Answered step by step

Verified Expert Solution

Question

1 Approved Answer

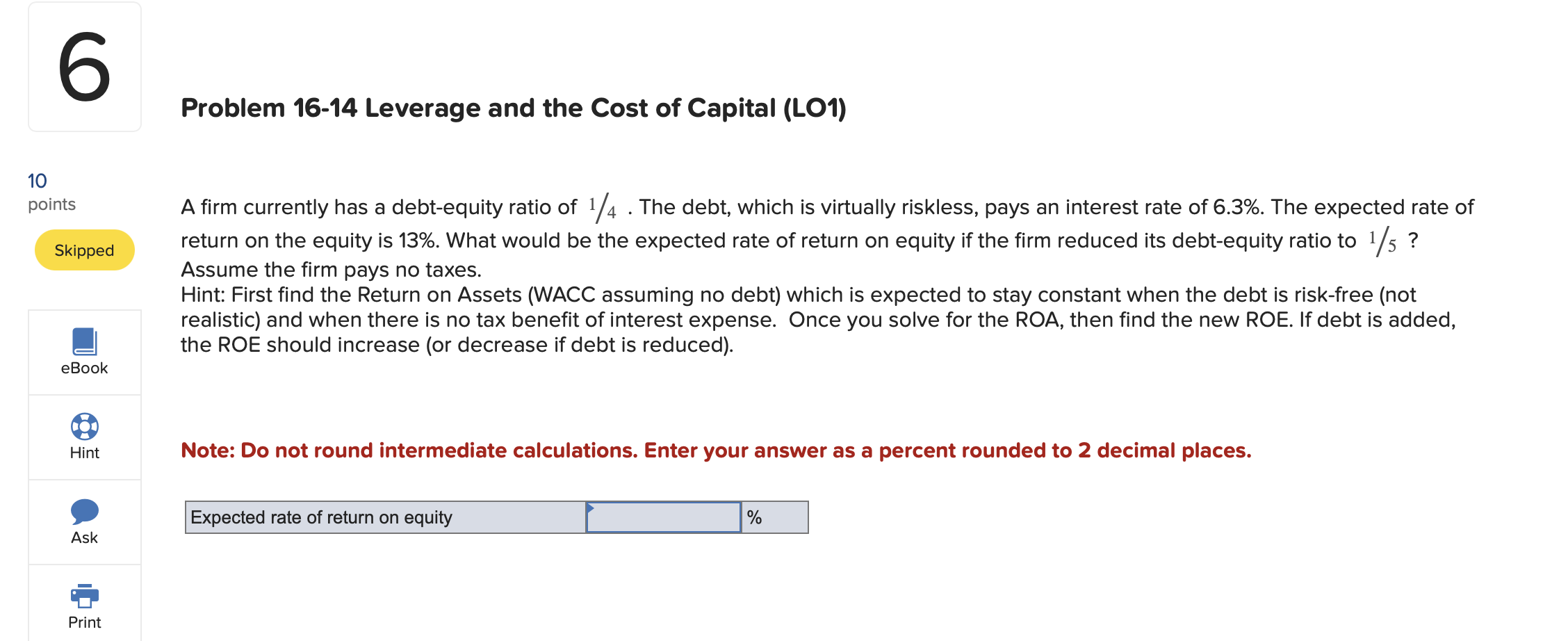

Problem 1 6 - 1 4 Leverage and the Cost of Capital ( LO 1 ) A firm currently has a debt - equity ratio

Problem Leverage and the Cost of Capital LO

A firm currently has a debtequity ratio of The debt, which is virtually riskless, pays an interest rate of The expected rate of

return on the equity is What would be the expected rate of return on equity if the firm reduced its debtequity ratio to

Assume the firm pays no taxes.

Hint: First find the Return on Assets WACC assuming no debt which is expected to stay constant when the debt is riskfree not

realistic and when there is no tax benefit of interest expense. Once you solve for the ROA, then find the new ROE. If debt is added,

the ROE should increase or decrease if debt is reduced

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to decimal places.

Expected rate of return on equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started