Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1 Find the internal rate of return (IRR) of a project that costs $10,000 and brings net revenue of $7,000 each year for

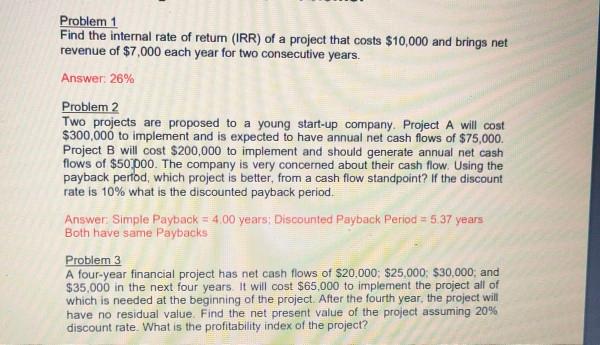

Problem 1 Find the internal rate of return (IRR) of a project that costs $10,000 and brings net revenue of $7,000 each year for two consecutive years. Answer: 26% Problem 2 Two projects are proposed to a young start-up company. Project A will cost $300,000 to implement and is expected to have annual net cash flows of $75,000. Project B will cost $200,000 to implement and should generate annual net cash flows of $50,000. The company is very concerned about their cash flow. Using the payback perfod, which project is better, from a cash flow standpoint? If the discount rate is 10% what is the discounted payback period. Answer: Simple Payback = 4.00 years: Discounted Payback Period = 5.37 years Both have same Paybacks Problem 3 A four-year financial project has net cash flows of $20,000; $25,000; $30,000; and $35,000 in the next four years. It will cost $65,000 to implement the project all of which is needed at the beginning of the project. After the fourth year, the project will have no residual value. Find the net present value of the project assuming 20% discount rate. What is the profitability index of the project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started