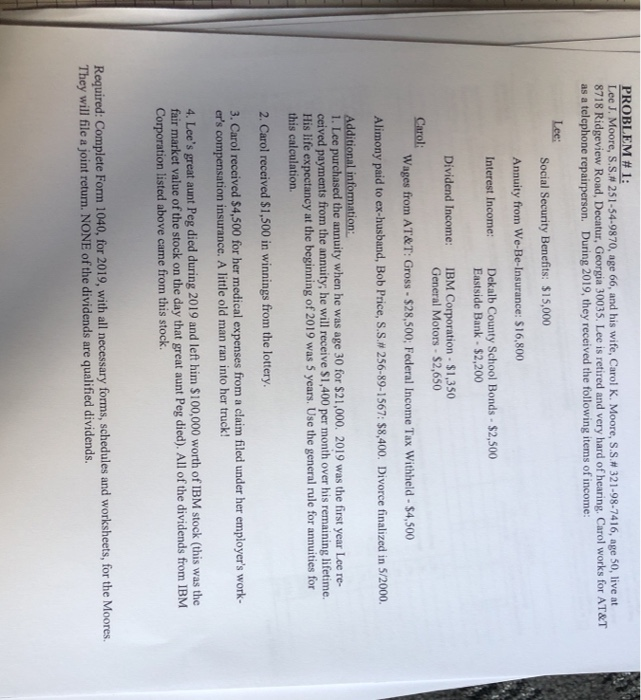

PROBLEM #1: Lee J. Moore, S.S.N 251-54-9870, age 66, and his wife, Carol K. Moore, S.S.# 321-98-7416, age 50, live at 8718 Ridgeview Road, Decatur, Georgia 30035. Lee is retired and very hard of hearing, Carol works for AT&T as a telephone repairperson. During 2019, they received the following items of income: Lee: Social Security Benefits: $15,000 Annuity from We-Be-Insurance: $16,800 Interest Income: Dekalb County School Bonds - $2,500 Eastside Bank - $2,200 Dividend Income: IBM Corporation - $1,350 General Motors - $2,650 Carol: Wages from AT&T: Gross - $28,500; Federal Income Tax Withheld - $4,500 Alimony paid to ex-husband, Bob Price, S.S. 256-89-1567: $8,400. Divorce finalized in 5/2000. Additional information: 1. Lee purchased the annuity when he was age 30 for $21,000. 2019 was the first year Lee re- ceived payments from the annuity; he will receive $1,400 per month over his remaining lifetime. His life expectancy at the beginning of 2019 was 5 years. Use the general rule for annuities for this calculation 2. Carol received $1,500 in winnings from the lottery. 3. Carol received $4,500 for her medical expenses from a claim filed under her employer's work- er's compensation insurance. A little old man ran into her truck! 4. Lee's great aunt Peg died during 2019 and left him $100,000 worth of IBM stock (this was the fair market value of the stock on the day that great aunt Peg died). All of the dividends from IBM Corporation listed above came from this stock. Required: Complete Form 1040, for 2019, with all necessary forms, schedules and worksheets, for the Moores. They will file a joint return. NONE of the dividends are qualified dividends. PROBLEM #1: Lee J. Moore, S.S.N 251-54-9870, age 66, and his wife, Carol K. Moore, S.S.# 321-98-7416, age 50, live at 8718 Ridgeview Road, Decatur, Georgia 30035. Lee is retired and very hard of hearing, Carol works for AT&T as a telephone repairperson. During 2019, they received the following items of income: Lee: Social Security Benefits: $15,000 Annuity from We-Be-Insurance: $16,800 Interest Income: Dekalb County School Bonds - $2,500 Eastside Bank - $2,200 Dividend Income: IBM Corporation - $1,350 General Motors - $2,650 Carol: Wages from AT&T: Gross - $28,500; Federal Income Tax Withheld - $4,500 Alimony paid to ex-husband, Bob Price, S.S. 256-89-1567: $8,400. Divorce finalized in 5/2000. Additional information: 1. Lee purchased the annuity when he was age 30 for $21,000. 2019 was the first year Lee re- ceived payments from the annuity; he will receive $1,400 per month over his remaining lifetime. His life expectancy at the beginning of 2019 was 5 years. Use the general rule for annuities for this calculation 2. Carol received $1,500 in winnings from the lottery. 3. Carol received $4,500 for her medical expenses from a claim filed under her employer's work- er's compensation insurance. A little old man ran into her truck! 4. Lee's great aunt Peg died during 2019 and left him $100,000 worth of IBM stock (this was the fair market value of the stock on the day that great aunt Peg died). All of the dividends from IBM Corporation listed above came from this stock. Required: Complete Form 1040, for 2019, with all necessary forms, schedules and worksheets, for the Moores. They will file a joint return. NONE of the dividends are qualified dividends