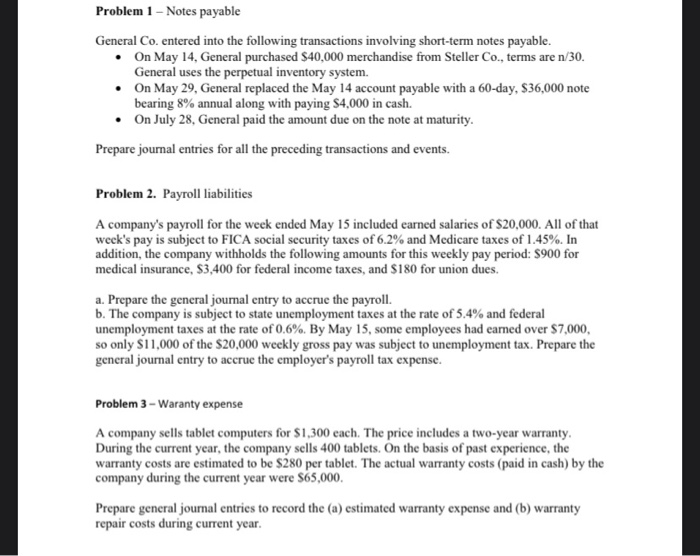

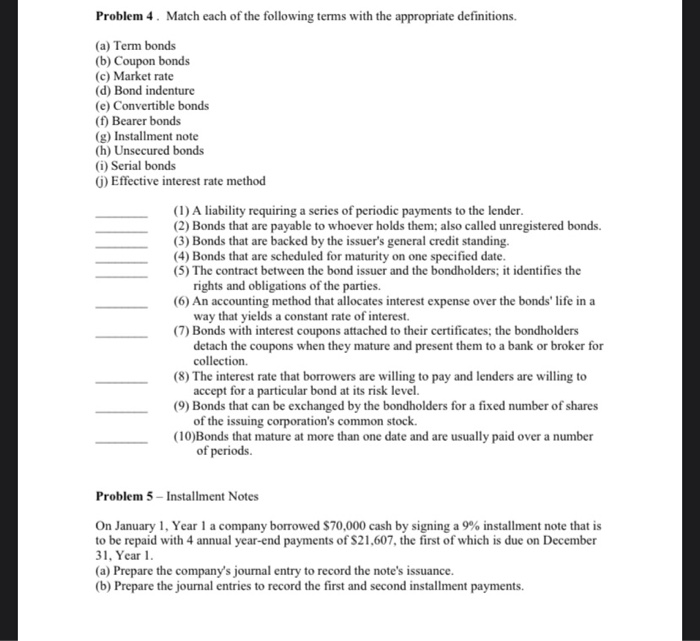

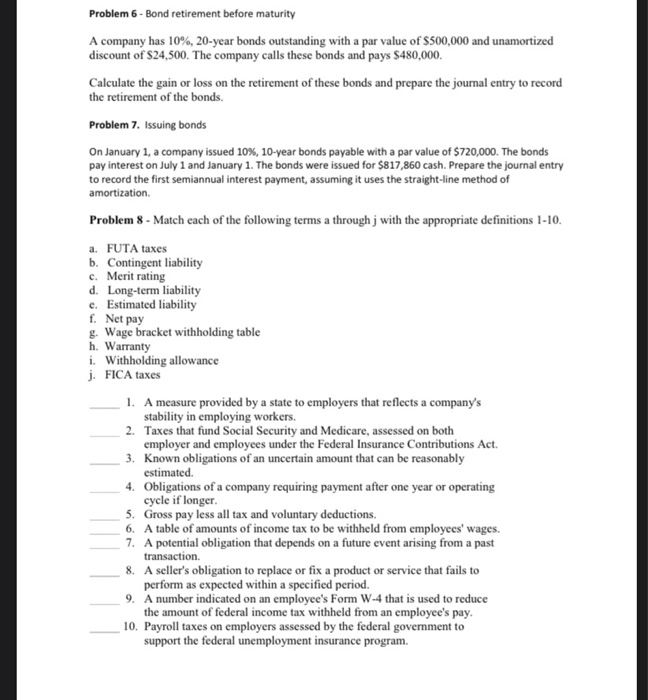

Problem 1 - Notes payable General Co, entered into the following transactions involving short-term notes payable. On May 14, General purchased S40,000 merchandise from Steller Co., terms are n/30. General uses the perpetual inventory system. On May 29, General replaced the May 14 account payable with a 60-day, S36,000 note bearing 8% annual along with paying $4,000 in cash. On July 28, General paid the amount due on the note at maturity. Prepare journal entries for all the preceding transactions and events. Problem 2. Payroll liabilities A company's payroll for the week ended May 15 included earned salaries of $20,000. All of that week's pay is subject to FICA social security taxes of 6.2% and Medicare taxes of 1.45%. In addition, the company withholds the following amounts for this weekly pay period: $900 for medical insurance, $3,400 for federal income taxes, and $180 for union dues a. Prepare the general journal entry to accrue the payroll. b. The company is subject to state unemployment taxes at the rate of 5.4% and federal unemployment taxes at the rate of 0.6%. By May 15, some employees had earned over $7,000, so only $11,000 of the $20,000 weekly gross pay was subject to unemployment tax. Prepare the general journal entry to accrue the employer's payroll tax expense. Problem 3 - Waranty expense A company sells tablet computers for $1,300 each. The price includes a two-year warranty, During the current year, the company sells 400 tablets. On the basis of past experience, the warranty costs are estimated to be $280 per tablet. The actual warranty costs (paid in cash) by the company during the current year were $65,000. Prepare general journal entries to record the (a) estimated warranty expense and (b) warranty repair costs during current year. Problem 4. Match each of the following terms with the appropriate definitions, (a) Term bonds (b) Coupon bonds (c) Market rate (d) Bond indenture (e) Convertible bonds (f) Bearer bonds (g) Installment note (h) Unsecured bonds (1) Serial bonds 6) Effective interest rate method (1) A liability requiring a series of periodic payments to the lender. (2) Bonds that are payable to whoever holds them; also called unregistered bonds. (3) Bonds that are backed by the issuer's general credit standing, (4) Bonds that are scheduled for maturity on one specified date. (5) The contract between the bond issuer and the bondholders; it identifies the rights and obligations of the parties. (6) An accounting method that allocates interest expense over the bonds' life in a way that yields a constant rate of interest (7) Bonds with interest coupons attached to their certificates; the bondholders