Answered step by step

Verified Expert Solution

Question

1 Approved Answer

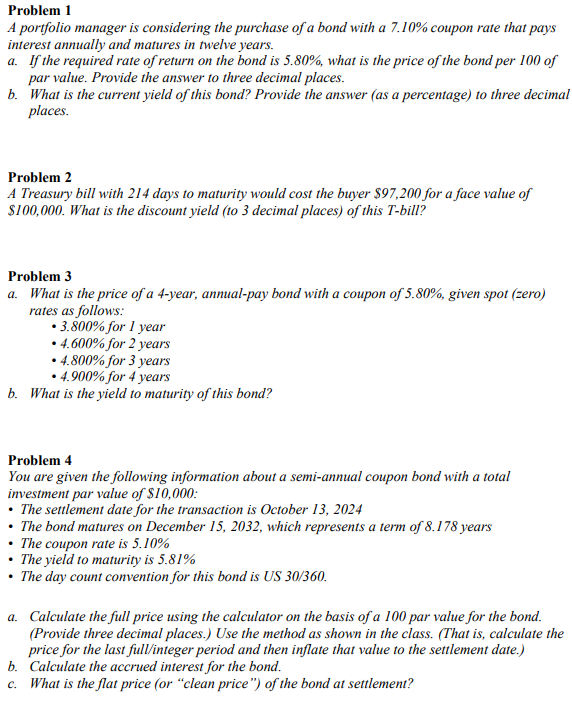

Problem 1 A portfolio manager is considering the purchase of a bond with a 7 . 1 0 % coupon rate that pays interest annually

Problem

A portfolio manager is considering the purchase of a bond with a coupon rate that pays

interest annually and matures in twelve years.

a If the required rate of return on the bond is what is the price of the bond per of

par value. Provide the answer to three decimal places.

b What is the current yield of this bond? Provide the answer as a percentage to three decimal

places.

Problem

A Treasury bill with days to maturity would cost the buyer $ for a face value of

$ What is the discount yield to decimal places of this Tbill?

Problem

a What is the price of a year, annualpay bond with a coupon of given spot zero

rates as follows:

for year

for years

for years

for years

b What is the yield to maturity of this bond?

Problem

You are given the following information about a semiannual coupon bond with a total

investment par value of $ :

The settlement date for the transaction is October

The bond matures on December which represents a term of years

The coupon rate is

The yield to maturity is

The day count convention for this bond is US

a Calculate the full price using the calculator on the basis of a par value for the bond.

Provide three decimal places. Use the method as shown in the class. That is calculate the

price for the last fullinteger period and then inflate that value to the settlement date.

b Calculate the accrued interest for the bond.

c What is the flat price or "clean price" of the bond at settlement?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started