Answered step by step

Verified Expert Solution

Question

1 Approved Answer

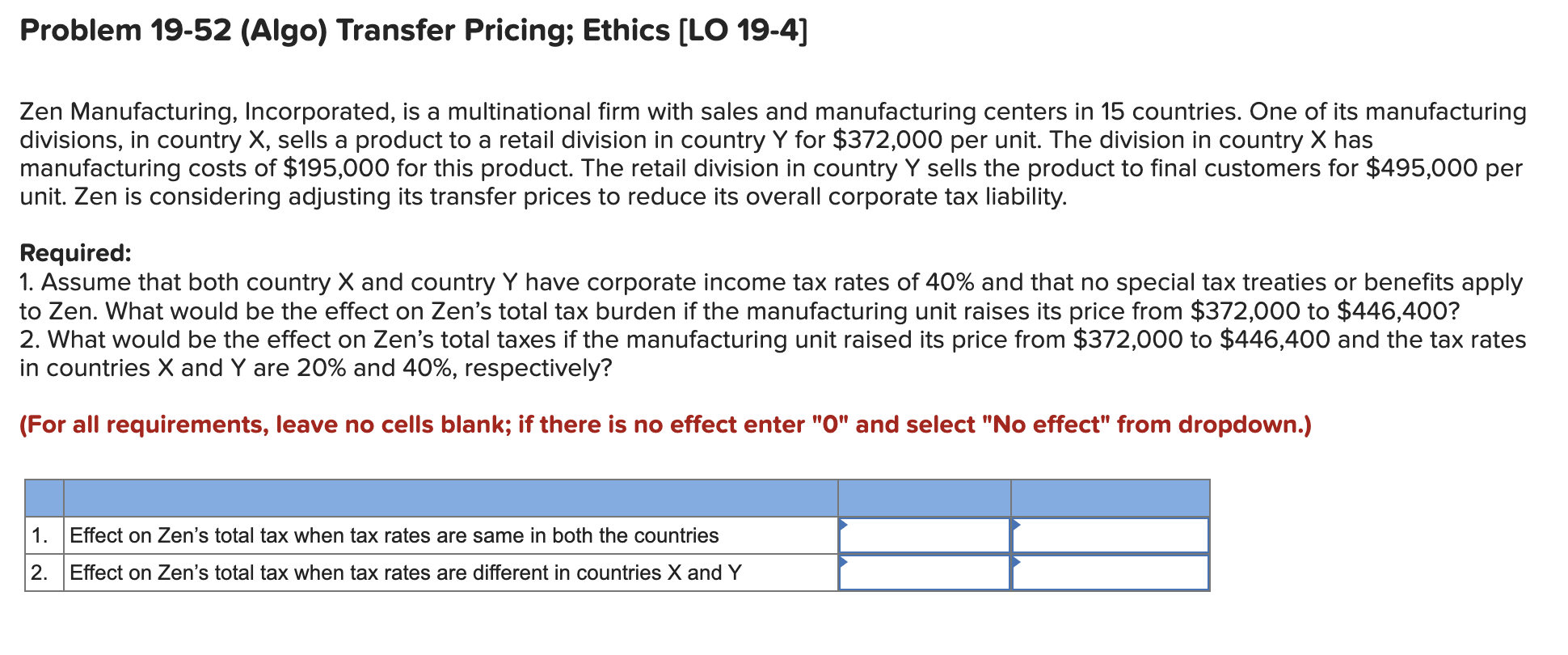

Problem 1 9 - 5 2 ( Algo ) Transfer Pricing; Ethics [ LO 1 9 - 4 ] Zen Manufacturing, Incorporated, is a multinational

Problem Algo Transfer Pricing; Ethics LO

Zen Manufacturing, Incorporated, is a multinational firm with sales and manufacturing centers in countries. One of its manufacturing

divisions, in country sells a product to a retail division in country for $ per unit. The division in country has

manufacturing costs of $ for this product. The retail division in country sells the product to final customers for $ per

unit. Zen is considering adjusting its transfer prices to reduce its overall corporate tax liability.

Required:

Assume that both country and country have corporate income tax rates of and that no special tax treaties or benefits apply

to Zen. What would be the effect on Zen's total tax burden if the manufacturing unit raises its price from $ to $

What would be the effect on Zen's total taxes if the manufacturing unit raised its price from $ to $ and the tax rates

in countries and are and respectively?

For all requirements, leave no cells blank; if there is no effect enter and select No effect" from dropdown.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started