Answered step by step

Verified Expert Solution

Question

1 Approved Answer

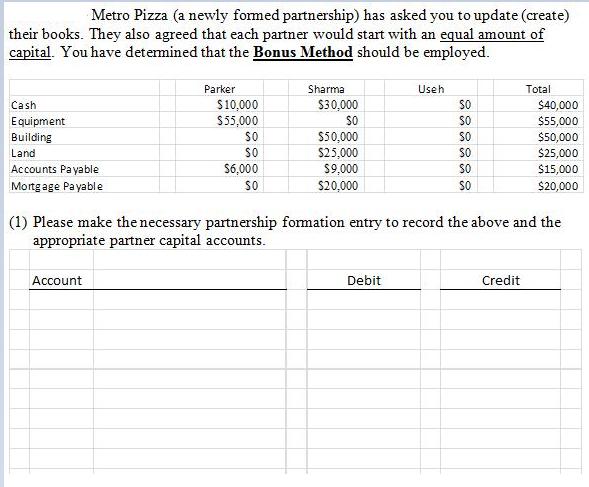

Metro Pizza (a newly fomed partnership) has asked you to update (create) their books. They also agreed that each partner would start with an

Metro Pizza (a newly fomed partnership) has asked you to update (create) their books. They also agreed that each partner would start with an equal amount of capital. You have detemined that the Bonus Method should be employed. Parker Sharma Useh Total $10,000 $5,000 Cash $30,000 so $50,000 $25,000 $9,000 SO $40,000 $55,000 $50,000 $25,000 $15,000 Equipment SO Building SO SO Land SO SO Accounts Payable S6,000 SO Mortgage Payable So $20,000 So $20,000 (1) Please make the necessary partnership formation entry to record the above and the appropriate partner capital accounts. Account Debit Credit (2) Assuming that the partners agreed that income (loss) would be distributed as follows: 30% for Parker 40% for Sharma 30% for Useh These income allocation percentages are applied after allocation for the following are taken into account: a. Interest on partner capital account of 15% (annually) b. Salary allocations as follows (annual amount should be applied to schedule) i. Parker $1,500/month ii. Sharma - $1,000/month iii. Useh - $1,500/month Prepare a schedule to allocate net income, assuming operations for the year resulted in a net income of $25,000. Parker Sharma Useh Total

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Parker Sharma Useh Total Cash 10000 30000 0 40000 Equipment 55000 0 0 55000 Building 0 50000 0 50000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started