Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1 on Equity Method Imogen Ltd acquired 20% of the ordinary shares of Alison Ltd on 1 January 2013. At this date, all

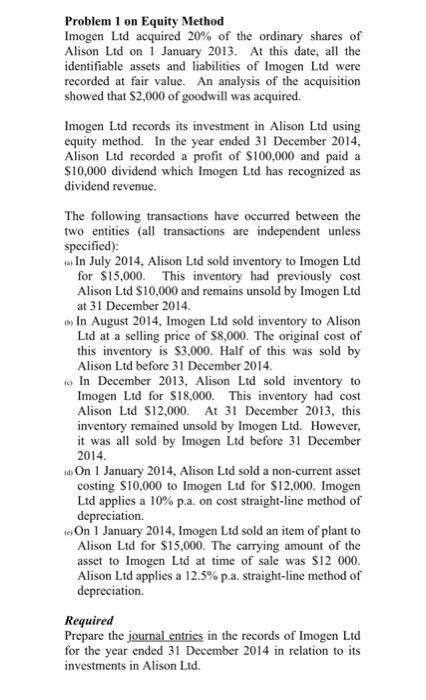

Problem 1 on Equity Method Imogen Ltd acquired 20% of the ordinary shares of Alison Ltd on 1 January 2013. At this date, all the identifiable assets and liabilities of Imogen Ltd were recorded at fair value. An analysis of the acquisition showed that $2,000 of goodwill was acquired. Imogen Ltd records its investment in Alison Ltd using equity method. In the year ended 31 December 2014, Alison Ltd recorded a profit of $100,000 and paid a $10,000 dividend which Imogen Ltd has recognized as dividend revenue. The following transactions have occurred between the two entities (all transactions are independent unless specified): In July 2014, Alison Ltd sold inventory to Imogen Ltd for $15,000. This inventory had previously cost Alison Ltd $10,000 and remains unsold by Imogen Ltd at 31 December 2014. In August 2014, Imogen Ltd sold inventory to Alison Ltd at a selling price of $8,000. The original cost of this inventory is $3,000. Half of this was sold by Alison Ltd before 31 December 2014. (c) In December 2013, Alison Ltd sold inventory to Imogen Ltd for $18,000. This inventory had cost Alison Ltd $12,000. At 31 December 2013, this inventory remained unsold by Imogen Ltd. However, it was all sold by Imogen Ltd before 31 December 2014. (d) On 1 January 2014, Alison Ltd sold a non-current asset costing $10,000 to Imogen Ltd for $12,000. Imogen Ltd applies a 10% p.a. on cost straight-line method of depreciation. (On 1 January 2014, Imogen Ltd sold an item of plant to Alison Ltd for $15,000. The carrying amount of the asset to Imogen Ltd at time of sale was $12 000. Alison Ltd applies a 12.5% p.a. straight-line method of depreciation. Required Prepare the journal entries in the records of Imogen Ltd for the year ended 31 December 2014 in relation to its investments in Alison Ltd.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started