Question

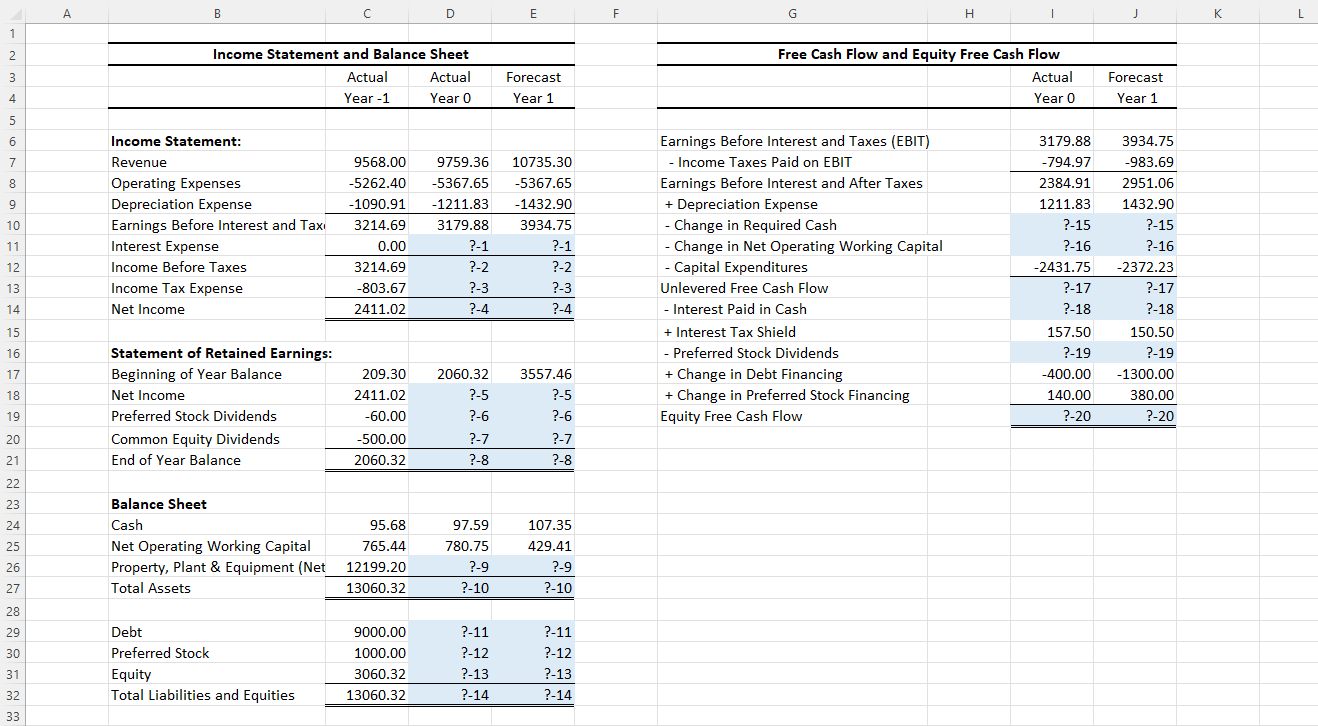

Problem 1 In the accompanying spreadsheet, on the worksheet labeled Problem 1, I provide partially completed calculations for the income statements, balance sheets, retained earnings,

Problem 1 In the accompanying spreadsheet, on the worksheet labeled Problem 1, I provide partially completed calculations for the income statements, balance sheets, retained earnings, and free cash flows for the Missing Data Company. All of the cash flows occur at the end of each year, including capital expenditures and any financing transactions. The company distributes all equity free cash flows to equity in the form of dividends; in other words, it does not hold any excess cash. The interest rate it pays on debt is 7%, and its preferred stock dividend rate is 8% (of the companys book value of preferred stock). All cash flows occur at the end of each year. The tax rate is 25% on the first $4,000 of income and 45% on all income above $4,000. The company has no income taxes payable (beyond those shown on the Income Statement) at the end of any of the three years. Complete the Missing Data Companys income statements, balance sheets, retained earnings, and free cash flow calculations for Years 0 and 1. Note: Do not just fill in numbers, but make sure your submission contains formulas linking all the statements; any changes made to assumptions must reflect through all the statements.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started