Answered step by step

Verified Expert Solution

Question

1 Approved Answer

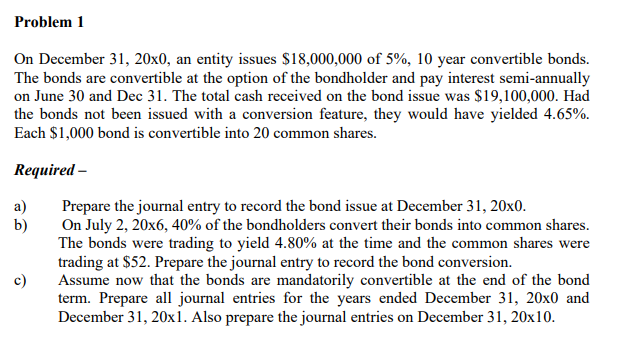

Problem 1 On December 31, 20x0, an entity issues $18,000,000 of 5%, 10 year convertible bonds. The bonds are convertible at the option of

Problem 1 On December 31, 20x0, an entity issues $18,000,000 of 5%, 10 year convertible bonds. The bonds are convertible at the option of the bondholder and pay interest semi-annually on June 30 and Dec 31. The total cash received on the bond issue was $19,100,000. Had the bonds not been issued with a conversion feature, they would have yielded 4.65%. Each $1,000 bond is convertible into 20 common shares. Required - a) b) c) Prepare the journal entry to record the bond issue at December 31, 20x0. On July 2, 20x6, 40% of the bondholders convert their bonds into common shares. The bonds were trading to yield 4.80% at the time and the common shares were trading at $52. Prepare the journal entry to record the bond conversion. Assume now that the bonds are mandatorily convertible at the end of the bond term. Prepare all journal entries for the years ended December 31, 20x0 and December 31, 20x1. Also prepare the journal entries on December 31, 20x10.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started