Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1 (7 points) Consider the Diamond-Dybvig model. There are three dates (T=0, 1, 2) and a unit mass of ex-ante identical consumers. Each of

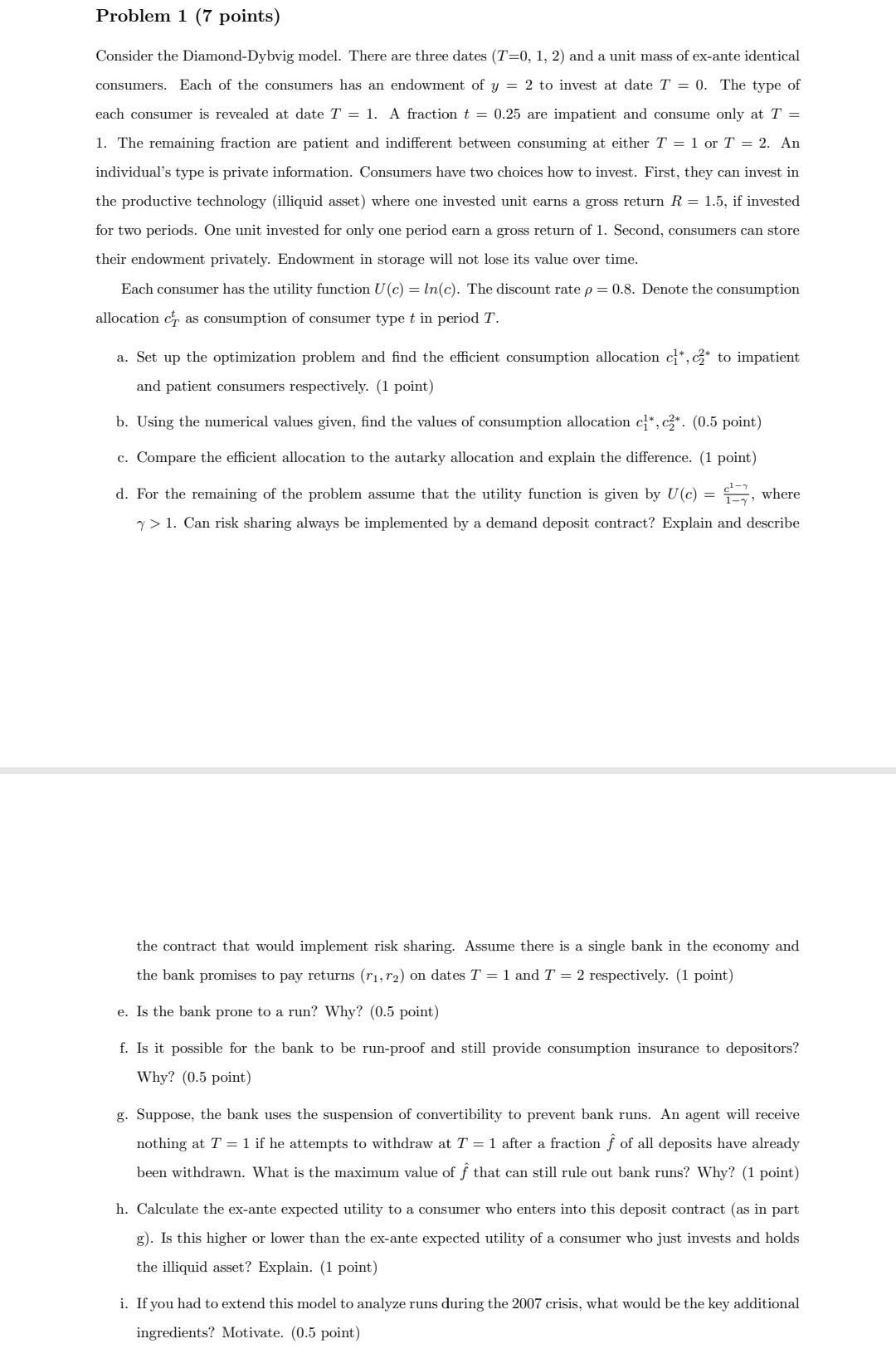

Problem 1 (7 points) Consider the Diamond-Dybvig model. There are three dates (T=0, 1, 2) and a unit mass of ex-ante identical consumers. Each of the consumers has an endowment of y = 2 to invest at date T = 0. The type of each consumer is revealed at date T = 1. A fraction t = 0.25 are impatient and consume only at T = 1. The remaining fraction are patient and indifferent between consuming at either T = 1 or T = 2. An individual's type is private information. Consumers have two choices how to invest. First, they can invest in the productive technology (illiquid asset) where one invested unit earns a gross return R = 1.5, if invested for two periods. One unit invested for only one period earn a gross return of 1. Second, consumers can store their endowment privately. Endowment in storage will not lose its value over time. Each consumer has the utility function U(c) = ln(c). The discount rate p=0.8. Denote the consumption allocation , as consumption of consumer type t in period T. a. Set up the optimization problem and find the efficient consumption allocation c*c* to impatient and patient consumers respectively. (1 point) b. Using the numerical values given, find the values of consumption allocation c1* cz*. (0.5 point) c. Compare the efficient allocation to the autarky allocation and explain the difference. (1 point) ci- d. For the remaining of the problem assume that the utility function is given by U(c) = , where 7>1. Can risk sharing always be implemented by a demand deposit contract? Explain and describe the contract that would implement risk sharing. Assume there is a single bank in the economy and the bank promises to pay returns (T1,r2) on dates T = 1 and T = 2 respectively. (1 point) e. Is the bank prone to a run? Why? (0.5 point) f. Is it possible for the bank to be run-proof and still provide consumption insurance to depositors? Why? (0.5 point) g. Suppose, the bank uses the suspension of convertibility to prevent bank runs. An agent will receive nothing at T = 1 if he attempts to withdraw at T = 1 after a fraction f of all deposits have already been withdrawn. What is the maximum value of f that can still rule out bank runs? Why? (1 point) h. Calculate the ex-ante expected utility to a consumer who enters into this deposit contract (as in part g). Is this higher or lower than the ex-ante expected utility of a consumer who just invests and holds the illiquid asset? Explain. (1 point) i. If you had to extend this model to analyze runs during