Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In this problem, you will analyze the steady state of an infinite-period consumer analysis in which a credit crunch is occurring. Specifically, consider a

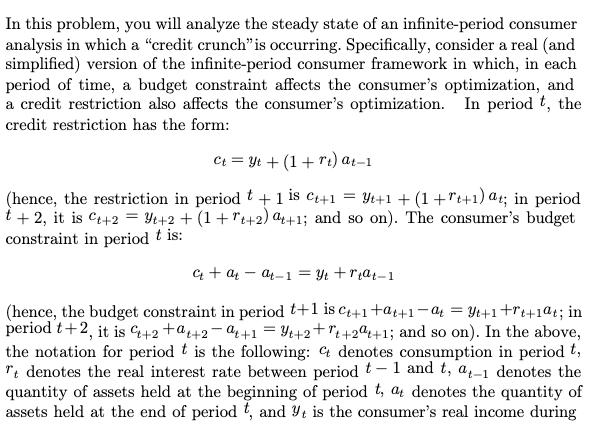

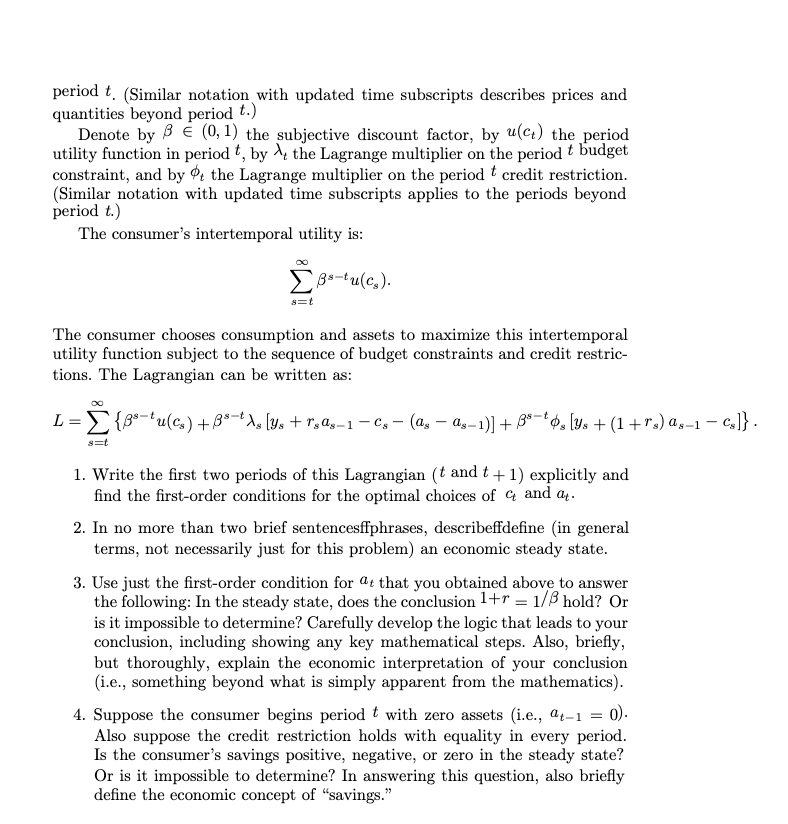

In this problem, you will analyze the steady state of an infinite-period consumer analysis in which a "credit crunch" is occurring. Specifically, consider a real (and simplified) version of the infinite-period consumer framework in which, in each period of time, a budget constraint affects the consumer's optimization, and a credit restriction also affects the consumer's optimization. In period t, the credit restriction has the form: Ct = Yt + (1 + r) at-1 (hence, the restriction in period t + 1 is ct+1=Yt+1+(1+rt+1) at; in period t + 2, it is ct+2 = Y+2+(1++2) at+1; and so on). The consumer's budget constraint in period tis: G+ atat_1=Yt +rtat-1 - (hence, the budget constraint in period t+1 is ct+1+at+1- = y+1++1t; in period t+2, it is +2+a+2a+1=+2+7+2+1; and so on). In the above, the notation for period t is the following: & denotes consumption in period t, Tt denotes the real interest rate between period t-1 and t, a-1 denotes the quantity of assets held at the beginning of period t, at denotes the quantity of assets held at the end of period t, and yt is the consumer's real income during period t. (Similar notation with updated time subscripts describes prices and quantities beyond period t.) Denote by 3 (0, 1) the subjective discount factor, by u(c) the period utility function in period t, by the Lagrange multiplier on the period t budget constraint, and by the Lagrange multiplier on the period t credit restriction. (Similar notation with updated time subscripts applies to the periods beyond period t.) The consumer's intertemporal utility is: L= s=t The consumer chooses consumption and assets to maximize this intertemporal utility function subject to the sequence of budget constraints and credit restric- tions. The Lagrangian can be written as: {ps-tu(cs) +3-X [Ys + r1 ( A-1)] + B- [Ys + (1+rs) s1 Cs]} . s=t Bs-tu(c). 1. Write the first two periods of this Lagrangian (t and t + 1) explicitly and find the first-order conditions for the optimal choices of and at. 2. In no more than two brief sentencesffphrases, describeffdefine (in general terms, not necessarily just for this problem) an economic steady state. 3. Use just the first-order condition for at that you obtained above to answer the following: In the steady state, does the conclusion 1+r = 1/3 hold? Or is it impossible to determine? Carefully develop the logic that leads to your conclusion, including showing any key mathematical steps. Also, briefly, but thoroughly, explain the economic interpretation of your conclusion (i.e., something beyond what is simply apparent from the mathematics). 4. Suppose the consumer begins period t with zero assets (i.e., a-1 = 0). Also suppose the credit restriction holds with equality in every period. Is the consumer's savings positive, negative, or zero in the steady state? Or is it impossible to determine? In answering this question, also briefly define the economic concept of "savings."

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The first two periods of the Lagrangian are 1 1 1 1 1 1 L t t1 uc t t1 t y t r t a t1 c t t1 t y t 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started