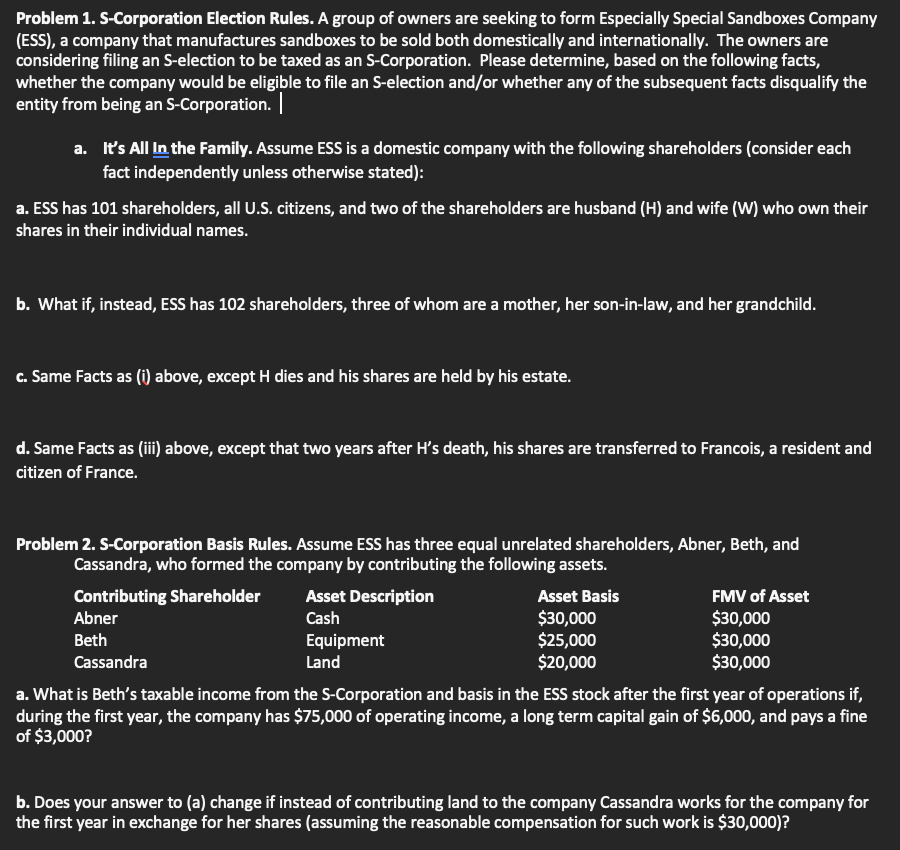

Problem 1. S-Corporation Election Rules. A group of owners are seeking to form Especially Special Sandboxes Company (ESS), a company that manufactures sandboxes to be sold both domestically and internationally. The owners are considering filing an S-election to be taxed as an S-Corporation. Please determine, based on the following facts, whether the company would be eligible to file an S-election and/or whether any of the subsequent facts disqualify the entity from being an S-Corporation. a. It's All In the Family. Assume ESS is a domestic company with the following shareholders (consider each fact independently unless otherwise stated): a. ESS has 101 shareholders, all U.S. citizens, and two of the shareholders are husband (H) and wife (W) who own their shares in their individual names. b. What if, instead, ESS has 102 shareholders, three of whom are a mother, her son-in-law, and her grandchild. c. Same Facts as (i) above, except H dies and his shares are held by his estate. d. Same Facts as (iii) above, except that two years after H's death, his shares are transferred to Francois, a resident and citizen of France. Problem 2. S-Corporation Basis Rules. Assume ESS has three equal unrelated shareholders, Abner, Beth, and Cassandra, who formed the company by contributing the following assets. a. What is Beth's taxable income from the S-Corporation and basis in the ESS stock after the first year of operations if, during the first year, the company has $75,000 of operating income, a long term capital gain of $6,000, and pays a fine of $3,000 ? b. Does your answer to (a) change if instead of contributing land to the company Cassandra works for the company for the first year in exchange for her shares (assuming the reasonable compensation for such work is $$30,000)? Problem 1. S-Corporation Election Rules. A group of owners are seeking to form Especially Special Sandboxes Company (ESS), a company that manufactures sandboxes to be sold both domestically and internationally. The owners are considering filing an S-election to be taxed as an S-Corporation. Please determine, based on the following facts, whether the company would be eligible to file an S-election and/or whether any of the subsequent facts disqualify the entity from being an S-Corporation. a. It's All In the Family. Assume ESS is a domestic company with the following shareholders (consider each fact independently unless otherwise stated): a. ESS has 101 shareholders, all U.S. citizens, and two of the shareholders are husband (H) and wife (W) who own their shares in their individual names. b. What if, instead, ESS has 102 shareholders, three of whom are a mother, her son-in-law, and her grandchild. c. Same Facts as (i) above, except H dies and his shares are held by his estate. d. Same Facts as (iii) above, except that two years after H's death, his shares are transferred to Francois, a resident and citizen of France. Problem 2. S-Corporation Basis Rules. Assume ESS has three equal unrelated shareholders, Abner, Beth, and Cassandra, who formed the company by contributing the following assets. a. What is Beth's taxable income from the S-Corporation and basis in the ESS stock after the first year of operations if, during the first year, the company has $75,000 of operating income, a long term capital gain of $6,000, and pays a fine of $3,000 ? b. Does your answer to (a) change if instead of contributing land to the company Cassandra works for the company for the first year in exchange for her shares (assuming the reasonable compensation for such work is $$30,000)