Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROBLEM 1: On January 1, 2021, Vim Company purchased an equipment for P3,000,000.00 cash for the purpose of leasing it. The machine is expected

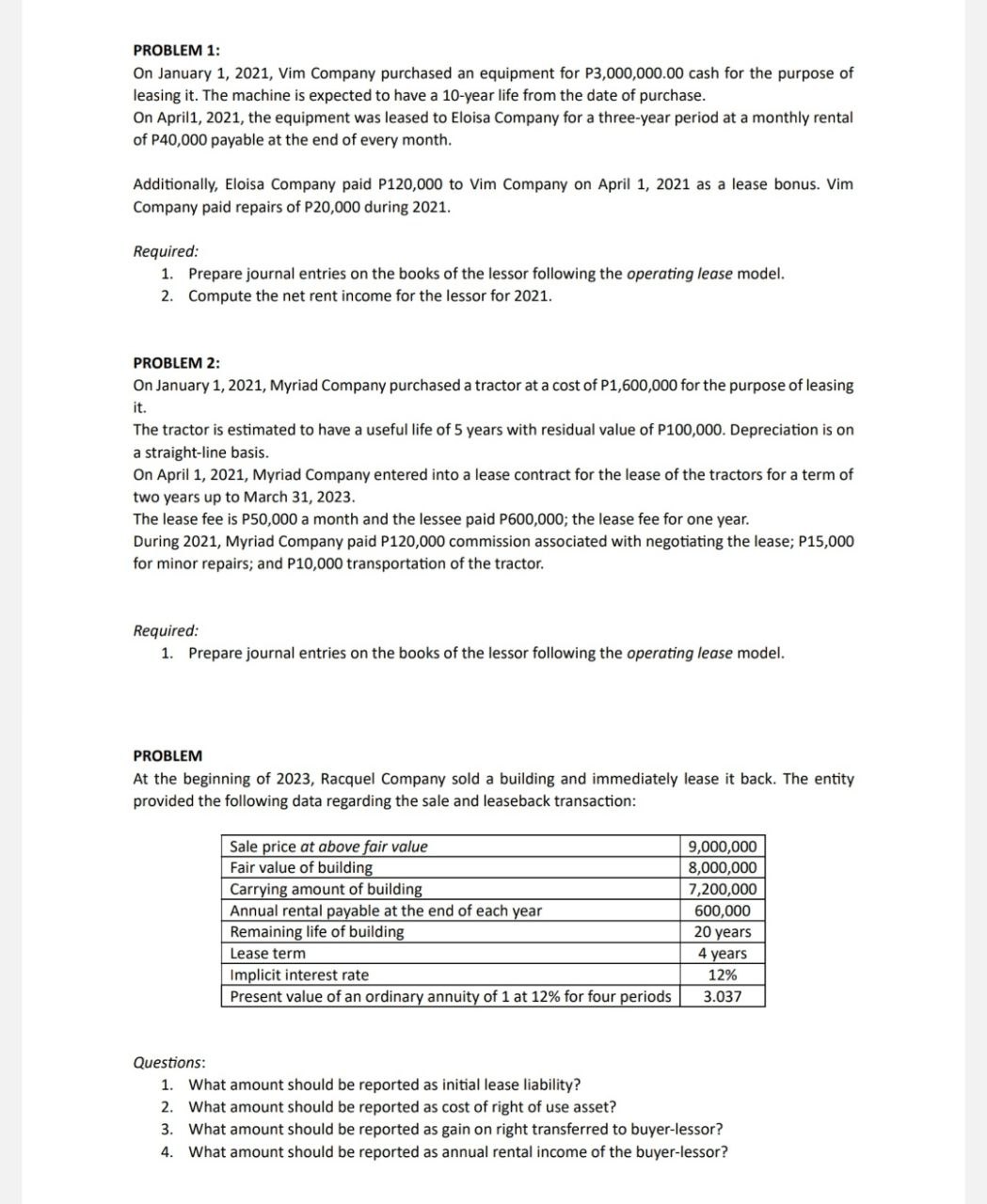

PROBLEM 1: On January 1, 2021, Vim Company purchased an equipment for P3,000,000.00 cash for the purpose of leasing it. The machine is expected to have a 10-year life from the date of purchase. On April 1, 2021, the equipment was leased to Eloisa Company for a three-year period at a monthly rental of P40,000 payable at the end of every month. Additionally, Eloisa Company paid P120,000 to Vim Company on April 1, 2021 as a lease bonus. Vim Company paid repairs of P20,000 during 2021. Required: 1. Prepare journal entries on the books of the lessor following the operating lease model. 2. Compute the net rent income for the lessor for 2021. PROBLEM 2: On January 1, 2021, Myriad Company purchased a tractor at a cost of P1,600,000 for the purpose of leasing it. The tractor is estimated to have a useful life of 5 years with residual value of P100,000. Depreciation is on a straight-line basis. On April 1, 2021, Myriad Company entered into a lease contract for the lease of the tractors for a term of two years up to March 31, 2023. The lease fee is P50,000 a month and the lessee paid P600,000; the lease fee for one year. During 2021, Myriad Company paid P120,000 commission associated with negotiating the lease; P15,000 for minor repairs; and P10,000 transportation of the tractor. Required: 1. Prepare journal entries on the books of the lessor following the operating lease model. PROBLEM At the beginning of 2023, Racquel Company sold a building and immediately lease it back. The entity provided the following data regarding the sale and leaseback transaction: Sale price at above fair value Fair value of building Carrying amount of building Annual rental payable at the end of each year Remaining life of building Lease term Implicit interest rate Present value of an ordinary annuity of 1 at 12% for four periods 9,000,000 8,000,000 7,200,000 600,000 20 years 4 years 12% 3.037 Questions: 1. What amount should be reported as initial lease liability? 2. What amount should be reported as cost of right of use asset? 3. What amount should be reported as gain on right transferred to buyer-lessor? 4. What amount should be reported as annual rental income of the buyer-lessor?

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

answer Lets address each problem one by one Problem 1 Date Account Debit DR Credit CR Jan 1 2021 Equ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started