Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1 On May 1, R. C. Twining started RC Flying School, a company that provides flying lessons, by investing $40,000 cash in the

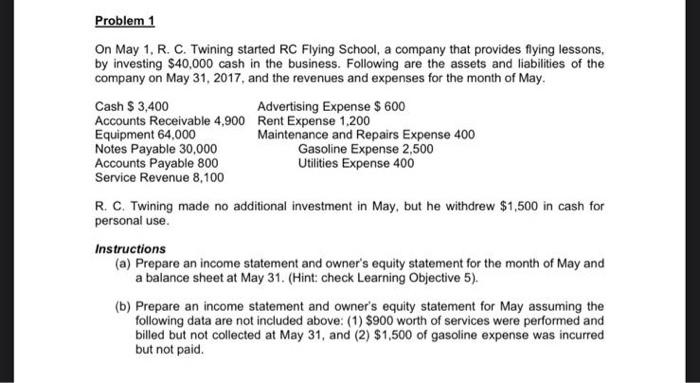

Problem 1 On May 1, R. C. Twining started RC Flying School, a company that provides flying lessons, by investing $40,000 cash in the business. Following are the assets and liabilities of the company on May 31, 2017, and the revenues and expenses for the month of May. Cash $ 3,400 Advertising Expense $ 600 Maintenance and Repairs Expense 400 Accounts Receivable 4,900 Rent Expense 1.200 Equipment 64,000 Notes Payable 30,000 Accounts Payable 800 Service Revenue 8,100 Gasoline Expense 2,500 Utilities Expense 400 R. C. Twining made no additional investment in May, but he withdrew $1,500 in cash for personal use. Instructions (a) Prepare an income statement and owner's equity statement for the month of May and a balance sheet at May 31. (Hint: check Learning Objective 5). (b) Prepare an income statement and owner's equity statement for May assuming the following data are not included above: (1) $900 worth of services were performed and billed but not collected at May 31, and (2) $1,500 of gasoline expense was incurred but not paid.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started