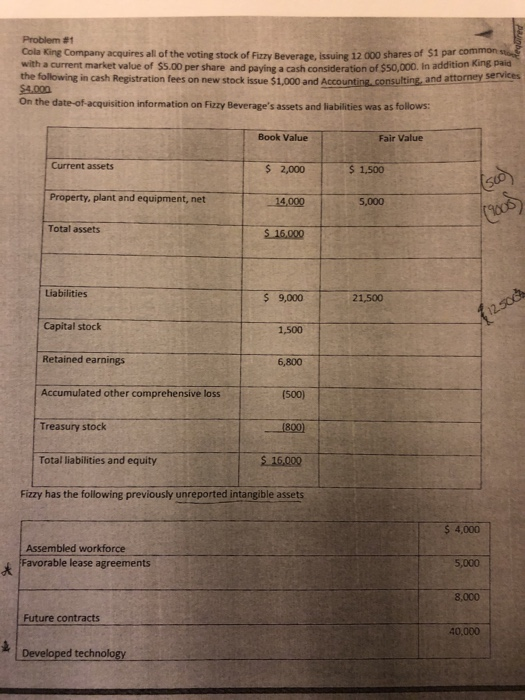

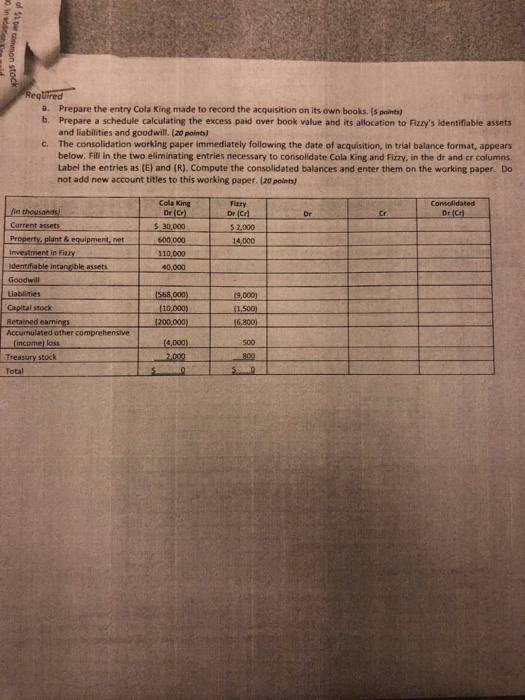

Problem #1 Cola Kine Company acquires all of the voting stock of Fizzy Beverage, issuing 12 000 shares of $1 par common with a current market value of $5.00 per share and paying a cash consideration of $50,000. in addition King paid the following in cash Registration fees on new stock issue $1,000 and Accounting.consulting, and attormey On the date-of-acquisition information on Fizzy Beverage's assets and liabilities was as follows: Book Value Fair Value Current assets $ 2,000 $ 1,500 Property, plant and equipment, net 5,000 Total assets $ 16,000 Liabilities $ 9,000 21,500 Capital stock 1,500 Retained earnings 6,800 Accumulated other comprehensive loss Treasury stock Total liabilities and equity (500) 16,000 Fizzy has the following previously unreported intangible assets $ 4,000 Assembled workforce Favorable lease agreements 5,000 8,000 Future contracts 40,000 Developed technology red a. Prepare the entry Cola King made to record the acquisition on its own books. (s points) b. Prepare a schedule calculating the excess paid over book value and its allocation to Fizzy's identifiable assets and liabilities and goodwill. (20 points) The consolidation working paper immediately following the date of acquisition, in trial balance format, appears below. Fill in the two eliminating entries necessary to consolidate Cola King and Fizzy, in the dr and cr columns Label the entries as (E) and (R). Compute the consolidated balances and enter them on the working paper. Do not add new account titles to this working paper. (20 points C. Cola King Fitry Consolidated fin thousands Current assets Dr Cr Dr Property,plant&equipment, net 110,000 identifiable intangible a 40,000 1568,000 Liabilities Capital stock Retained earnings 200,000)16.800 incomel loss Treasuy Total S00 Problem #1 Cola Kine Company acquires all of the voting stock of Fizzy Beverage, issuing 12 000 shares of $1 par common with a current market value of $5.00 per share and paying a cash consideration of $50,000. in addition King paid the following in cash Registration fees on new stock issue $1,000 and Accounting.consulting, and attormey On the date-of-acquisition information on Fizzy Beverage's assets and liabilities was as follows: Book Value Fair Value Current assets $ 2,000 $ 1,500 Property, plant and equipment, net 5,000 Total assets $ 16,000 Liabilities $ 9,000 21,500 Capital stock 1,500 Retained earnings 6,800 Accumulated other comprehensive loss Treasury stock Total liabilities and equity (500) 16,000 Fizzy has the following previously unreported intangible assets $ 4,000 Assembled workforce Favorable lease agreements 5,000 8,000 Future contracts 40,000 Developed technology red a. Prepare the entry Cola King made to record the acquisition on its own books. (s points) b. Prepare a schedule calculating the excess paid over book value and its allocation to Fizzy's identifiable assets and liabilities and goodwill. (20 points) The consolidation working paper immediately following the date of acquisition, in trial balance format, appears below. Fill in the two eliminating entries necessary to consolidate Cola King and Fizzy, in the dr and cr columns Label the entries as (E) and (R). Compute the consolidated balances and enter them on the working paper. Do not add new account titles to this working paper. (20 points C. Cola King Fitry Consolidated fin thousands Current assets Dr Cr Dr Property,plant&equipment, net 110,000 identifiable intangible a 40,000 1568,000 Liabilities Capital stock Retained earnings 200,000)16.800 incomel loss Treasuy Total S00