Question

Problem 1. In your new role as a project financial analyst, you are tasked to evaluate project Tetra, a new and innovative software that allows

Problem 1. In your new role as a project financial analyst, you are tasked to evaluate project Tetra, a new and innovative software that allows doctors from around the world to communicate current best practices in real time. The project has two phases: you may invest in the first, both, or neither. Phase 1 (Tetra 1) requires an initial investment of $100. One year later, Tetra 1 will produce project CFs of either $160 or $60, each with equal probability of occurrence. At this year 1 point and after cash flows have been received, you may invest an additional $100 for Tetra 2. One year later, Tetra 2 pays out either 20% more in project CFs than Tetra 1 or (equally likely) 20% less. No taxes need to be assumed.

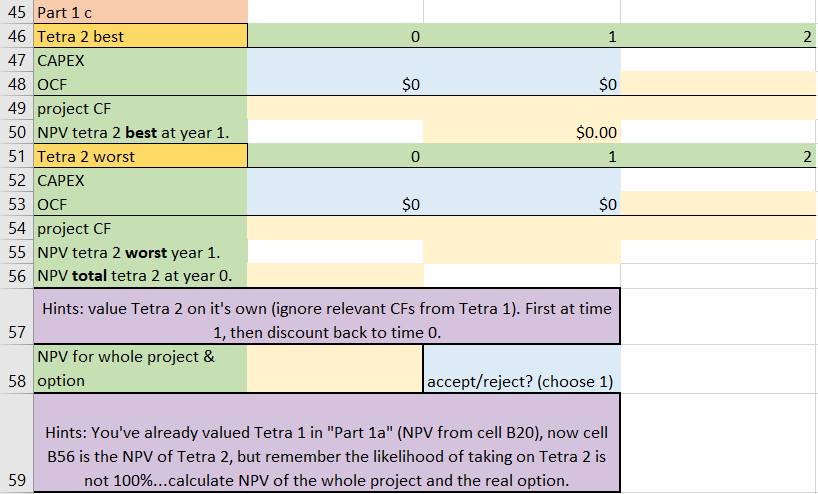

Part 1 c: How much is Tetra project worth if you have access to both Tetra 1 and 2, but can wait to decide whether to invest in Tetra 2 after 1 year (i.e. can see Tetra 1 through)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started