Answered step by step

Verified Expert Solution

Question

1 Approved Answer

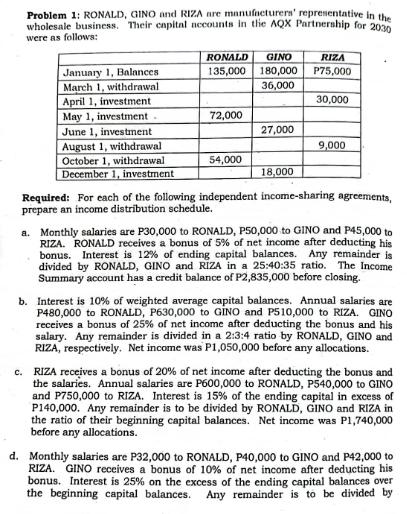

Problem 1: RONALD, GINO and RIZA are manufacturers' representative in the wholesale business. Their capital accounts in the AQX Partnership for 2030 were as

Problem 1: RONALD, GINO and RIZA are manufacturers' representative in the wholesale business. Their capital accounts in the AQX Partnership for 2030 were as follows: January 1, Balances March 1, withdrawal April 1, investment May 1, investment. June 1, investment August 1, withdrawal October 1, withdrawal December 1, investment RONALD GINO 135,000 180,000 36,000 72,000 54,000 27,000 18,000 RIZA P75,000 30,000 9,000 Required: For each of the following independent income-sharing agreements, prepare an income distribution schedule. a. Monthly salaries are P30,000 to RONALD, P50,000 to GINO and P45,000 to RIZA. RONALD receives a bonus of 5% of net income after deducting his bonus. Interest is 12% of ending capital balances. Any remainder is divided by RONALD, GINO and RIZA in a 25:40:35 ratio. The Income Summary account has a credit balance of P2,835,000 before closing. b. Interest is 10% of weighted average capital balances. Annual salaries are P480,000 to RONALD, P630,000 to GINO and P510,000 to RIZA. GINO receives a bonus of 25% of net income after deducting the bonus and his salary. Any remainder is divided in a 2:3:4 ratio by RONALD, GINO and RIZA, respectively. Net income was P1,050,000 before any allocations. c. RIZA receives a bonus of 20% of net income after deducting the bonus and the salaries. Annual salaries are P600,000 to RONALD, P540,000 to GINO and P750,000 to RIZA. Interest is 15% of the ending capital in excess of P140,000. Any remainder is to be divided by RONALD, GINO and RIZA in the ratio of their beginning capital balances. Net income was P1,740,000 before any allocations. d. Monthly salaries are P32,000 to RONALD, P40,000 to GINO and P42,000 to RIZA. GINO receives a bonus of 10% of net income after deducting his bonus. Interest is 25% on the excess of the ending capital balances over the beginning capital balances. Any remainder is to be divided by

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To solve each of the incomesharing agreements we need to calculate the net income for the partnership and then distribute it according to the specified ratios Lets go through each scenario stepbystep ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started