Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1. (Portfolio Allocation. Considering following four: an aggressive growth fund (Fund 1), an index fund (Fund 2), a corporate bond fund (Fund 3), and

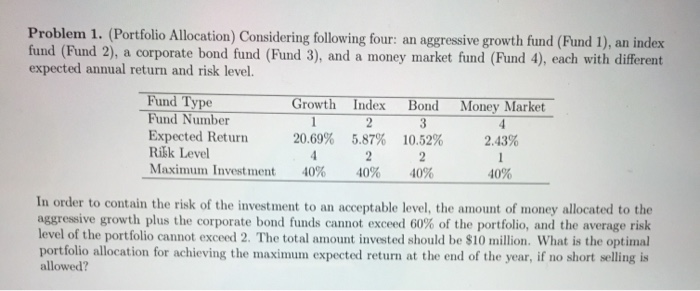

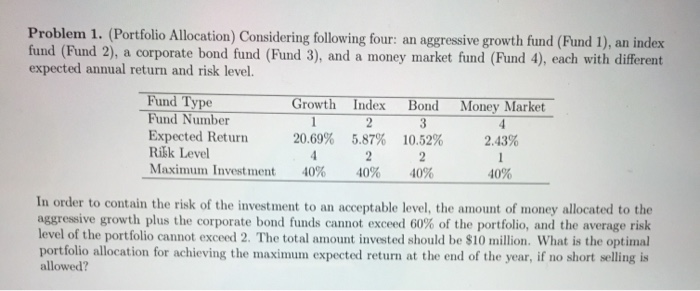

Problem 1. (Portfolio Allocation. Considering following four: an aggressive growth fund (Fund 1), an index fund (Fund 2), a corporate bond fund (Fund 3), and a money market fund (Fund 4), each with different expected annual return and risk level. Growth Index Bond Money Market Fund Type Fund Number Expected Return Rilk Level Maximum Investment 20.69% 5.87% 2.43% 10.52% 2 40% 40% 40% 40% In order to contain the risk of the investment to an acceptable level, the amount of money allocated to the aggressive growth plus the corporate bond funds cannot exceed 60% of the portfolio, and the average risk level of the portfolio cannot exceed 2. The total amount invested should be $10 million. What is the optimal portfolio allocation for achieving the maximum expected return at the end of the year, if no short selling is allowed

Problem 1. (Portfolio Allocation. Considering following four: an aggressive growth fund (Fund 1), an index fund (Fund 2), a corporate bond fund (Fund 3), and a money market fund (Fund 4), each with different expected annual return and risk level. Growth Index Bond Money Market Fund Type Fund Number Expected Return Rilk Level Maximum Investment 20.69% 5.87% 2.43% 10.52% 2 40% 40% 40% 40% In order to contain the risk of the investment to an acceptable level, the amount of money allocated to the aggressive growth plus the corporate bond funds cannot exceed 60% of the portfolio, and the average risk level of the portfolio cannot exceed 2. The total amount invested should be $10 million. What is the optimal portfolio allocation for achieving the maximum expected return at the end of the year, if no short selling is allowed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started