Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1 Part 1 - Corporation On April 1, 2022, a corporation with a December 31 taxation year purchased a three-year investment certificate for $20,000.

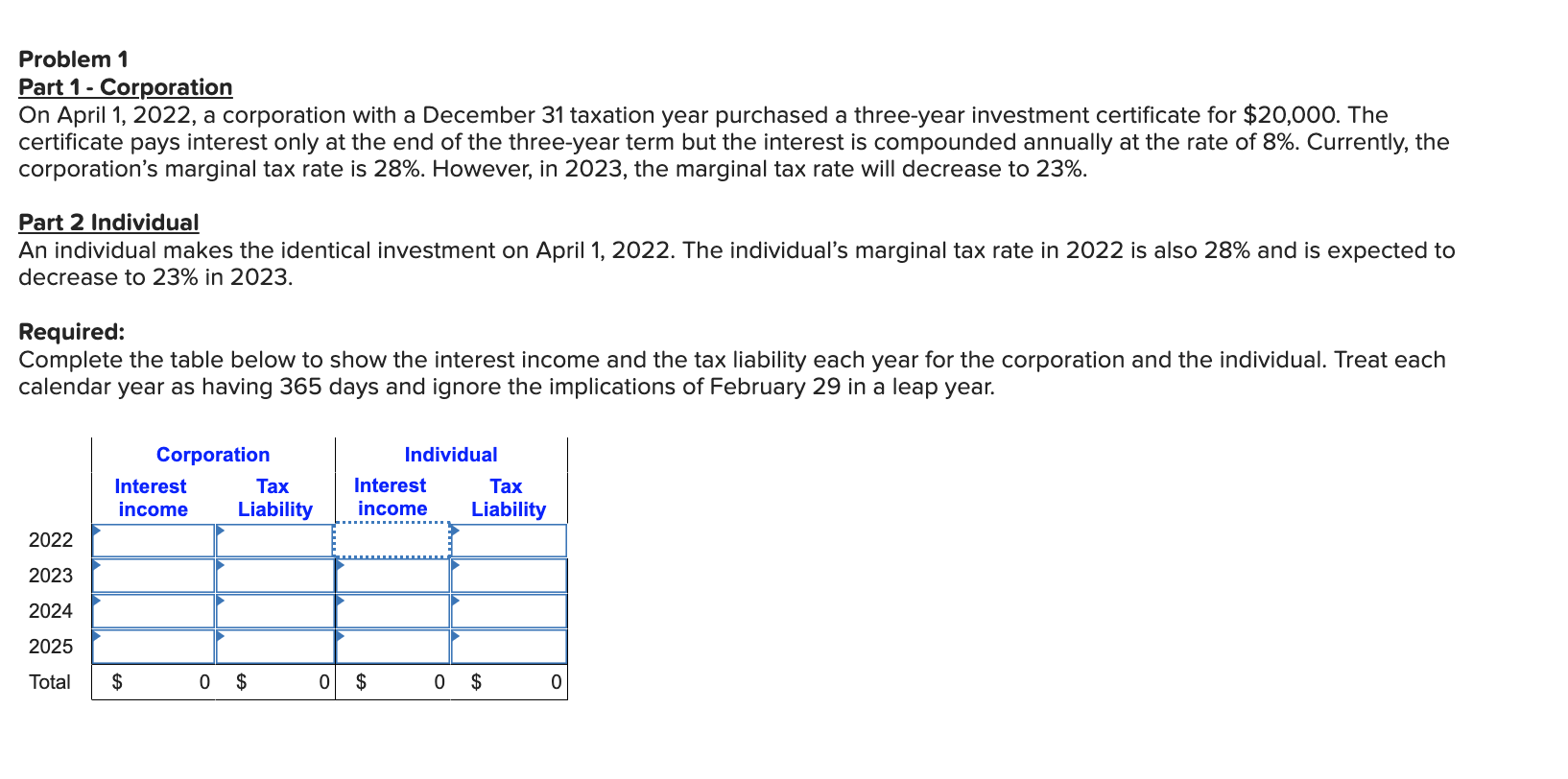

Problem 1 Part 1 - Corporation On April 1, 2022, a corporation with a December 31 taxation year purchased a three-year investment certificate for $20,000. The certificate pays interest only at the end of the three-year term but the interest is compounded annually at the rate of 8%. Currently, the corporation's marginal tax rate is 28%. However, in 2023 , the marginal tax rate will decrease to 23%. Part 2 Individual An individual makes the identical investment on April 1, 2022. The individual's marginal tax rate in 2022 is also 28% and is expected to decrease to 23% in 2023. Required: Complete the table below to show the interest income and the tax liability each year for the corporation and the individual. Treat each calendar year as having 365 days and ignore the implications of February 29 in a leap year. Problem 1 Part 1 - Corporation On April 1, 2022, a corporation with a December 31 taxation year purchased a three-year investment certificate for $20,000. The certificate pays interest only at the end of the three-year term but the interest is compounded annually at the rate of 8%. Currently, the corporation's marginal tax rate is 28%. However, in 2023 , the marginal tax rate will decrease to 23%. Part 2 Individual An individual makes the identical investment on April 1, 2022. The individual's marginal tax rate in 2022 is also 28% and is expected to decrease to 23% in 2023. Required: Complete the table below to show the interest income and the tax liability each year for the corporation and the individual. Treat each calendar year as having 365 days and ignore the implications of February 29 in a leap year

Problem 1 Part 1 - Corporation On April 1, 2022, a corporation with a December 31 taxation year purchased a three-year investment certificate for $20,000. The certificate pays interest only at the end of the three-year term but the interest is compounded annually at the rate of 8%. Currently, the corporation's marginal tax rate is 28%. However, in 2023 , the marginal tax rate will decrease to 23%. Part 2 Individual An individual makes the identical investment on April 1, 2022. The individual's marginal tax rate in 2022 is also 28% and is expected to decrease to 23% in 2023. Required: Complete the table below to show the interest income and the tax liability each year for the corporation and the individual. Treat each calendar year as having 365 days and ignore the implications of February 29 in a leap year. Problem 1 Part 1 - Corporation On April 1, 2022, a corporation with a December 31 taxation year purchased a three-year investment certificate for $20,000. The certificate pays interest only at the end of the three-year term but the interest is compounded annually at the rate of 8%. Currently, the corporation's marginal tax rate is 28%. However, in 2023 , the marginal tax rate will decrease to 23%. Part 2 Individual An individual makes the identical investment on April 1, 2022. The individual's marginal tax rate in 2022 is also 28% and is expected to decrease to 23% in 2023. Required: Complete the table below to show the interest income and the tax liability each year for the corporation and the individual. Treat each calendar year as having 365 days and ignore the implications of February 29 in a leap year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started