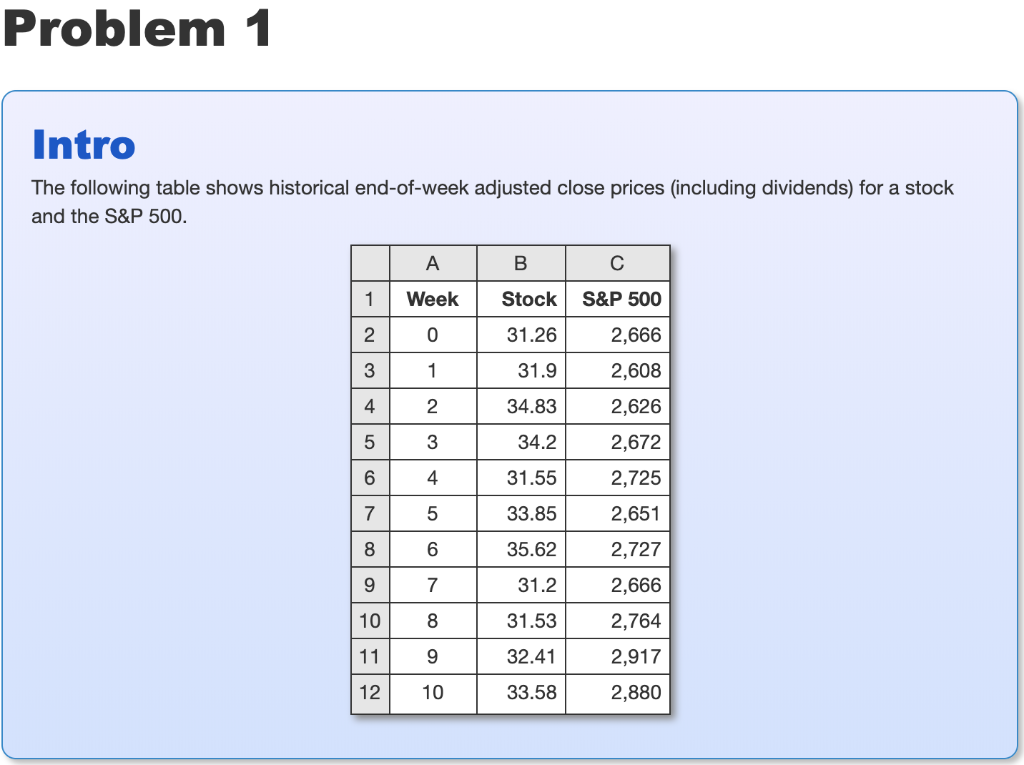

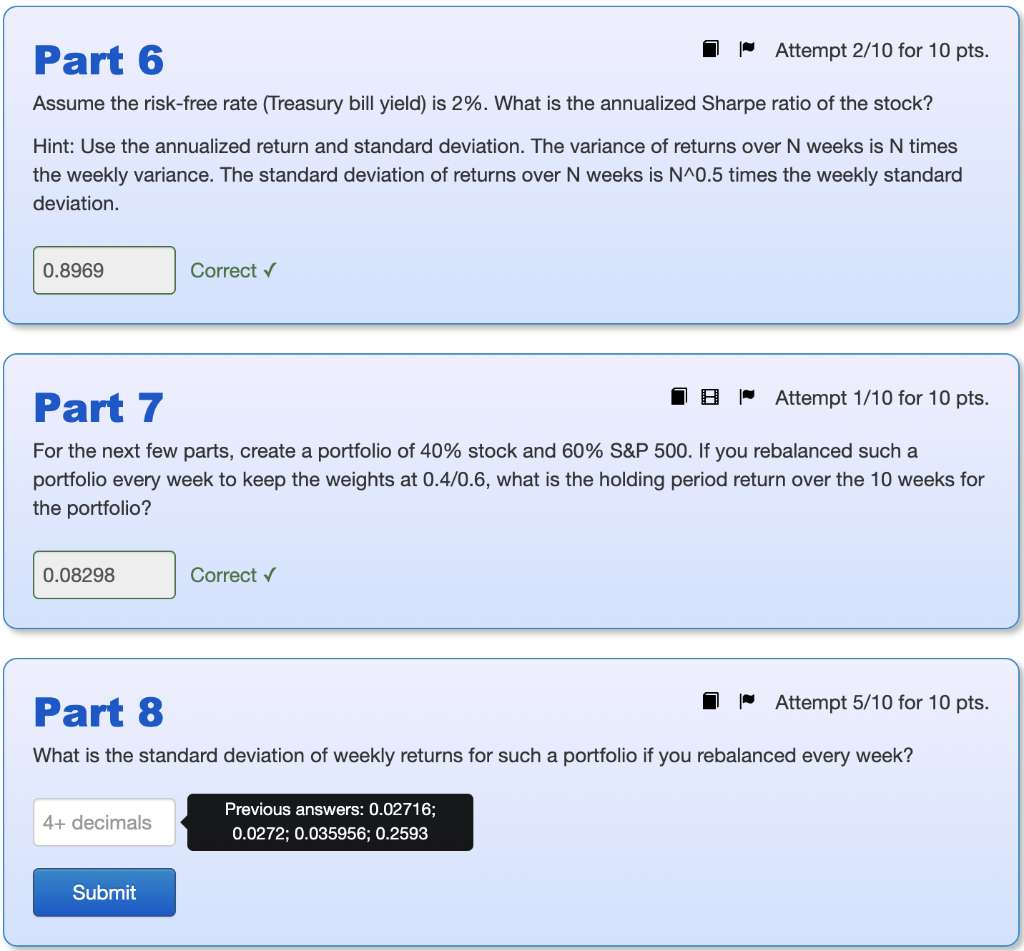

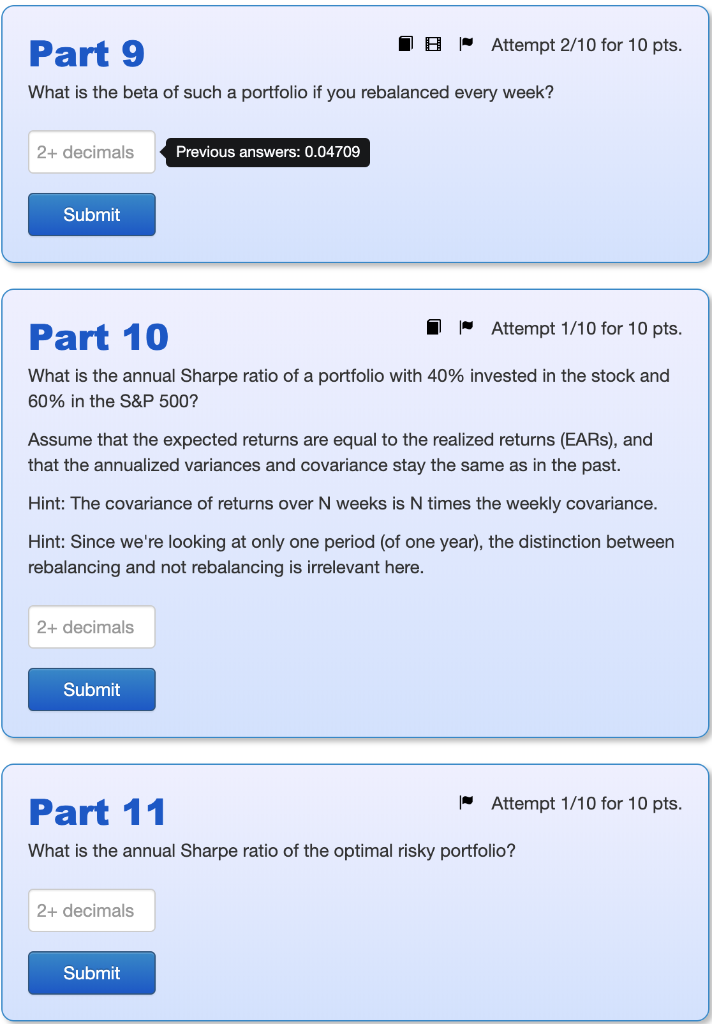

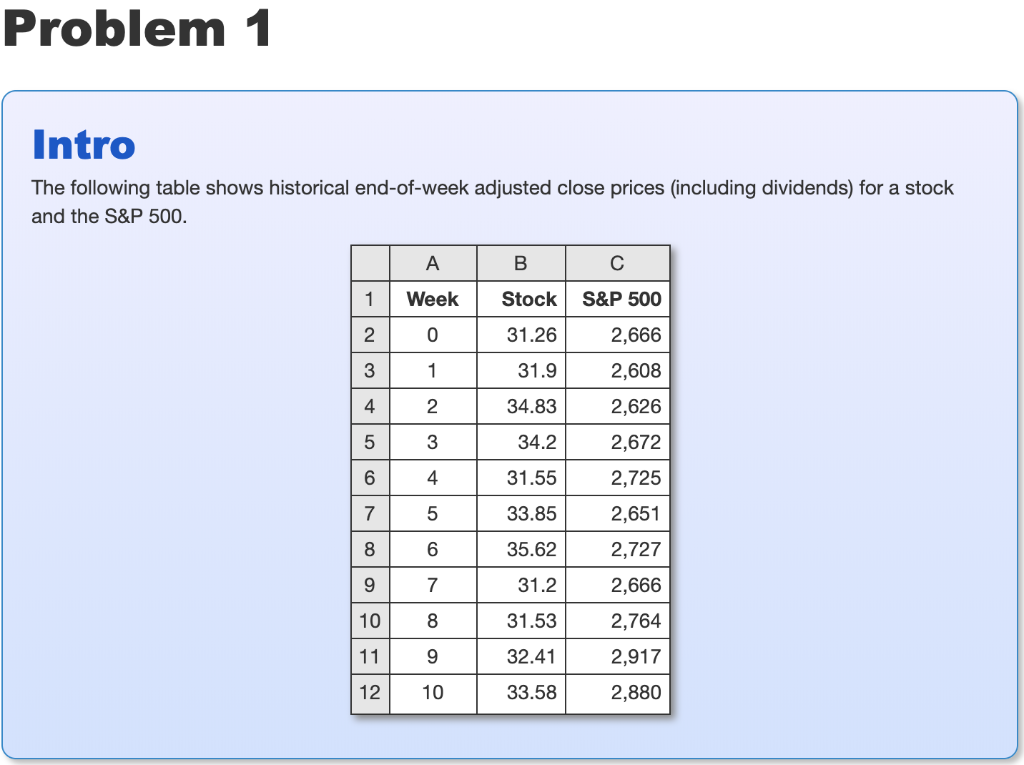

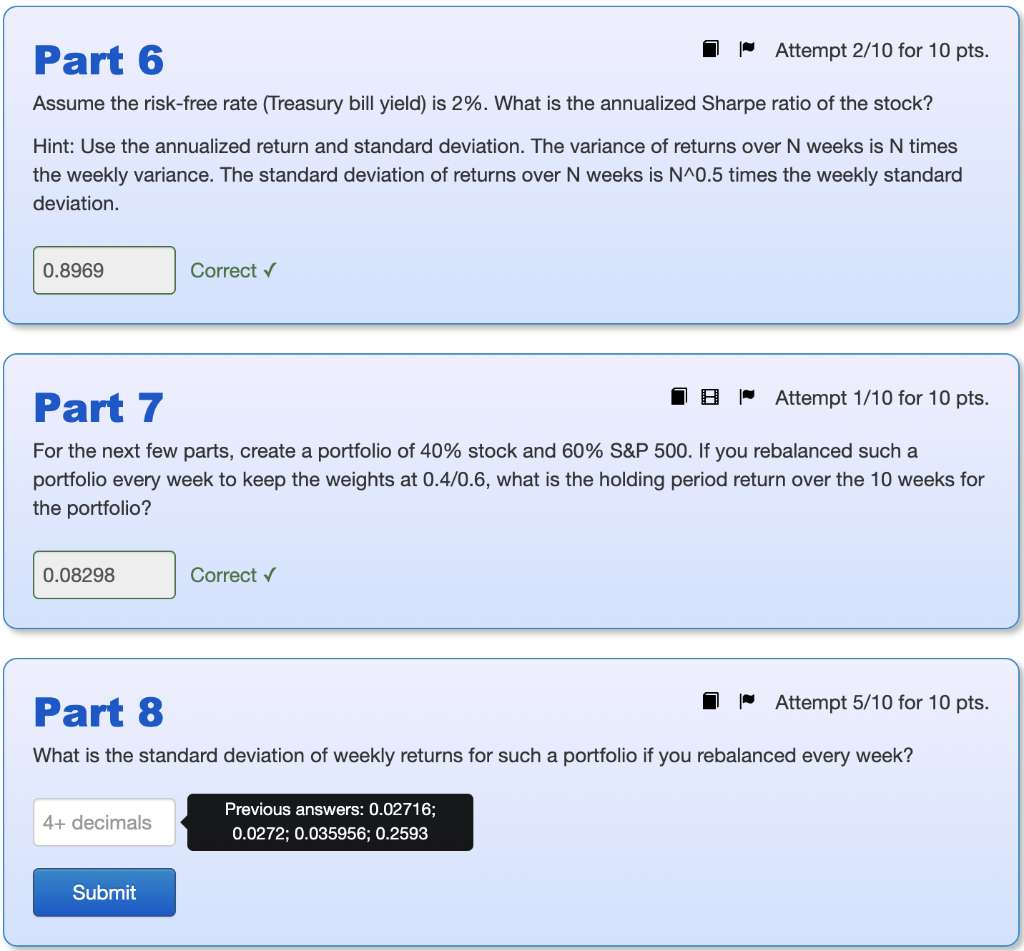

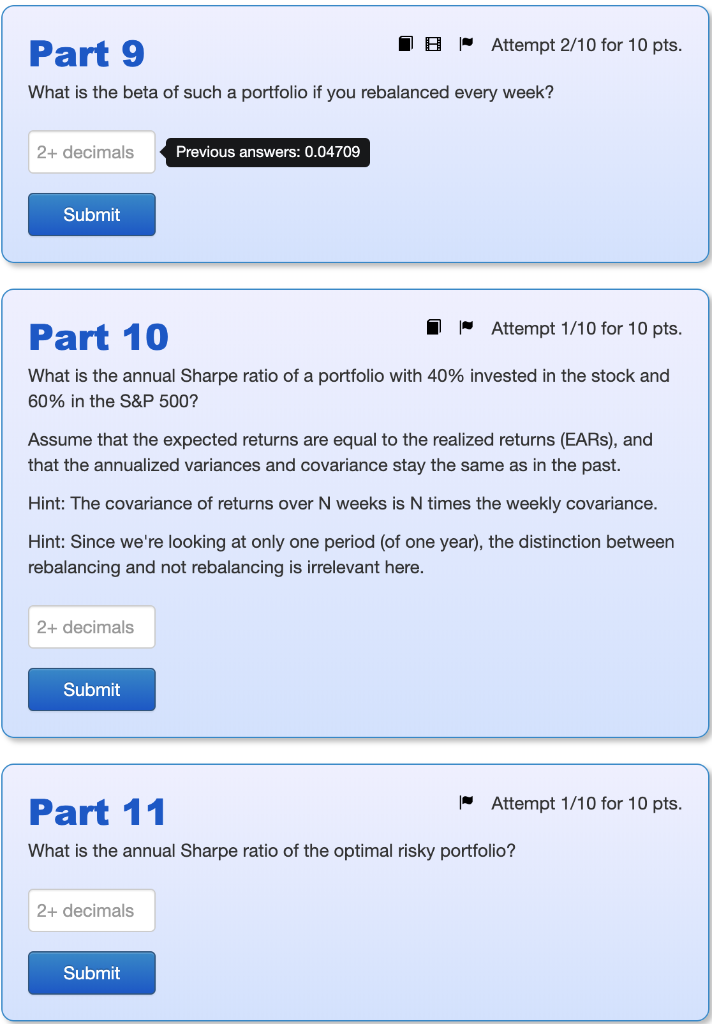

Problem 1 Intro The following table shows historical end-of-week adjusted close prices (including dividends) for a stock and the S&P 500. C S&P 500 1 2 3 4 2,666 A Week 0 1 2 | 3 B Stock 31.26 31.9 2,608 2,626 34.83 34.2 31.55 4 33.85 35.62 2,672 2,725 2,651 2,727 2,666 2,764 2,917 2,880 31.2 11 9 31.53 32.41 33.58 10 Part 6 1 Attempt 2/10 for 10 pts. Assume the risk-free rate (Treasury bill yield) is 2%. What is the annualized Sharpe ratio of the stock? Hint: Use the annualized return and standard deviation. The variance of returns over N weeks is N times the weekly variance. The standard deviation of returns over N weeks is N^0.5 times the weekly standard deviation. 