Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that after operations and partner's withdrawals during 2017 and 2018. DE partnership has a book value of P120,000, that is D, capital P72,000

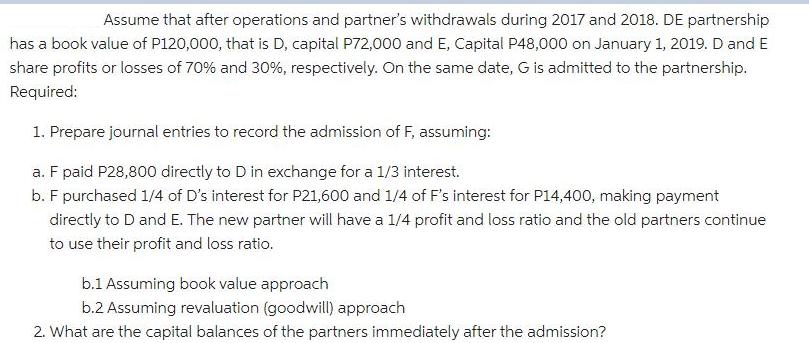

Assume that after operations and partner's withdrawals during 2017 and 2018. DE partnership has a book value of P120,000, that is D, capital P72,000 and E, Capital P48,000 on January 1, 2019. D and E share profits or losses of 70% and 30%, respectively. On the same date, G is admitted to the partnership. Required: 1. Prepare journal entries to record the admission of F, assuming: a. F paid P28,800 directly to D in exchange for a 1/3 interest. b. F purchased 1/4 of D's interest for P21,600 and 1/4 of F's interest for P14,400, making payment directly to D and E. The new partner will have a 1/4 profit and loss ratio and the old partners continue to use their profit and loss ratio. b.1 Assuming book value approach b.2 Assuming revaluation (goodwill) approach 2. What are the capital balances of the partners immediately after the admission?

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 SOLUTION Book value of DE Partnership P 120000 Capital balances as ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started