Answered step by step

Verified Expert Solution

Question

1 Approved Answer

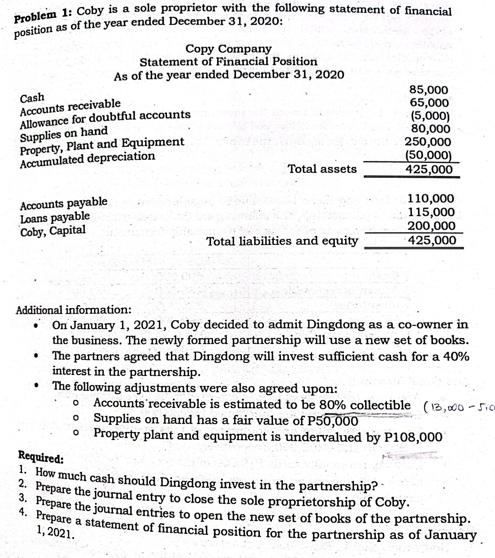

Problem 1: Coby is a sole proprietor with the following statement of financial as of the year ended December 31, 2020: position Cash Accounts

Problem 1: Coby is a sole proprietor with the following statement of financial as of the year ended December 31, 2020: position Cash Accounts receivable Allowance for doubtful accounts Supplies on hand Property, Plant and Equipment Accumulated depreciation Accounts payable Loans payable Coby, Capital Copy Company Statement of Financial Position As of the year ended December 31, 2020 . . Total assets Total liabilities and equity 85,000 65,000 (5,000) 80,000 250,000 (50,000) 425,000 Additional information: On January 1, 2021, Coby decided to admit Dingdong as a co-owner in the business. The newly formed partnership will use a new set of books. The partners agreed that Dingdong will invest sufficient cash for a 40% interest in the partnership. The following adjustments were also agreed upon: 0 Accounts receivable is estimated to be 80% collectible (13,000-Fic o Supplies on hand has a fair value of P50,000 o Property plant and equipment is undervalued by P108,000 110,000 115,000 200,000 425,000 Required: 1. How much cash should Dingdong invest in the partnership? 2. Prepare the journal entry to close the sole proprietorship of Coby. 3. Prepare the journal entries to open the new set of books of the partnership. 4. Prepare a statement of financial position for the partnership as of January

Step by Step Solution

★★★★★

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Answer to Question 1 To obtain a 40 interest in the partnership firm Dingdong should invest at least ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started