Answered step by step

Verified Expert Solution

Question

1 Approved Answer

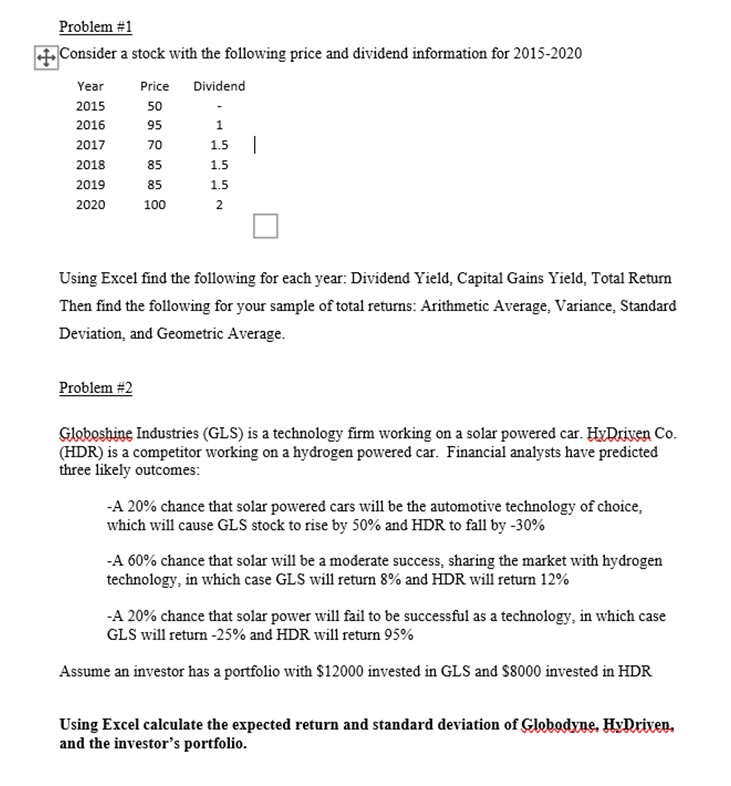

Problem #1: Consider a stock with the following price and dividend information for 2015-2020 Please answer both questions and show work in excel please! Problem

Problem #1: Consider a stock with the following price and dividend information for 2015-2020

Please answer both questions and show work in excel please!

Problem #1 . Consider a stock with the following price and dividend information for 2015-2020 Dividend Price 50 95 Year 2015 2016 2017 2018 2019 2020 70 1.5 1.5 1.5 1002 Using Excel find the following for each year: Dividend Yield, Capital Gains Yield, Total Return Then find the following for your sample of total returns: Arithmetic Average, Variance, Standard Deviation, and Geometric Average. Problem #2 Globoshine Industries (GLS) is a technology firm working on a solar powered car. HyDriven Co. (HDR) is a competitor working on a hydrogen powered car. Financial analysts have predicted three likely outcomes: -A 20% chance that solar powered cars will be the automotive technology of choice, which will cause GLS stock to rise by 50% and HDR to fall by -30% -A 60% chance that solar will be a moderate success, sharing the market with hydrogen technology, in which case GLS will return 8% and HDR will return 12% -A 20% chance that solar power will fail to be successful as a technology, in which case GLS will return -25% and HDR will return 95% Assume an investor has a portfolio with $12000 invested in GLS and $8000 invested in HDR Using Excel calculate the expected return and standard deviation of Globodyne. Hy Driven, and the investor's portfolioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started