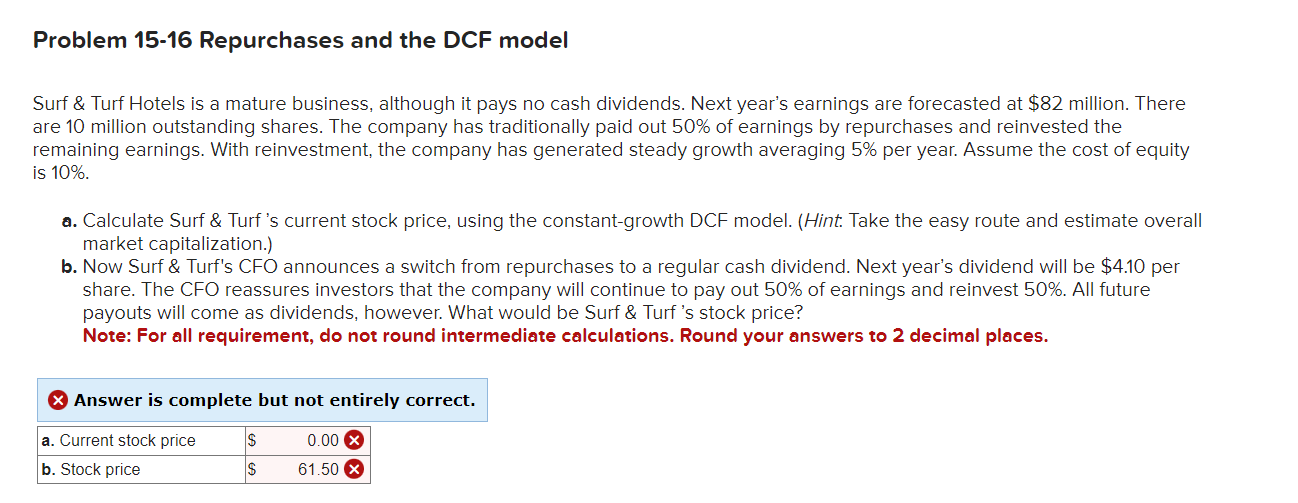

Problem 1 5 - 1 6 Repurchases and the DCF model Surf & Turf Hotels is a mature business, although it pays no cash dividends.

Problem Repurchases and the DCF model

Surf & Turf Hotels is a mature business, although it pays no cash dividends. Next year's earnings are forecasted at $ million. There

are million outstanding shares. The company has traditionally paid out of earnings by repurchases and reinvested the

remaining earnings. With reinvestment, the company has generated steady growth averaging per year. Assume the cost of equity

is

a Calculate Surf & Turf s current stock price, using the constantgrowth DCF model. Hint Take the easy route and estimate overall

market capitalization.

b Now Surf & Turf's CFO announces a switch from repurchases to a regular cash dividend. Next year's dividend will be $ per

share. The CFO reassures investors that the company will continue to pay out of earnings and reinvest All future

payouts will come as dividends, however. What would be Surf & Turf s stock price?

Note: For all requirement, do not round intermediate calculations. Round your answers to decimal places.

IMPORTANT

Answer A is not or and Answer B is not or

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started