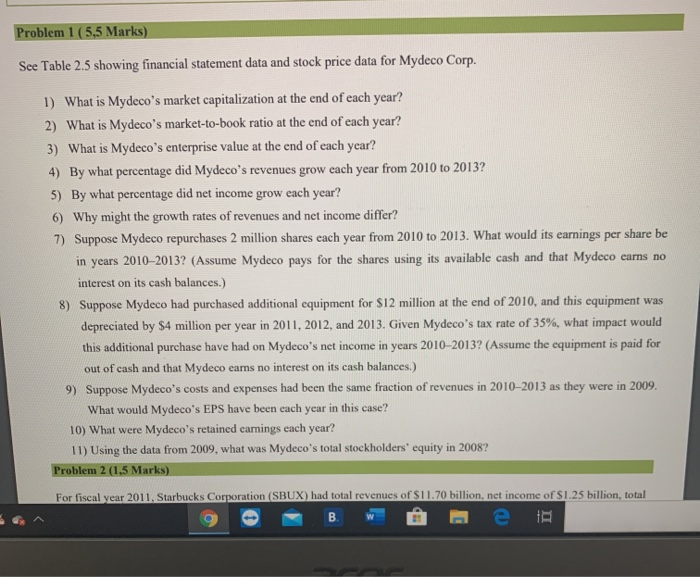

Problem 1 (5,5 Marks) See Table 2.5 showing financial statement data and stock price data for Mydeco Corp. 1) What is Mydeco's market capitalization at the end of each year? 2) What is Mydeco's market-to-book ratio at the end of each year? 3) What is Mydeco's enterprise value at the end of each year? 4) By what percentage did Mydeco's revenues grow each year from 2010 to 2013? 5) By what percentage did net income grow each year? 6) Why might the growth rates of revenues and net income differ? 7) Suppose Mydeco repurchases 2 million shares each year from 2010 to 2013. What would its earnings per share be in years 2010-2013? (Assume Mydeco pays for the shares using its available cash and that Mydeco earns no interest on its cash balances.) 8) Suppose Mydeco had purchased additional equipment for S12 million at the end of 2010, and this equipment was depreciated by $4 million per year in 2011, 2012, and 2013. Given Mydeco's tax rate of 35%, what impact would this additional purchase have had on Mydeco's net income in years 2010-2013? (Assume the equipment is paid for out of cash and that Mydeco eams no interest on its cash balances.) 9) Suppose Mydeco's costs and expenses had been the same fraction of revenues in 2010-2013 as they were in 2009. What would Mydeco's EPS have been each year in this case? 10) What were Mydeco's retained earnings each year? 11) Using the data from 2009, what was Mydeco's total stockholders' equity in 2008? Problem 2 (1,5 Marks) For fiscal year 2011. Starbucks Corporation (SBUX) had total revenues of SI1.70 billion, net income of SL 25 billion total Problem 1 (5,5 Marks) See Table 2.5 showing financial statement data and stock price data for Mydeco Corp. 1) What is Mydeco's market capitalization at the end of each year? 2) What is Mydeco's market-to-book ratio at the end of each year? 3) What is Mydeco's enterprise value at the end of each year? 4) By what percentage did Mydeco's revenues grow each year from 2010 to 2013? 5) By what percentage did net income grow each year? 6) Why might the growth rates of revenues and net income differ? 7) Suppose Mydeco repurchases 2 million shares each year from 2010 to 2013. What would its earnings per share be in years 2010-2013? (Assume Mydeco pays for the shares using its available cash and that Mydeco earns no interest on its cash balances.) 8) Suppose Mydeco had purchased additional equipment for S12 million at the end of 2010, and this equipment was depreciated by $4 million per year in 2011, 2012, and 2013. Given Mydeco's tax rate of 35%, what impact would this additional purchase have had on Mydeco's net income in years 2010-2013? (Assume the equipment is paid for out of cash and that Mydeco eams no interest on its cash balances.) 9) Suppose Mydeco's costs and expenses had been the same fraction of revenues in 2010-2013 as they were in 2009. What would Mydeco's EPS have been each year in this case? 10) What were Mydeco's retained earnings each year? 11) Using the data from 2009, what was Mydeco's total stockholders' equity in 2008? Problem 2 (1,5 Marks) For fiscal year 2011. Starbucks Corporation (SBUX) had total revenues of SI1.70 billion, net income of SL 25 billion total