Question

Problem 1. MACRS & Bonus Depreciation. MMMM Thats Good, Inc. (or MTG) owns a successful chain of over 150 casual dining restaurants nationwide. Please calculate

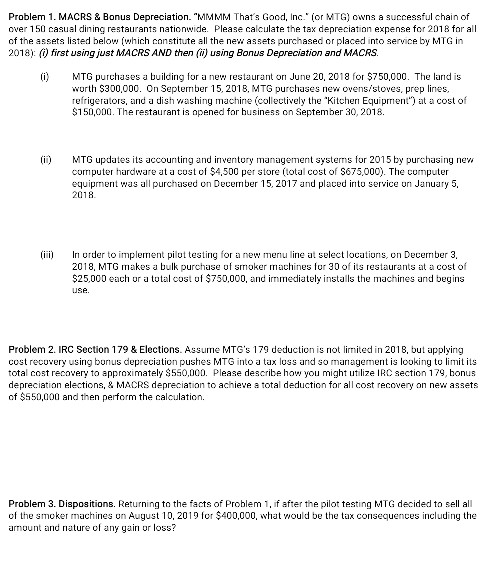

Problem 1. MACRS & Bonus Depreciation. MMMM Thats Good, Inc. (or MTG) owns a successful chain of over 150 casual dining restaurants nationwide. Please calculate the tax depreciation expense for 2018 for all of the assets listed below (which constitute all the new assets purchased or placed into service by MTG in 2018): (i) first using just MACRS AND then (ii) using Bonus Depreciation and MACRS. (i) MTG purchases a building for a new restaurant on June 20, 2018 for $750,000. The land is worth $300,000. On September 15, 2018, MTG purchases new ovens/stoves, prep lines, refrigerators, and a dish washing machine (collectively the Kitchen Equipment) at a cost of $150,000. The restaurant is opened for business on September 30, 2018. (ii) MTG updates its accounting and inventory management systems for 2015 by purchasing new computer hardware at a cost of $4,500 per store (total cost of $675,000). The computer equipment was all purchased on December 15, 2017 and placed into service on January 5, 2018. (iii)In order to implement pilot testing for a new menu line at select locations, on December 3, 2018, MTG makes a bulk purchase of smoker machines for 30 of its restaurants at a cost of $25,000 each or a total cost of $750,000, and immediately installs the machines and begins use.

Problem 2. IRC Section 179 & Elections. Assume MTGs 179 deduction is not limited in 2018, but applying cost recovery using bonus depreciation pushes MTG into a tax loss and so management is looking to limit its total cost recovery to approximately $550,000. Please describe how you might utilize IRC section 179, bonus depreciation elections, & MACRS depreciation to achieve a total deduction for all cost recovery on new assets of $550,000 and then perform the calculation.

Problem 3. Dispositions. Returning to the facts of Problem 1, if after the pilot testing MTG decided to sell all of the smoker machines on August 10, 2019 for $400,000, what would be the tax consequences including the amount and nature of any gain or loss?

Problem 1. MACRS & Bonus Depreciation. "MMMM That's Good, Inc. or MTG) owns a successful chain of over 150 casual dining restaurants nationwide. Please calculate the tax depreciation expense for 2018 for all of the assets listed below (which constitute all the new assets purchased or placed into service by MTG in 2018): (1) first using just MACRS AND then (i) using Bonus Depreciation and MACRS. (i) MTG purchases a building for a new restaurant on June 20, 2018 for $750,000. The land is worth $300,000. On September 15, 2018, MTG purchases new ovens/stoves, prep lines, refrigerators, and a dish washing machine (collectively the "Kitchen Equipment') at a cost of $150,000. The restaurant is opened for business on September 30, 2018. MTG updates its accounting and inventory management systems for 2015 by purchasing new corriputer hardware at a cost of $4,500 per store (total cost of S675,000). The computer equipment was all purchased on December 15, 2017 and placed into service on January 5. 2018 In order to implement pilot testing for a new meru line at select locations on December 3. 2018, MTG makes a bulk purchase of Srroker machines for 30 of its restaurants at a cost of $25,000 each or a total cost of $750,000, and immediately installs the machines and begins use. Problem 2. IRC Section 179 & Elections. Assume MTG's 179 deduction is not limited in 2018, but applying cost recovery using bonus depreciation pushes MTG into a tax loss and so management is looking to limit its total cost recovery to approximately $550,000. Please describe how you might utilize IRC section 179, bonus depreciation elections, & MACRS depreciation to achieve a total deduction for all cost recovery on new assets of $550,000 and then perform the calculation. Problem 3. Dispositions. Returning to the facts of Problem 1. if after the pilot testing MTG decided to sell all of the smoker machines on August 10, 2019 for $400,000, what would be the tax consequences including the armount and nature of any gair or loss? Problem 1. MACRS & Bonus Depreciation. "MMMM That's Good, Inc. or MTG) owns a successful chain of over 150 casual dining restaurants nationwide. Please calculate the tax depreciation expense for 2018 for all of the assets listed below (which constitute all the new assets purchased or placed into service by MTG in 2018): (1) first using just MACRS AND then (i) using Bonus Depreciation and MACRS. (i) MTG purchases a building for a new restaurant on June 20, 2018 for $750,000. The land is worth $300,000. On September 15, 2018, MTG purchases new ovens/stoves, prep lines, refrigerators, and a dish washing machine (collectively the "Kitchen Equipment') at a cost of $150,000. The restaurant is opened for business on September 30, 2018. MTG updates its accounting and inventory management systems for 2015 by purchasing new corriputer hardware at a cost of $4,500 per store (total cost of S675,000). The computer equipment was all purchased on December 15, 2017 and placed into service on January 5. 2018 In order to implement pilot testing for a new meru line at select locations on December 3. 2018, MTG makes a bulk purchase of Srroker machines for 30 of its restaurants at a cost of $25,000 each or a total cost of $750,000, and immediately installs the machines and begins use. Problem 2. IRC Section 179 & Elections. Assume MTG's 179 deduction is not limited in 2018, but applying cost recovery using bonus depreciation pushes MTG into a tax loss and so management is looking to limit its total cost recovery to approximately $550,000. Please describe how you might utilize IRC section 179, bonus depreciation elections, & MACRS depreciation to achieve a total deduction for all cost recovery on new assets of $550,000 and then perform the calculation. Problem 3. Dispositions. Returning to the facts of Problem 1. if after the pilot testing MTG decided to sell all of the smoker machines on August 10, 2019 for $400,000, what would be the tax consequences including the armount and nature of any gair or lossStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started