Question

Problem 1 Madeleine Blanger company is considering Projects A and B with the following information: 19X0 19X1 19X2 19X3 Year a. b. Cashflows Project

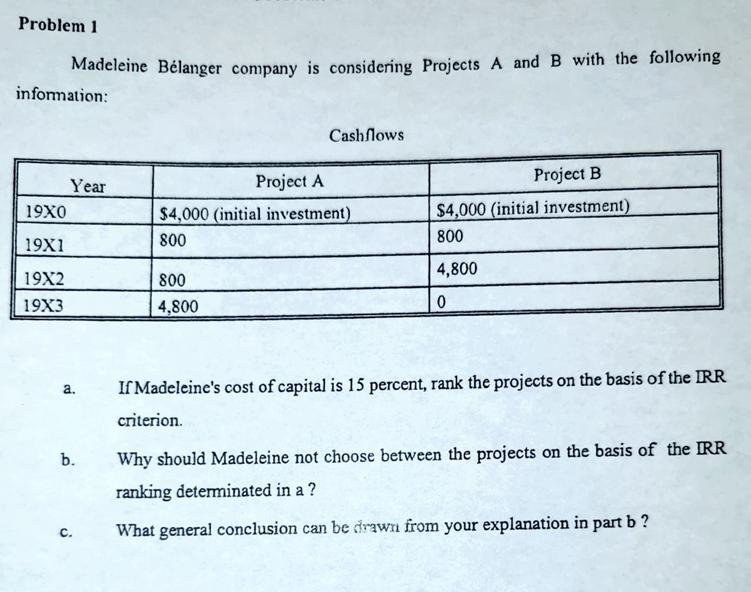

Problem 1 Madeleine Blanger company is considering Projects A and B with the following information: 19X0 19X1 19X2 19X3 Year a. b. Cashflows Project A $4,000 (initial investment) 800 800 4,800 Project B $4,000 (initial investment) 800 4,800 0 If Madeleine's cost of capital is 15 percent, rank the projects on the basis of the IRR criterion. Why should Madeleine not choose between the projects on the basis of the IRR ranking determinated in a ? What general conclusion can be drawn from your explanation in part b?

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of IRR of the project A1 B C D 2 Year PROJECT A PROJECT B 3 0 4000 4000 4 1 800 800 5 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Corporate Finance

Authors: Richard Brealey, Stewart Myers, Alan Marcus

8th edition

77861620, 978-0077861629

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App