0.8969 Correct Part 7 18 Attempt 1/10 for 10 pts. For the next few parts, create a portfolio of 40% stock and 60% S&P 500. If you rebalanced such a portfolio every week to keep the weights at 0.4/0.6, what is the holding period return over the 10 weeks for the portfolio? 0.08298 Correct v Part 8 I - Attempt 5/10 for 10 pts. What is the standard deviation of weekly returns for such a portfolio if you rebalanced every week? 4+ decimals Previous answers: 0.02716; 0.0272; 0.035956; 0.2593 Submit Part 9 IB | Attempt 2/10 for 10 pts. What is the beta of such a portfolio if you rebalanced every week? 2+ decimals Previous answers: 0.04709 Submit Part 10 1 Attempt 1/10 for 10 pts. What is the annual Sharpe ratio of a portfolio with 40% invested in the stock and 60% in the S&P 500? Assume that the expected returns are equal to the realized returns (EARs), and that the annualized variances and covariance stay the same as in the past. Hint: The covariance of returns over N weeks is N times the weekly covariance. Hint: Since we're looking at only one period (of one year), the distinction between rebalancing and not rebalancing is irrelevant here. 2+ decimals Submit Part 11 Attempt 1/10 for 10 pts. What is the annual Sharpe ratio of the optimal risky portfolio? 2+ decimals Submit Problem 1 Intro The following table shows historical end-of-week adjusted close prices (including dividends) for a stock and the S&P 500. C S&P 500 1 2 3 4 2,666 A Week 0 1 2 | 3 B Stock 31.26 31.9 2,608 2,626 34.83 34.2 31.55 4 33.85 35.62 2,672 2,725 2,651 2,727 2,666 2,764 2,917 2,880 