detach the coupons when they mature and present them to a bank or broker for collection. (8) The interest rate that borrowers are willing to pay and lenders are willing to accept for a particular bond at its risk level. (9) Bonds that can be exchanged by the bondholders for a fixed number of shares of the issuing corporation's common stock. (10)Bonds that mature at more than one date and are usually paid over a number of periods. Problem 5 - Installment Notes On January 1, Year 1 a company borrowed $70,000 cash by signing a 9% installment note that is to be repaid with 4 annual year-end payments of $21,607, the first of which is due on December 31, Year 1. (a) Prepare the company's journal entry to record the note's issuance. (b) Prepare the journal entries to record the first and second installment payments. Problem 6 - Bond retirement before maturity A company has 10%, 20-year bonds outstanding with a par value of $500,000 and unamortized discount of $24,500. The company calls these bonds and pays $480,000 Calculate the gain or loss on the retirement of these bonds and prepare the journal entry to record the retirement of the bonds. Problem 7. Issuing bonds On January 1, a company issued 10%, 10-year bonds payable with a par value of $720,000. The bonds pay interest on July 1 and January 1. The bonds were issued for $817,860 cash. Prepare the journal entry to record the first semiannual interest payment, assuming it uses the straight-line method of amortization Problem 8 - Match each of the following terms a through with the appropriate definitions 1-10. a. FUTA taxes b. Contingent liability c. Merit rating d. Long-term liability e. Estimated liability f. Net pay g. Wage bracket withholding table h. Warranty i. Withholding allowance j. FICA taxes 1. A measure provided by a state to employers that reflects a company's stability in employing workers. 2. Taxes that fund Social Security and Medicare, assessed on both employer and employees under the Federal Insurance Contributions Act. 3. Known obligations of an uncertain amount that can be reasonably estimated. 4. Obligations of a company requiring payment after one year or operating cycle if longer 5. Gross pay less all tax and voluntary deductions. 6. A table of amounts of income tax to be withheld from employees' wages. 7. A potential obligation that depends on a future event arising from a past transaction. 8. A seller's obligation to replace or fix a product or service that fails to perform as expected within a specified period. 9. A number indicated on an employee's Form W-4 that is used to reduce the amount of federal income tax withheld from an employee's pay. 10. Payroll taxes on employers assessed by the federal government to support the federal unemployment insurance program