the 2007 crisis, what would be the key additional ingredients? Motivate. (0.5 point) Problem 1 (7 points) Consider the Diamond-Dybvig model. There are three dates (T=0, 1, 2) and a unit mass of ex-ante identical consumers. Each of the consumers has an endowment of y = 2 to invest at date T = 0. The type of each consumer is revealed at date T = 1. A fraction t = 0.25 are impatient and consume only at T = 1. The remaining fraction are patient and indifferent between consuming at either T = 1 or T = 2. An individual's type is private information. Consumers have two choices how to invest. First, they can invest in the productive technology (illiquid asset) where one invested unit earns a gross return R = 1.5, if invested for two periods. One unit invested for only one period earn a gross return of 1. Second, consumers can store their endowment privately. Endowment in storage will not lose its value over time. Each consumer has the utility function U(c) = ln(c). The discount rate p=0.8. Denote the consumption allocation , as consumption of consumer type t in period T. a. Set up the optimization problem and find the efficient consumption allocation c*c* to impatient and patient consumers respectively. (1 point) b. Using the numerical values given, find the values of consumption allocation c1* cz*. (0.5 point) c. Compare the efficient allocation to the autarky allocation and explain the difference. (1 point) ci- d. For the remaining of the problem assume that the utility function is given by U(c) = , where 7>1. Can risk sharing always be implemented by a demand deposit contract? Explain and describe the contract that would implement risk sharing. Assume there is a single bank in the economy and the bank promises to pay returns (T1,r2) on dates T = 1 and T = 2 respectively. (1 point) e. Is the bank prone to a run? Why? (0.5 point) f. Is it possible for the bank to be run-proof and still provide consumption insurance to depositors? Why? (0.5 point) g. Suppose, the bank uses the suspension of convertibility to prevent bank runs. An agent will receive nothing at T = 1 if he attempts to withdraw at T = 1 after a fraction f of all deposits have already been withdrawn. What is the maximum value of f that can still rule out bank runs? Why? (1 point) h. Calculate the ex-ante expected utility to a consumer who enters into this deposit contract (as in part g). Is this higher or lower than the ex-ante expected utility of a consumer who just invests and holds the illiquid asset? Explain. (1 point) i. If you had to extend this model to analyze runs during the 2007 crisis, what would be the key additional ingredients? Motivate. (0.5 point)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started