Answered step by step

Verified Expert Solution

Question

1 Approved Answer

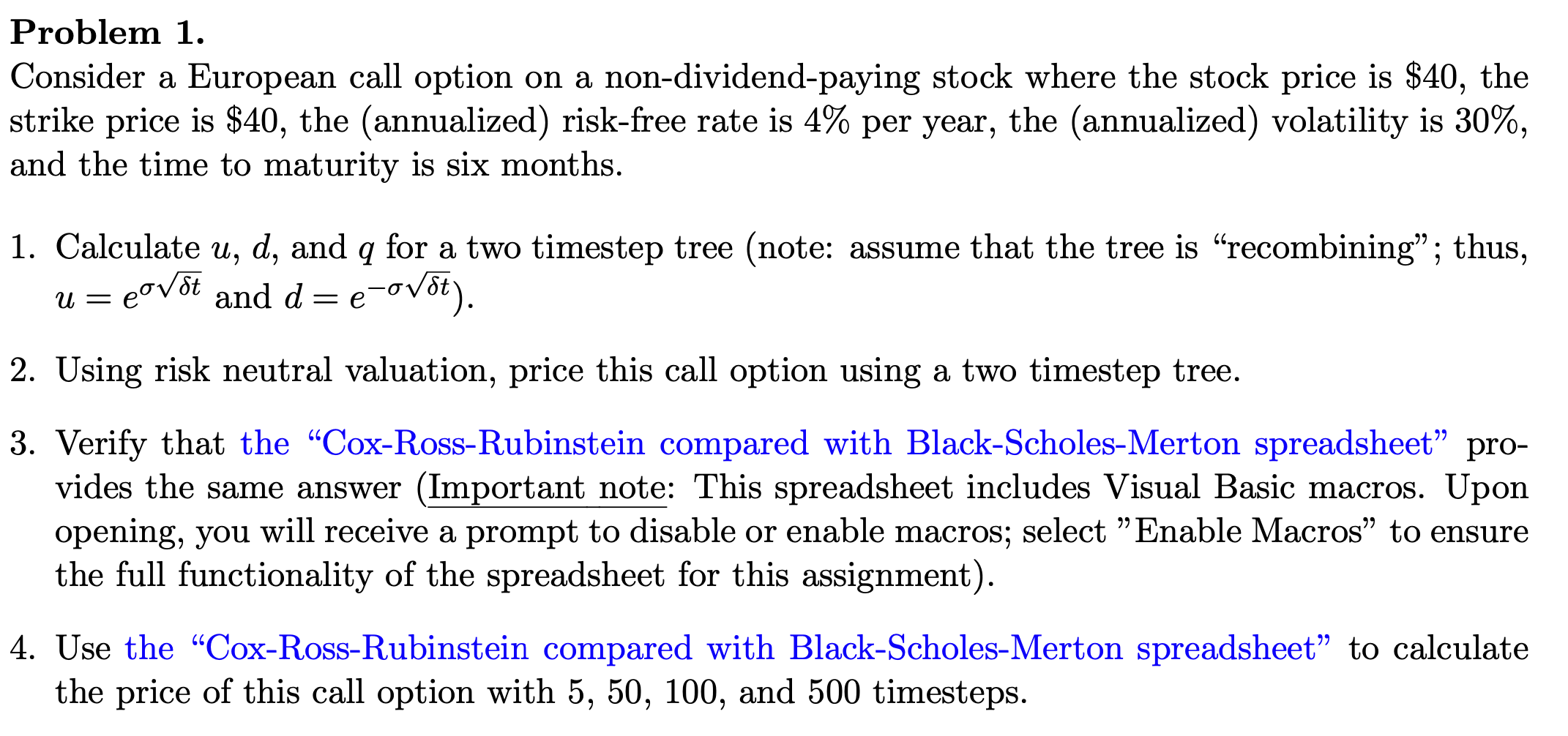

Problem 1 . Consider a European call option on a non - dividend - paying stock where the stock price is $ 4 0 ,

Problem

Consider a European call option on a nondividendpaying stock where the stock price is $ the

strike price is $ the annualized riskfree rate is per year, the annualized volatility is

and the time to maturity is six months.

Calculate and for a two timestep tree note: assume that the tree is "recombining"; thus,

and

Using risk neutral valuation, price this call option using a two timestep tree.

Verify that the "CoxRossRubinstein compared with BlackScholesMerton spreadsheet" pro

vides the same answer Important note: This spreadsheet includes Visual Basic macros. Upon

opening, you will receive a prompt to disable or enable macros; select "Enable Macros" to ensure

the full functionality of the spreadsheet for this assignment

Use the "CoxRossRubinstein compared with BlackScholesMerton spreadsheet" to calculate

the price of this call option with and timesteps.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started