31.2 11 9 31.53 32.41 33.58 10 Part 6 1 Attempt 2/10 for 10 pts. Assume the risk-free rate (Treasury bill yield) is 2%. What is the annualized Sharpe ratio of the stock? Hint: Use the annualized return and standard deviation. The variance of returns over N weeks is N times the weekly variance. The standard deviation of returns over N weeks is N^0.5 times the weekly standard deviation. 0.8969 Correct Part 7 18 Attempt 1/10 for 10 pts. For the next few parts, create a portfolio of 40% stock and 60% S&P 500. If you rebalanced such a portfolio every week to keep the weights at 0.4/0.6, what is the holding period return over the 10 weeks for the portfolio? 0.08298 Correct v Part 8 I - Attempt 5/10 for 10 pts. What is the standard deviation of weekly returns for such a portfolio if you rebalanced every week? 4+ decimals Previous answers: 0.02716; 0.0272; 0.035956; 0.2593 Submit Part 9 IB | Attempt 2/10 for 10 pts. What is the beta of such a portfolio if you rebalanced every week? 2+ decimals Previous answers: 0.04709 Submit Part 10 1 Attempt 1/10 for 10 pts. What is the annual Sharpe ratio of a portfolio with 40% invested in the stock and 60% in the S&P 500? Assume that the expected returns are equal to the realized returns (EARs), and that the annualized variances and covariance stay the same as in the past. Hint: The covariance of returns over N weeks is N times the weekly covariance. Hint: Since we're looking at only one period (of one year), the distinction between rebalancing and not rebalancing is irrelevant here. 2+ decimals Submit Part 11 Attempt 1/10 for 10 pts. What is the annual Sharpe ratio of the optimal risky portfolio? 2+ decimals Submit