Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1. (9 pts) The interest rates in this problem are in continuous compounding. a) (3 pts) A stock index currently stands at 350 .

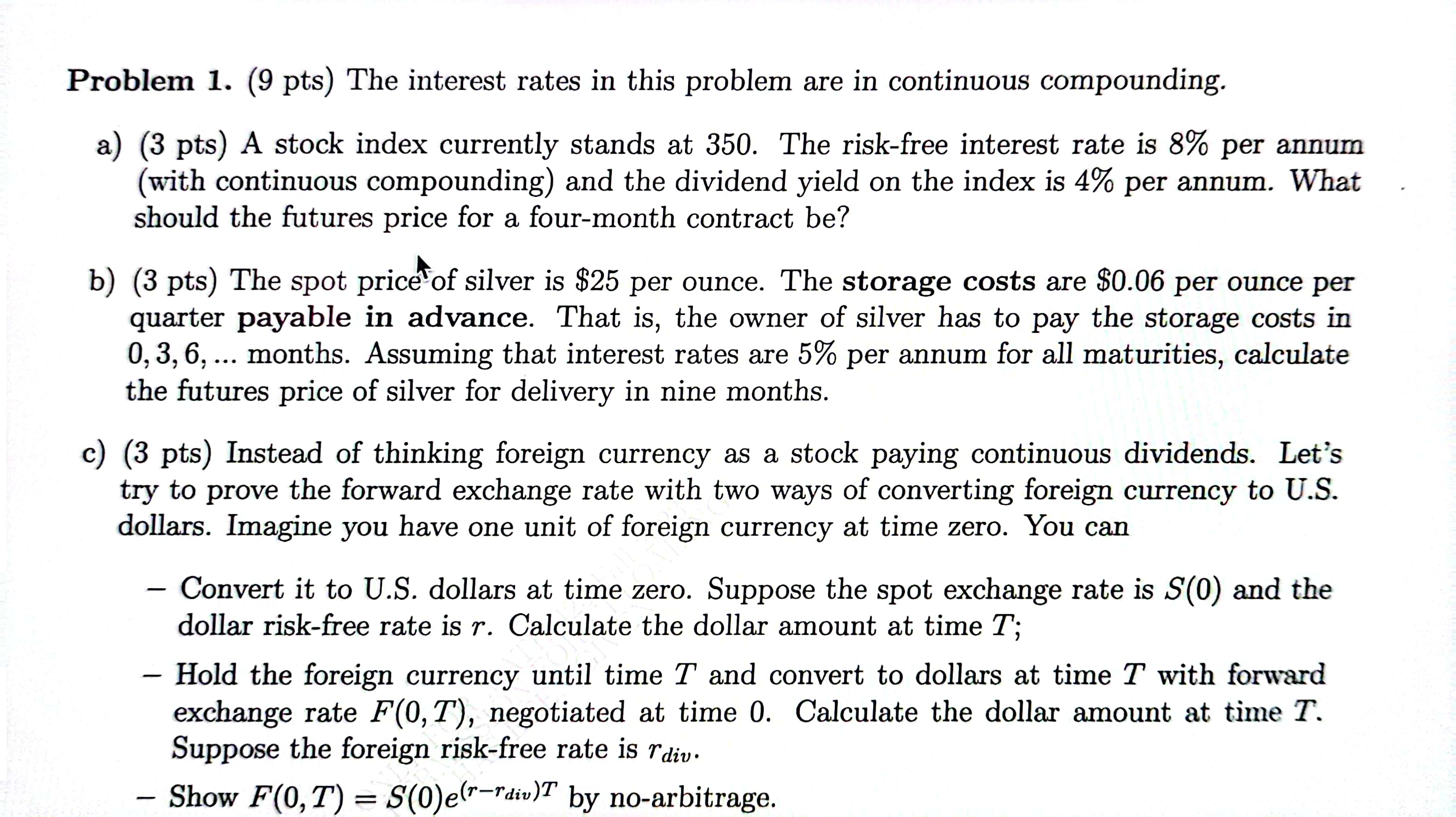

Problem 1. (9 pts) The interest rates in this problem are in continuous compounding. a) (3 pts) A stock index currently stands at 350 . The risk-free interest rate is 8% per annum (with continuous compounding) and the dividend yield on the index is 4% per annum. What should the futures price for a four-month contract be? b) (3 pts) The spot price of silver is $25 per ounce. The storage costs are $0.06 per ounce per quarter payable in advance. That is, the owner of silver has to pay the storage costs in 0,3,6, months. Assuming that interest rates are 5% per annum for all maturities, calculate the futures price of silver for delivery in nine months. c) (3 pts) Instead of thinking foreign currency as a stock paying continuous dividends. Let's try to prove the forward exchange rate with two ways of converting foreign currency to U.S. dollars. Imagine you have one unit of foreign currency at time zero. You can - Convert it to U.S. dollars at time zero. Suppose the spot exchange rate is S(0) and the dollar risk-free rate is r. Calculate the dollar amount at time T; - Hold the foreign currency until time T and convert to dollars at time T with forward exchange rate F(0,T), negotiated at time 0 . Calculate the dollar amount at time T. Suppose the foreign risk-free rate is rdiv. - Show F(0,T)=S(0)e(rrdiv)T by no-arbitrage

Problem 1. (9 pts) The interest rates in this problem are in continuous compounding. a) (3 pts) A stock index currently stands at 350 . The risk-free interest rate is 8% per annum (with continuous compounding) and the dividend yield on the index is 4% per annum. What should the futures price for a four-month contract be? b) (3 pts) The spot price of silver is $25 per ounce. The storage costs are $0.06 per ounce per quarter payable in advance. That is, the owner of silver has to pay the storage costs in 0,3,6, months. Assuming that interest rates are 5% per annum for all maturities, calculate the futures price of silver for delivery in nine months. c) (3 pts) Instead of thinking foreign currency as a stock paying continuous dividends. Let's try to prove the forward exchange rate with two ways of converting foreign currency to U.S. dollars. Imagine you have one unit of foreign currency at time zero. You can - Convert it to U.S. dollars at time zero. Suppose the spot exchange rate is S(0) and the dollar risk-free rate is r. Calculate the dollar amount at time T; - Hold the foreign currency until time T and convert to dollars at time T with forward exchange rate F(0,T), negotiated at time 0 . Calculate the dollar amount at time T. Suppose the foreign risk-free rate is rdiv. - Show F(0,T)=S(0)e(rrdiv)T by no-arbitrage Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started