Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1 Part A (11 Marks) Note: It is suggested that you read all both parts of Problem 1 before you start so that

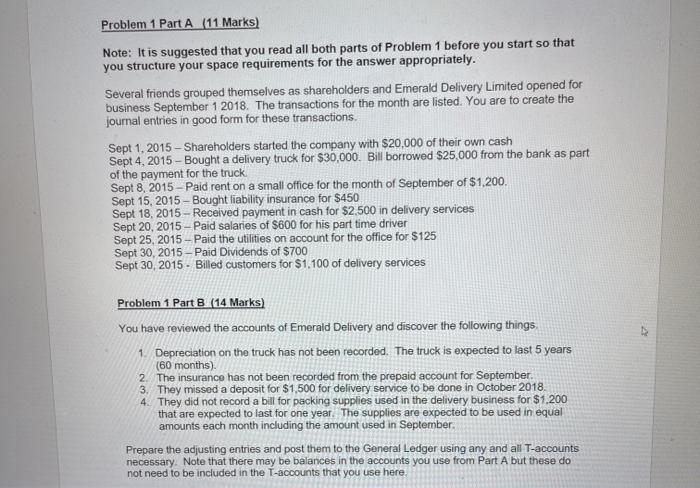

Problem 1 Part A (11 Marks) Note: It is suggested that you read all both parts of Problem 1 before you start so that you structure your space requirements for the answer appropriately. Several friends grouped themselves as shareholders and Emerald Delivery Limited opened for business September 1 2018. The transactions for the month are listed. You are to create the journal entries in good form for these transactions. Sept 1, 2015 Shareholders started the company with $20,000 of their own cash Sept 4, 2015-Bought a delivery truck for $30,000. Bill borrowed $25,000 from the bank as part of the payment for the truck. Sept 8, 2015-Paid rent on a small office for the month of September of $1,200. Sept 15, 2015-Bought liability insurance for $450 Sept 18, 2015-Received payment in cash for $2,500 in delivery services Sept 20, 2015 Paid salaries of $600 for his part time driver Sept 25, 2015-Paid the utilities on account for the office for $125 Sept 30, 2015-Paid Dividends of $700 Sept 30, 2015 Billed customers for $1,100 of delivery services Problem 1 Part B (14 Marks) You have reviewed the accounts of Emerald Delivery and discover the following things. 1. Depreciation on the truck has not been recorded. The truck is expected to last 5 years (60 months). 2. The insurance has not been recorded from the prepaid account for September. 3. They missed a deposit for $1,500 for delivery service to be done in October 2018. 4. They did not record a bill for packing supplies used in the delivery business for $1,200 that are expected to last for one year. The supplies are expected to be used in equal amounts each month including the amount used in September. Prepare the adjusting entries and post them to the General Ledger using any and all T-accounts necessary. Note that there may be balances in the accounts you use from Part A but these do not need to be included in the T-accounts that you use here.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started